Euro-Area Currencies Weaken At End Of Trading Week

- 19 Jun 2020

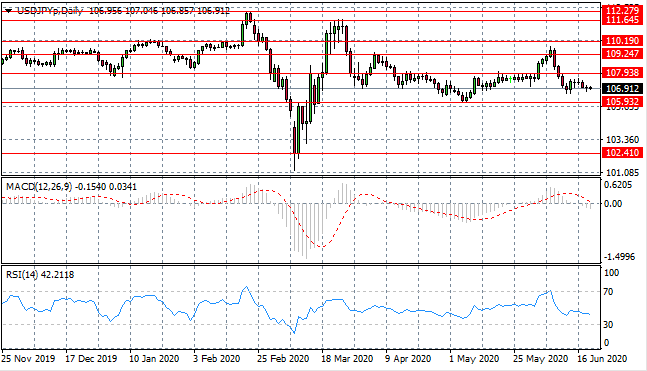

USD/JPY

The USD/JPY pair seems set to oscillate between the 105.93 and 107.93 price levels in the near-term. There are currently no signs of dominance from either buyers or sellers. Momentum indicators reflect bearish sentiment with downward trajectories.

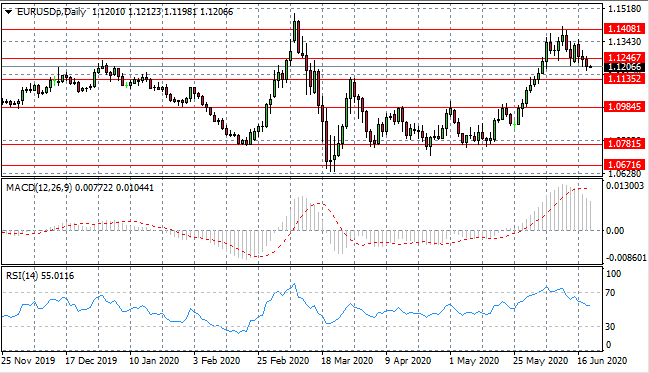

EUR/USD

Eurodollar sellers have made a breakthrough resulting in the breach of the 1.124 support level which had previously been a sticking point for the pair. The next target is the 1.113 support level. Momentum indicators are undergoing reversals with RSI moving below the 70 overbought line.

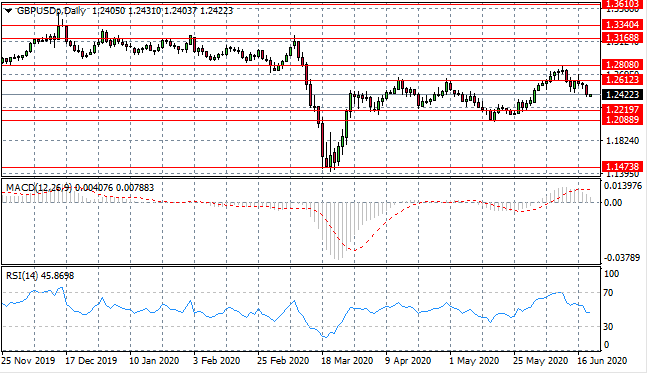

GBP/USD

The GBP/USD pair broke the 1.261 resistance level as once again the US dollar finds support. Price action is now headed towards the 1.221 support level and has reentered a previous trading range. Momentum indicators have downward trajectories.

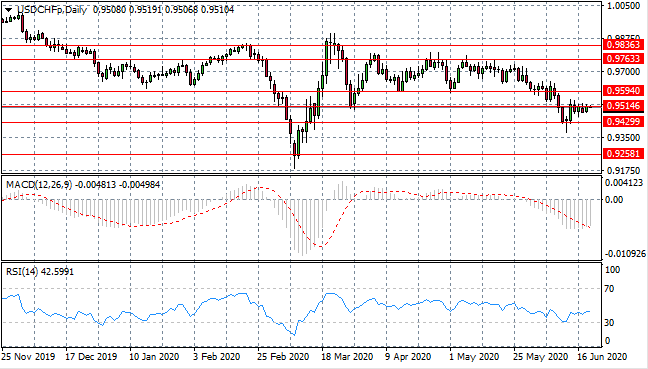

USD/CHF

The USD/CHF test of the 0.951 resistance line continues as there is a lack of conviction from both buyers and sellers. The US dollar seems likely to remain subdued at least until some fundamental news drives price action. Momentum indicators are undergoing bullish reversals.

