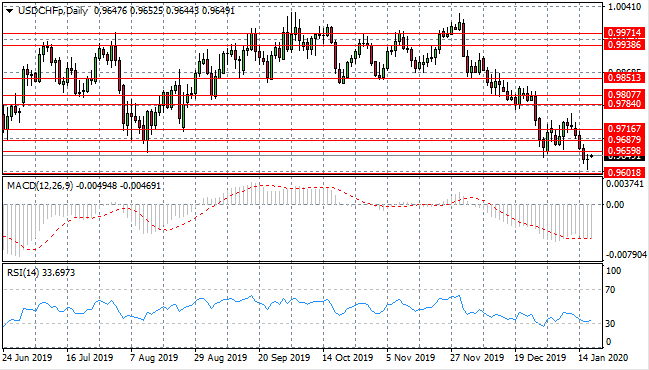

A Reversal Underway For The USD/CHF Pair?

- 17 Jan 2020

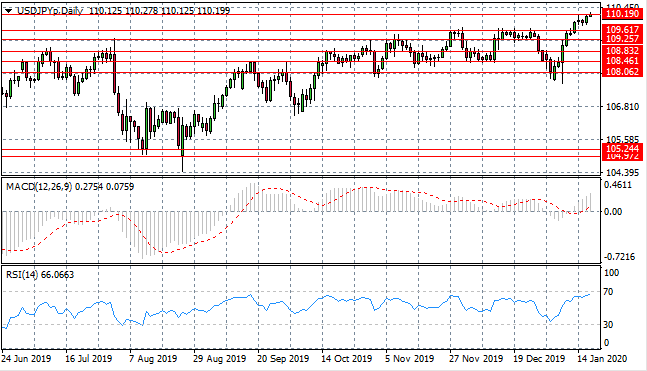

USD/JPY

The USD/JPY pair is testing the 110.19 resistance line once again after a moderate pullback in recent trading. The pair has yet to break this recent price high as buyers appear to lack the conviction. It remains to be seen how far the recent rally will go in terms of price action. Momentum indicators are bullish with RSI approaching overbought territory.

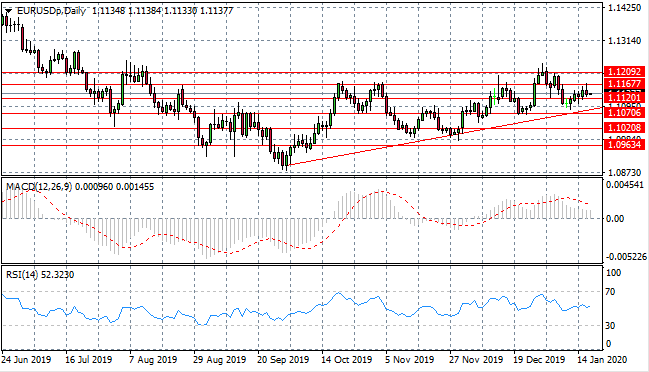

EUR/USD

The Eurodollar appears to be entering into an ascending triangle pattern with higher highs and higher lows, at the same time, oscillations are narrowing into an apex. A bullish breakout is therefore indicated with a target being the 1.120 resistance line. Momentum indicators are moderately bullish.

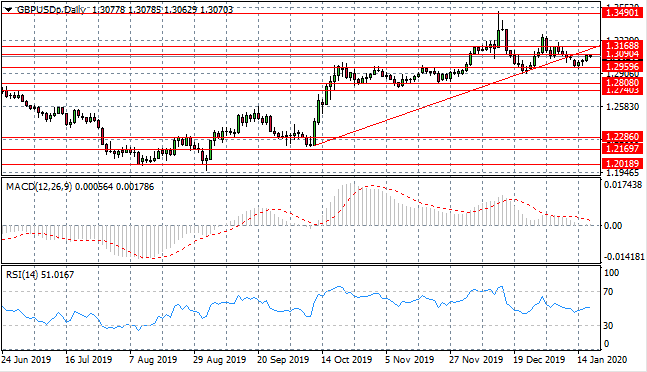

GBP/USD

The GBP/USD pair has rebounded from the 1.295 price area which has represented an obstacle on previous occasions. Price action is now testing the 1.309 price line with the next target being the ascending trendline/1.316 resistance area. Momentum indicators are neutral.

USD/CHF

The USD/CHF pair has come under pressure once again with strong bearish momentum taking price action towards the 0.960 support area, although price action closed well above this recent price low. Despite buying pressure, a long legged doji indicates consolidation at this price level and may be the beginning of an uptrend. Momentum indicators have stalled in bearish territory, with RSI testing oversold conditions.

