Precious Metals Sell-off On Dollar Strength

- 8 Nov 2019

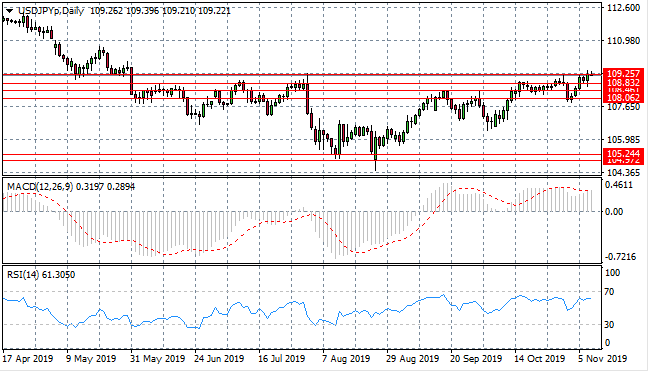

USD/JPY

The USD/JPY pair has broken out of the 108 price range and is now testing the 109.25 resistance level. There has been a moderate increase in selling pressure in recent trading, which may suggest that the rally will not last. Momentum indicators have flattened in bullish territory.

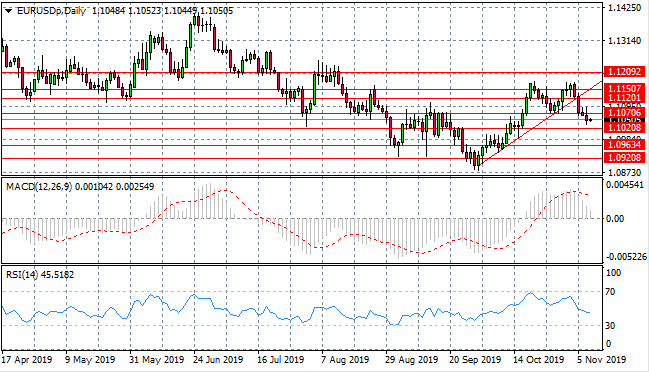

EUR/USD

The Eurodollar has continued to sell-off resulting in a break of the ascending trendline and the 1.107 support level. The next support level for the pair is the 1.102 support level. Momentum indicators have turned sharply bearish and are pulling back from bullish positions.

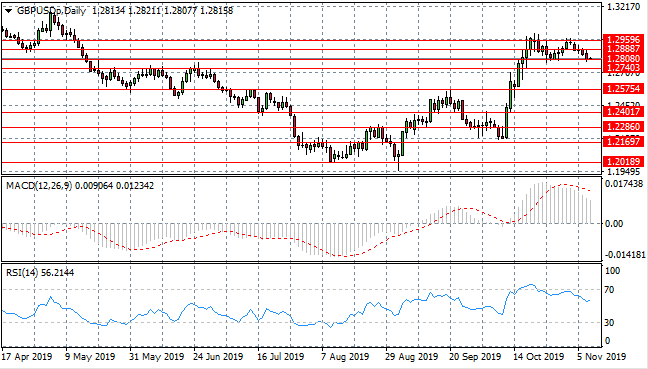

GBP/USD

The GBP/USD pair has reached an obstacle in the form of the 1.295 resistance level, which has sent price action back to test the 1.280 support level. The recent rally has seen the pair now reach a trading range last established at the start of the year. Geopolitical developments are most likely to govern near term price action. Momentum indicators are pulling back from overbought conditions.

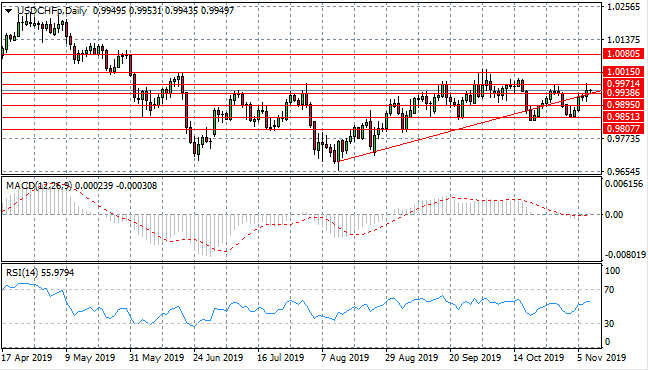

USD/CHF

The USD/CHF pair has broken both the ascending trendline and the 0.993 support level, with a spike in price action towards the 0.997 resistance level. The ascending trendline has gone from acting as a support to a resistance level and price action may hug the line going forward. Momentum indicators remain in neutral territory with slightly bullish sentiment.

