Dollar Recovery Is Patchy

- 3 Jul 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

Dollar weakness continues to persist taking USD/JPY pair back to the the 107.61 support level. Volatility has led market participants into safe haven assets such as the Yen. The pair will likely remain in this thin trading range for the foreseeable future. Momentum indicators, however, support bullish sentiment and are presenting with upward trajectories.

EUR/USD

The EUR/USD pair has once again suffered from a sell-off resulting in a break of the 1.130 support level. The break has since resulted in the deceleration of bearish price action. Overall, in the longer-term, the trend is bullish with a series of oscillations represented by the current direction of price action. Momentum indicators are moderately bullish.

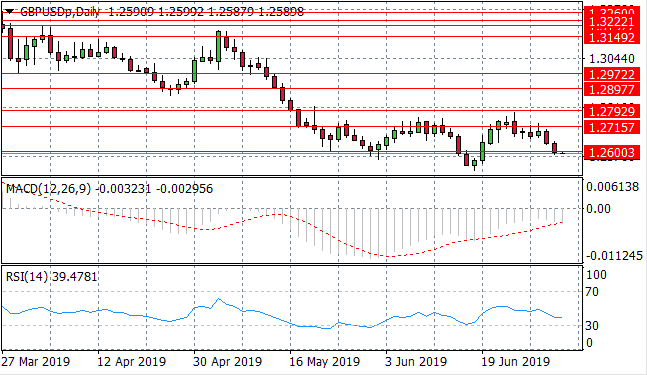

GBP/USD

The GBP/USD pair appears to be trading horizontally with a series of doji candles and mild tests of the 1.271 resistance line. The pair is more likely to be impacted by fundamental factors going forward. Momentum indicators are moderately bearish.

USD/CHF

The USD/CHF pair has made a recovery to break the 0.980 resistance line, with the next target at the 0.990 support level. Price action will reflect sentiment in the dollar, as the greenback begins to strengthen, price action will continue to move higher. Momentum indicators appear to be undergoing bullish reversals.

USD/CAD

The USD/CAD pair has plummeted to the 1.309 support level after a strong dollar sell-off last week. On previous occasions this price level has proven to be a strong support resulting in a bullish reversal. The pair continues to test the support level and momentum indicators have flattened in strongly bearish territory.

SILVER

Silver’s rally has recovered after a mild pullback; breaking the 15.23 support line and a test of the 15.42 resistance line. Fundamental factors are likely to come into play in terms of the future direction of price action. RSI has pulled away from the overbought 70 resistance line and MACD has flattened in bullish territory.

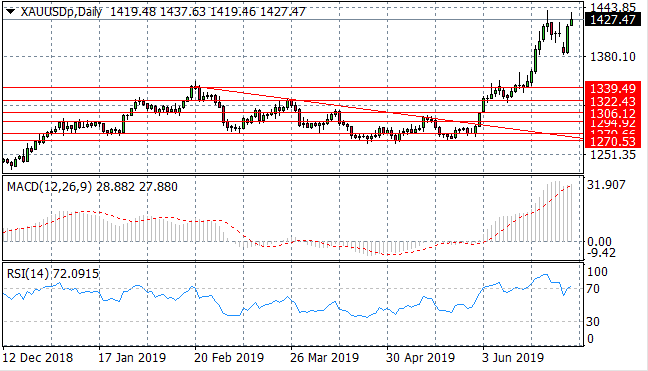

GOLD

Gold price action has been volatile in recent trading. Buyers are still very much present for the metal as recent price highs continue to be tested. There are sings in momentum indicators that the bullish sentiment is starting to wane, as MACD pulls back from strongly bullish territory and RSI tests the 70 overbought line.

OIL

WTI has found resistance at the $60 per barrel price range and as such, sellers have returned sending price action towards the 55.86 price level. Momentum indicators are neutral which suggests that sentiment is neither strongly bullish or bearish.

Follow Us on Facebook: