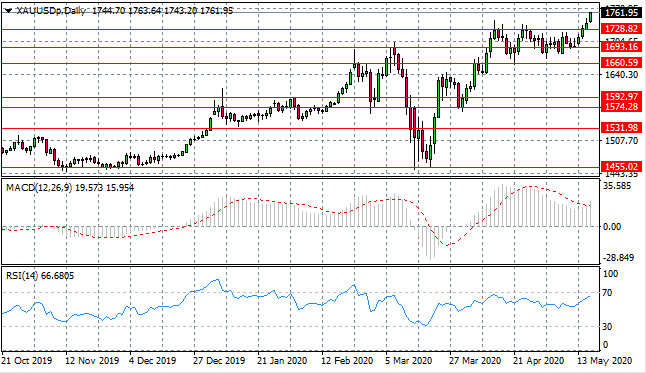

Gold Approaches Highs Not Seen Since 2011

- 18 May 2020

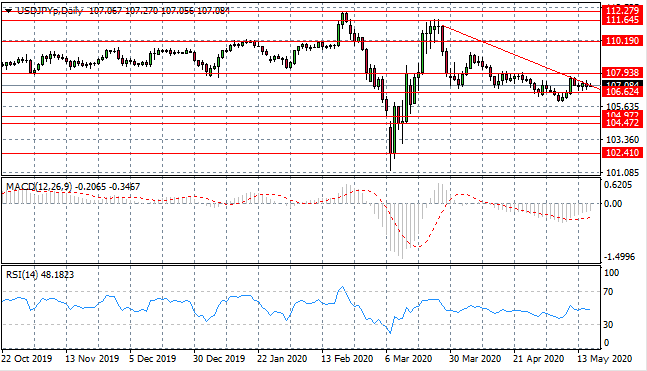

USD/JPY

The USD/JPY pair has rebounded from the 106.62 price level and continues to test the descending trendline. A longer-term downtrend is underway and will have more weight if the pair fails to break the trendline. Momentum indicators have stalled in neutral/bearish territory.

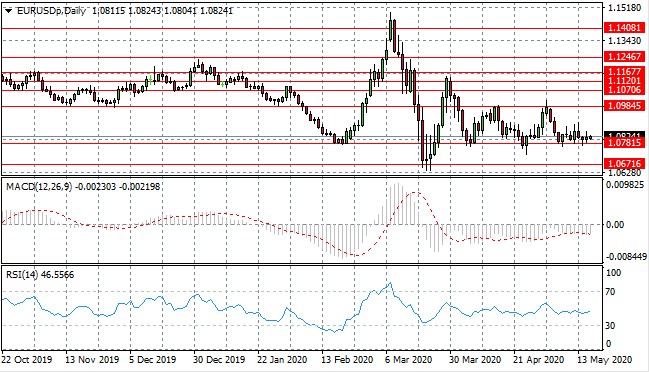

EUR/USD

The Eurodollar has reverted back to the 1.078 support line and price action continues to hug the support level where previously bullish rebounds have taken place. Lack of certainty seems to be contributing to the direction of price action. Momentum indicators are neutral if slightly bearish.

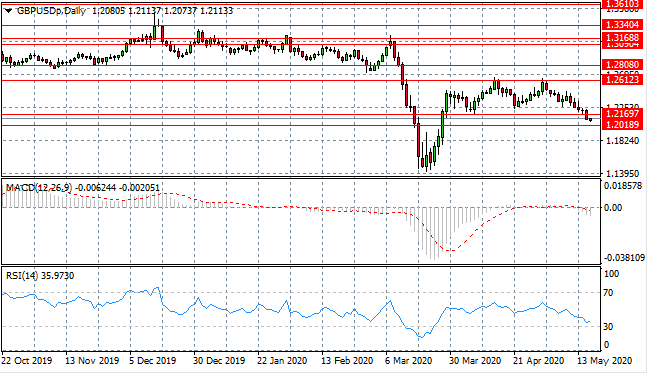

GBP/USD

The GBP/USD pair is heading lower with a break of the 1.216 support level which has represented a recent price floor. The next target is the 1.201 support level and a break of this support area would see the pair return to a trading range seen at the first signs of the covid-19 outbreak. Momentum indicators have moved into the ‘sell’ channel.