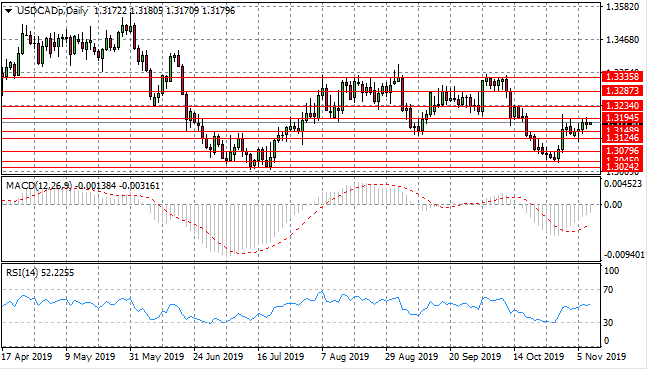

USD/CAD

The USD/CAD pair has decelerated mid-rally as selling pressure begins to rise for the pair. Price action has made several tests of the 1.319 resistance level, but is yet to break. Small-bodied candles denote uncertainty in market participants. Momentum indicators have upward trajectories indicate a bullish bias.

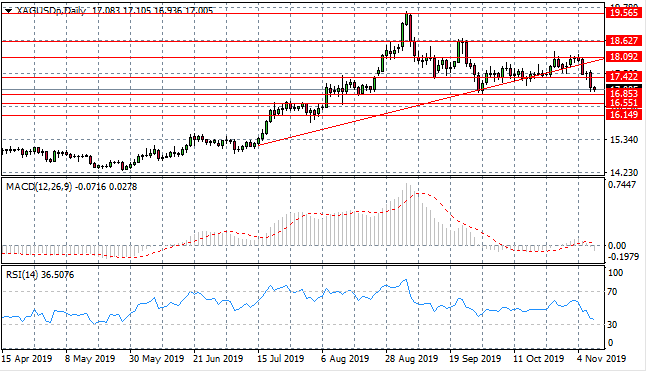

SILVER

Silver has broken both the ascending trendline and the 17.42 support level. The next support level is the 16.85 as heavy selling pressure continues. The metal may remain in the 16.85- 18.09 price range. Momentum indicators have turned sharply bearish with RSI approaching oversold conditions.

GOLD

Gold has rejected the ascending trendline which has resulted in a sell-off of the metal. A break of the 1485.27 support level has finally materialized and price action may now head towards the 1446.82 support level. Momentum indicators have turned sharply bearish with MACD breaking the zero line to the downside.

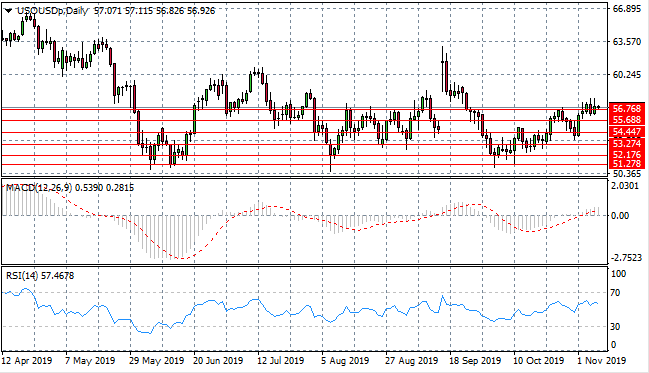

OIL

WTI has spiked through the 56.78 resistance line yet price action has pushed back below the resistance level. Sellers appear to still be active in the commodity. The next support level for the commodity is the 55.68 price line. The 56.76 price level represents a ceiling where conviction from buyers is beginning to wane. Momentum indicators have bullish trajectories.