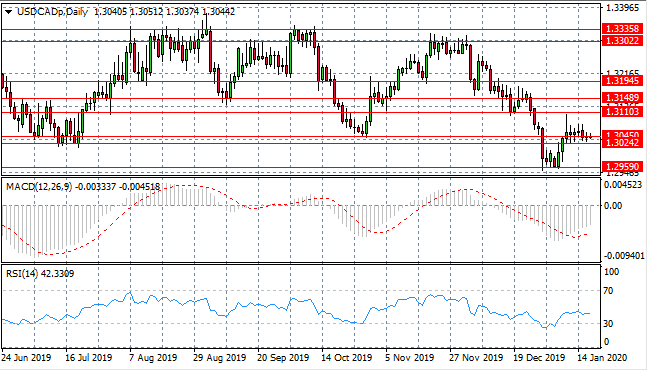

USD/CAD

The USD/CAD pair has stalled at the 1.304 resistance level where price has consolidated in recent trading, perhaps as the first sign of further downside or a bearish breakout. A break of the current price area is significant as it represents a key support level. Momentum indicators have flattened in bearish territory.

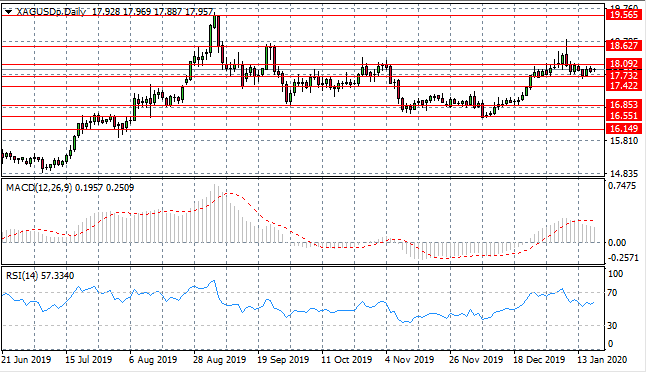

SILVER

Silver has returned to a previous trading range between the 16.55 and 18.09 price levels. However, price action continues to test the 18.09 resistance area. A narrowing of oscillations may represent a build up before a breakout. The direction of a potential breakout is unclear as momentum indicators have flattened in bullish territory.

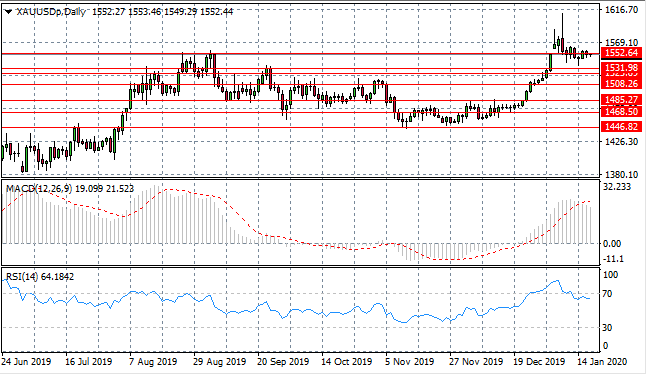

GOLD

Gold continues to test the 1552 resistance area which has represented a recent price high. A break in recent trading was a result of geopolitical tensions which have since subsided, therefore this price ceiling will likely remain intact in the absence of major market events. Momentum indicators are pulling back from strongly overbought conditions.

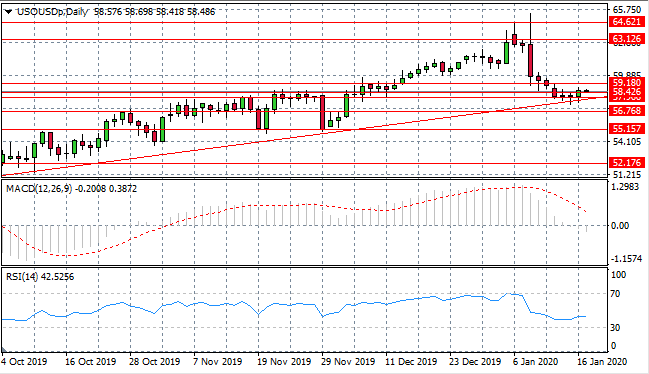

OIL

WTI price action continues to fall towards the ascending trendline where, true to form, a bullish rebound has taken place. Price action has since climbed beyond the 58.42 resistance level. A stabilizing price for the oil market is at $60 per barrel. Momentum indicators remain bearish.