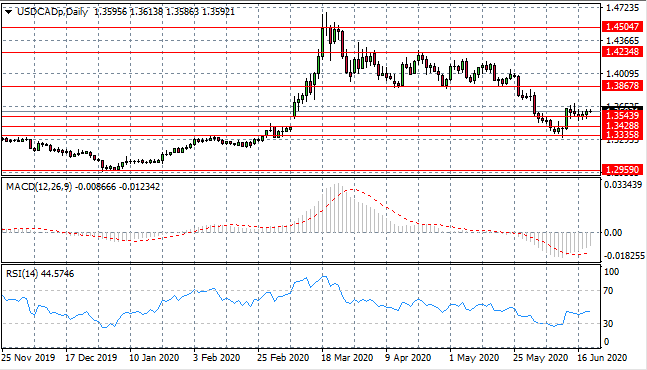

USD/CAD

The USD/CAD has found support after an extended sell-off yet revival appears to have been short-lived. A series of small-bodied candles represent exhaustion after a strong bullish move resulted in a break of several resistance levels. Momentum indicators have upward trajectories.

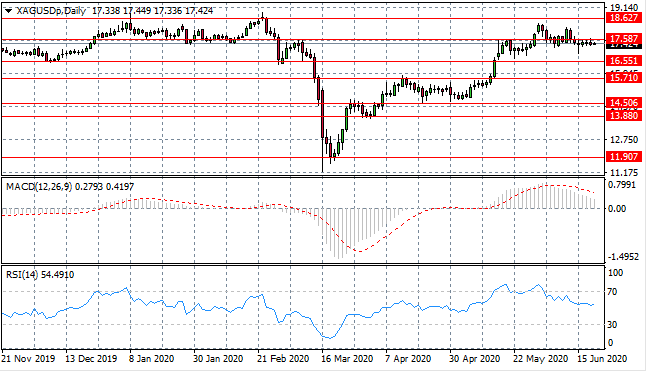

SILVER

Silver has returned to the 17.58 price line and attempted bullish breaks have not been sustained. The pair will continue to hug this price line until some fundamental news changes the metal’s course. Momentum indicators have flattened in bullish territory.

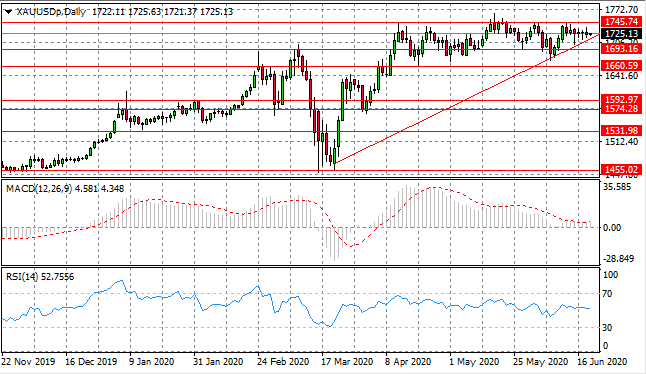

GOLD

Gold buyers have become subdued in recent trading stalling just below the 1745.74 resistance line. A breakout may be imminent, however, as price action approaches the apex of a longer-term ascending triangle pattern. Momentum indicators have flattened in neutral/bullish territory.

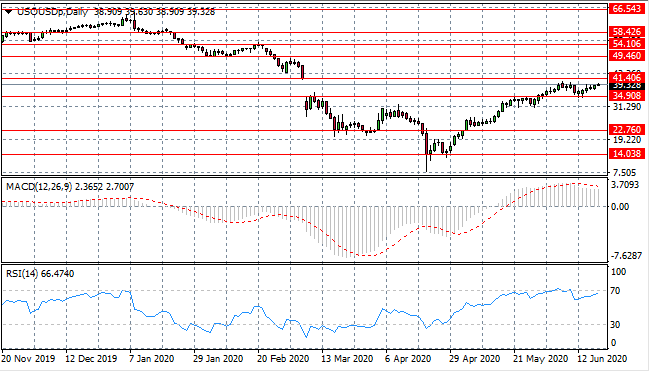

OIL

WTI may make another attempt at the 41.40 resistance line although moves are lacking conviction with very few new developments. The $35-40 per barrel range may be a stabilizing price and may represent a longer-term floor and ceiling for the commodity. Momentum indicators are bullish with RSI approaching overbought conditions.