A Bearish Reversal Imminent For GBP/USD Pair?

- 4 Aug 2020

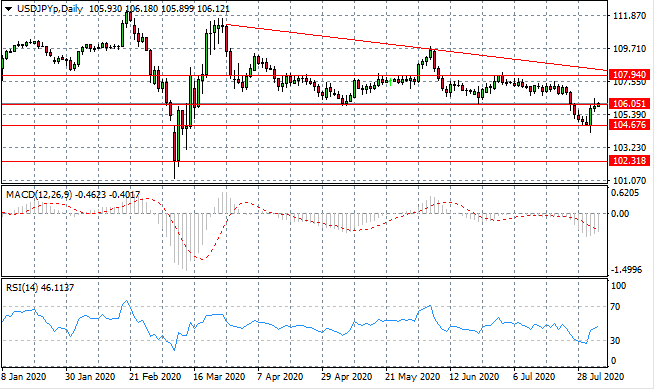

USD/JPY

The USD/JPY pair has moved to test the 106.05 resistance level after recovering from a sell-off during the last trading week. Despite a spike through the resistance line, price action has been contained. Horizontal price action will likely resume especially if the pair returns to the previous trading range. Momentum indicators are moving away from oversold conditions.

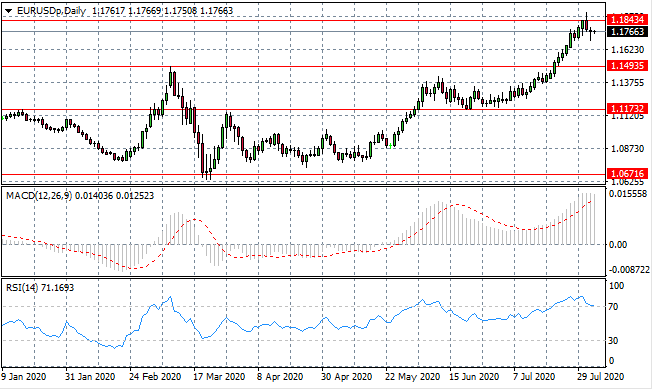

EUR/USD

A Eurodollar reversal appears to be underway, as sellers returned at the 1.184 price level. A doji candle to follow the trend change indicates that buyers are still active and that buying pressure remains (indicated by the long lower shadow). Momentum indicators are undergoing bearish reversals with RSI moving to test the 70 overbought line.

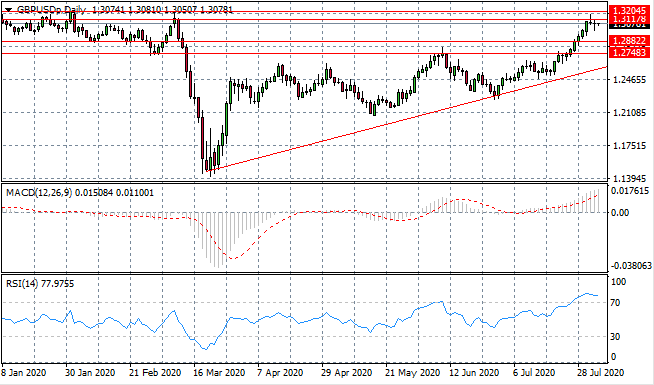

GBP/USD

The GBP/USD pair has pulled back from the 1.311 resistance line as a series doji candles signify an imminent trend change, however, momentum is yet to be established. The longer-term direction for price action remains bullish. Momentum indicators appear to have stalled in bullish territory with RSI beginning a descent.

