USD/CHF Pair Plummets Towards The End Of The Trading Week

- 27 Mar 2020

USD/JPY

USD/JPY pair has broken back below the 110.19 support level with price action returning to a previous and fairly tight trading range. The next target is the 107.93 support level which has represented a price floor within that range. Momentum indicators remain in bullish territory although sentiment appears to be changing.

EUR/USD

Eurodollar buyers show no sign of slowing down as several resistance levels have been broken, taking price action towards the 1.107 resistance line. Momentum indicators support the bullish trajectory, with MACD testing the zero line.

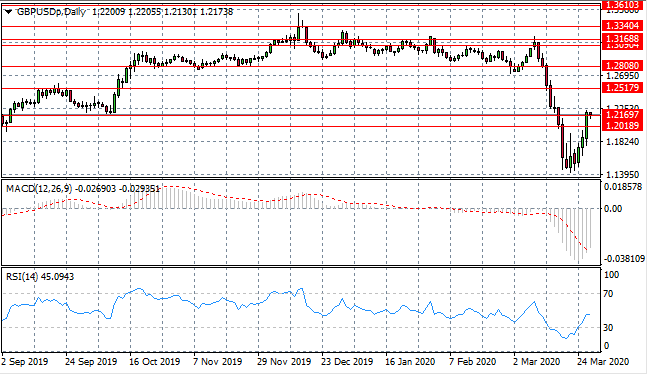

GBP/USD

The GBP/USD recovery has stalled at the 1.216 resistance level which represents a previous long-term support area. If the pair can break this price line, the pair will return to a previous trading range and likely more moderate oscillations. Momentum indicators are also undergoing a reversal, with RSI recovering from oversold conditions forming a break of the 30 support level.

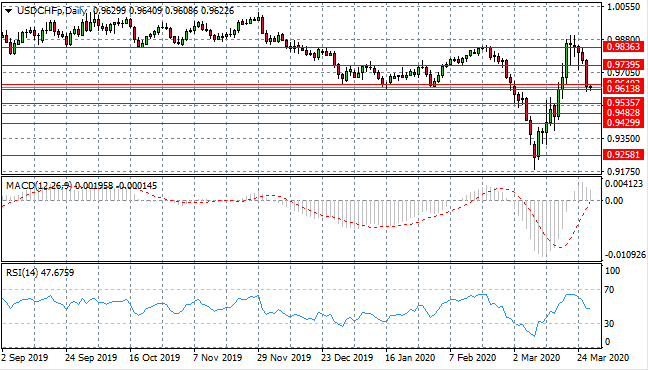

USD/CHF

The USD/CHF pair has plummeted towards the 0.961 support level as sellers returned with conviction to the pair once the 0.983 resistance area was reached. This support area has proven to be an obstacle for sellers where bullish rebounds have taken place on several previous occasions. Momentum indicators are also pulling back from overbought positions.

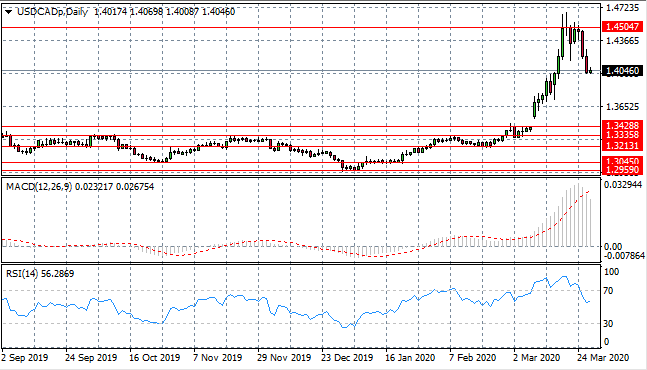

USD/CAD

The USD/CAD rally has started to revert as sellers have returned to push price action back towards a more moderate trading range. The pair may remain at elevated levels until some resolution of the COVID-19 virus situation appears. Momentum indicators support the bearish bias with a break of the 70 overbought line on RSI and momentum reversal on MACD.

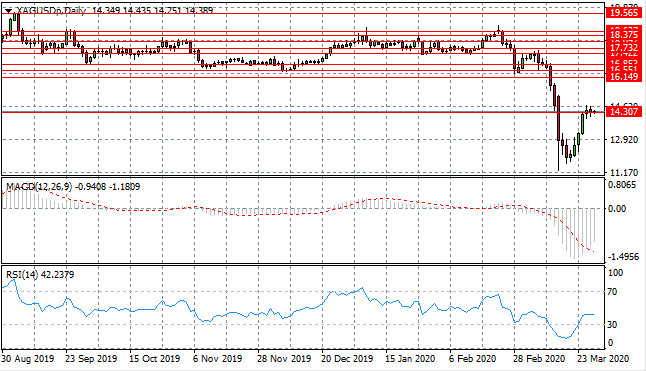

SILVER

The Silver revival appears to be gaining traction with buyers beginning to gather momentum. The metal has met an obstacle at the 14.30 resistance line where sellers appear to have returned at least to limit upward momentum. RSI has broken the 30 oversold line to the upside and MACD is undergoing a momentum reversal.

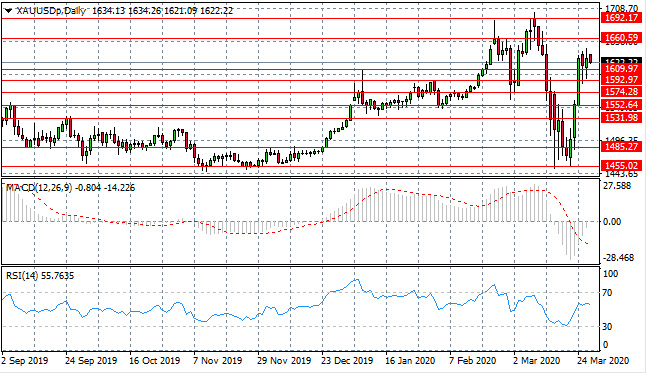

GOLD

Gold has stalled after a buying frenzy in response to the prospect of more stimulus. The metal has sustained the 1600 range for the time being, yet there have been several pullbacks. Momentum indicators are mixed with RSI stalling in neutral/bullish territory yet MACD has an upward trajectory.

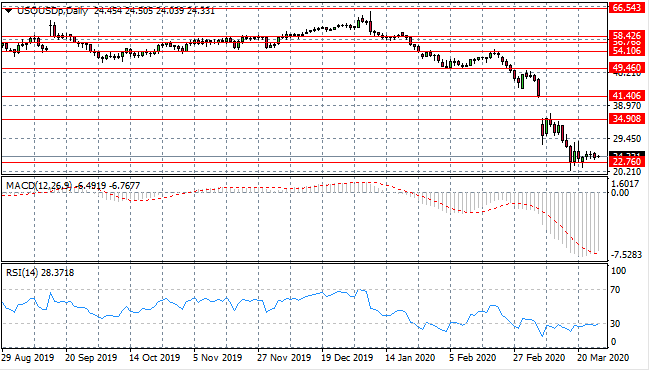

OIL

WTI prices remain at all-time lows testing the $20 per barrel range yet a bounce back has started, albeit at a moderate pace as, currently, buyers appear to lack conviction. The next obvious target is the 34.90 resistance line which also represents the gap fill line and a potential price recovery. Momentum indicators have flattened in bearish territory with RSI hugging the 30 support level.