Eurodollar Lift-Off

- 22 Jul 2020

USD/JPY

The USD/JPY pair has taken a bearish turn as sellers return to test the shorter term descending trendline. The pair may hug this support level going forward as the longer-term downtrend resumes. A price target exists at the 106.05 support line and a break would mean the breach of a long term trading range. Momentum indicators have flattened in neutral/bearish territory.

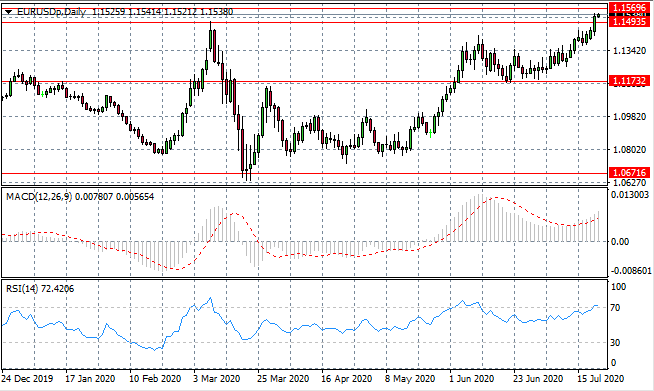

EUR/USD

The Eurodollar rally has surged passed the recent price high at 1.149 price level and is now approaching a multi-year high at the 1.156 resistance level, as positive news regarding a covid-19 bailout was reached yesterday. Momentum indicators suggest the pair is overbought and therefore the current rally may not last especially after the good news dissipates.

GBP/USD

A GBP/USD rally appears to be beginning with buyers now testing the 1.274 price line which also represents the resistance line of an ascending triangle pattern. A breakout would give weight to the established, long-term uptrend. Momentum indicators have upward trajectories.

USD/CHF

The USD/CHF bearish breakout is underway and the next obvious target is the 0.925 support level which represents the price reached during the first outbreak of covid-19. The descending trendline is likely to remain a key resistance area for the pair going forward. Momentum indicators suggest the pair is oversold.

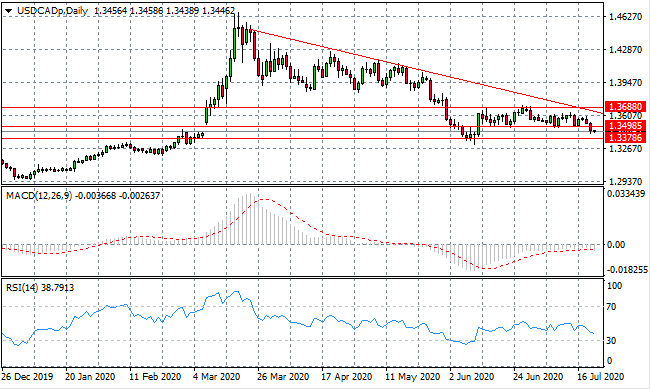

USD/CAD

The USD/CAD pair remains volatile within a tight trading range indicating a breakout may be imminent. The 1.349 price level has been broken and the 1.337 support level is in sight. The break is significant given the history of bullish rebounds at this price line. Momentum indicators are bearish with RSI approaching oversold conditions.

GOLD

Gold buyers have found momentum as the metal has blasted passed the 1810.10 resistance line and continues to make new highs. Some selling activity has begun yet, a clear, established uptrend has formed. Momentum indicators are strongly bullish with RSI moving beyond the overbought line, therefore, the current pace may not be sustainable.

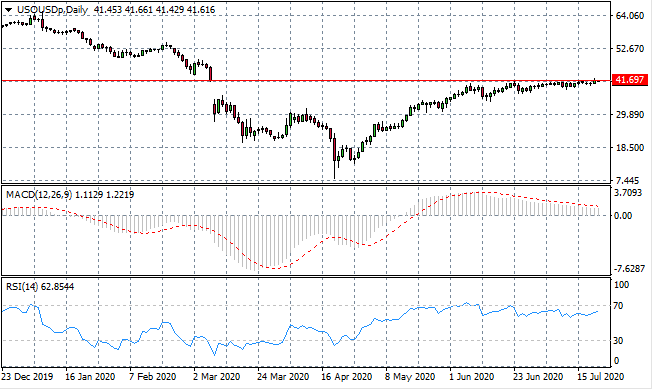

OIL

WTI has failed repeatedly to move beyond the the 41.69 resistance line which represents the gap fill line, or in other words, the marker of full price recovery to pre-covid levels. Appetite for the commodity has dwindled despite further easing in production from OPEC+. Maintenance at $40 per barrel is sustainable for the major oil suppliers. Momentum indicators are bullish.