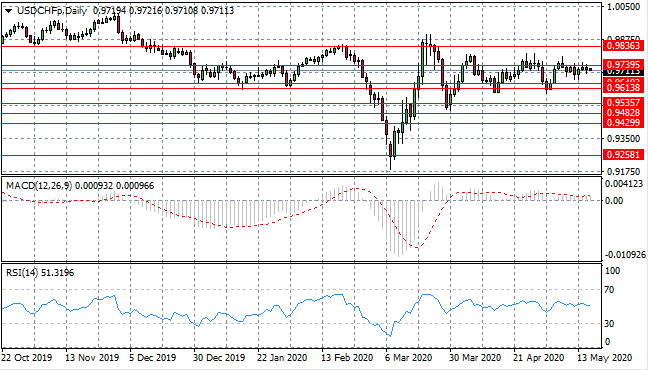

USD/CHF

The USD/CHF pair has failed several times at the 0.973 price level. Each pullback results in another test of the resistance area and it seems likely that the pair will continue to move within the 0.961- 0.973 trading range. Momentum indicators are languishing in neutral territory.

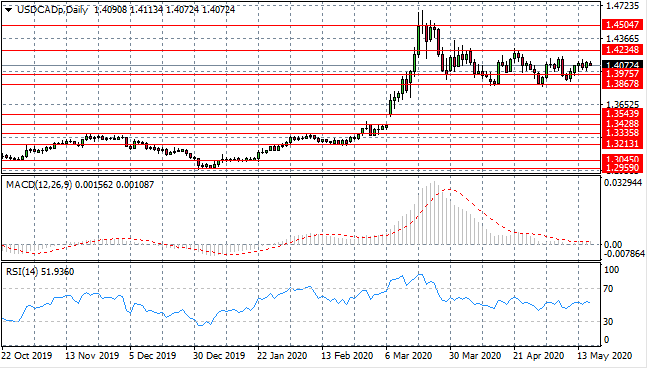

USD/CAD

The USD/CAD pair has broken the 1.397 price line to the upside and the next target is the 1.423 resistance area. However, each bullish move is met with the return of sellers to drive price action back to the support level. Momentum indicators are neutral.

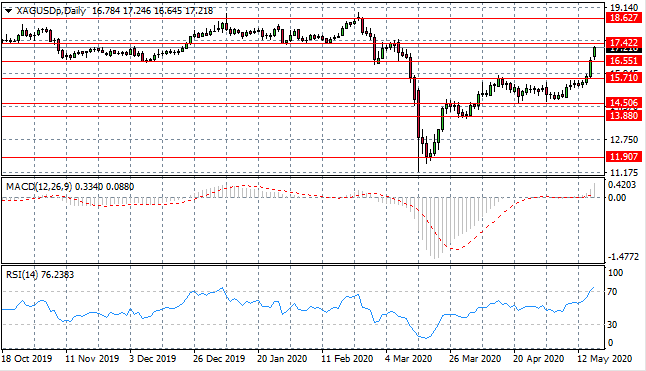

SILVER

A Silver rally has taken the metal back towards the 17.42 resistance area which represents a previous trading range. Given the uncertain fundamentals, the rally may not be sustained. Momentum indicators are testing overbought conditions.

GOLD

Gold has broken the upper trading range at the 1728 resistance level, as buyers build momentum. The break has seen the metal reach recent price highs and is beginning to approach highs last seen in 2010-2011. Momentum indicators support the bullish bias with upward trajectories, though RSI is approaching overbought conditions.

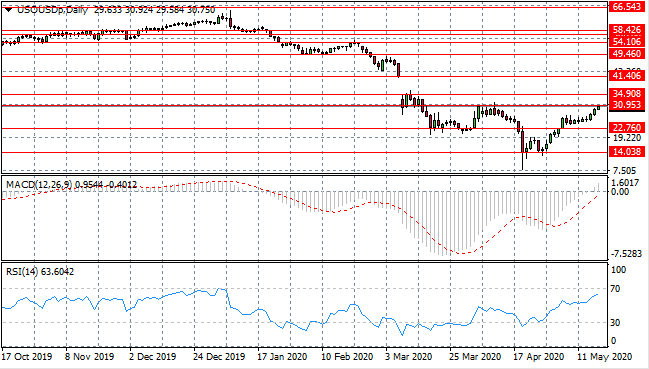

OIL

WTI has finally pushed beyond the 22.76 resistance line yet despite the break, buyers lacked the conviction to drive price action. A target exists at the 30.95 resistance area which has proven to be an obstacle for buyers in the past. Momentum indicators have sharp upward trajectories.