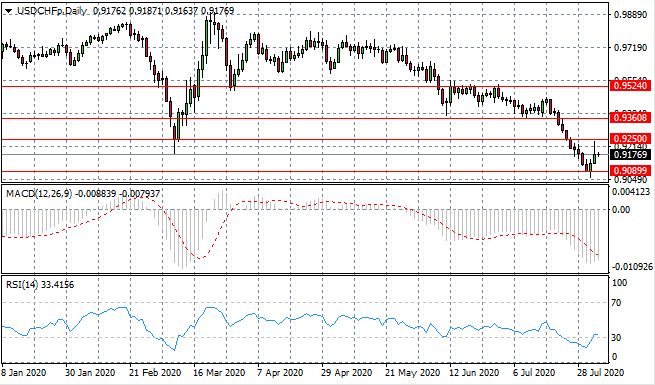

USD/CHF

The USD/CHF pair has rebounded from the 0.908 support level as buyers return to the pair. The next resistance level is the 0.925 price line, yet sellers are very much active; preventing a test of the resistance area in yesterday’s trading. Momentum indicators are undergoing bullish reversals with RSI testing the 30 support level.

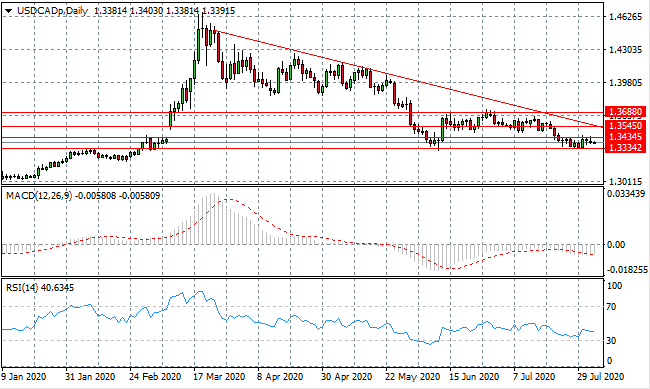

USD/CAD

The USD/CAD pair appears set to resume the downtrend, as any bullish price momentum has been short-lived. As such, the pair is now heading back to the 1.333 support level. Once again, any attempts by buyers to drive a trend change seem to be short-lived. Momentum indicators have flattened in bearish territory.

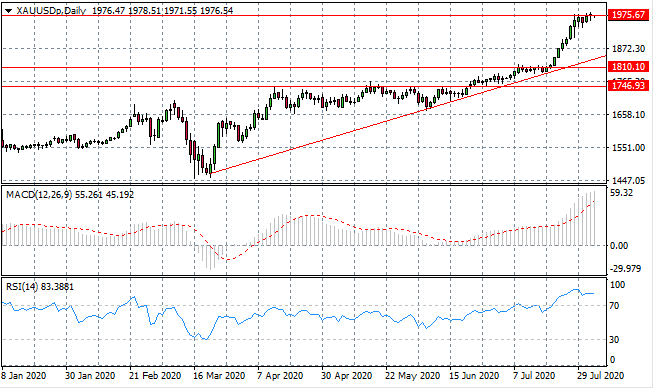

GOLD

Gold buyers have stalled at the 1975.67 resistance line after an exclusively bullish seven days of trading. A series of doji candles may indicate a price reversal, yet fundamentals suggest that given current economic conditions, the stall may be a break before the metal moves higher. Momentum indicators have stalled in bullish territory.

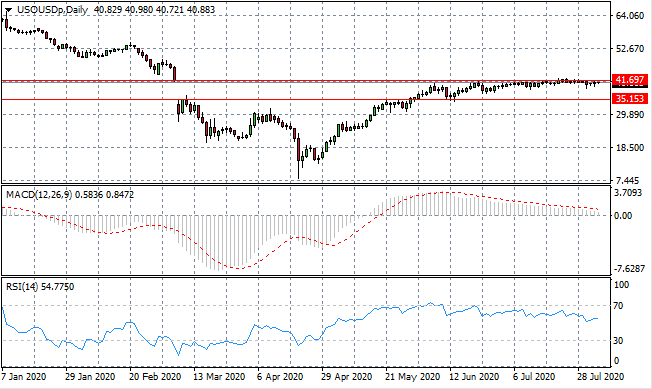

OIL

WTI is stuck to the gap-fill line and without a break, the commodity is unlikely to gain any traction in the near-term. There appears, currently, to be little appetite from sellers to drive price action. Horizontal/ range-bound price action is, therefore, likely to be the mainstay for some time to come. Momentum indicators have a bearish bias.