Sell-Off For Precious Metals

- 12 Nov 2019

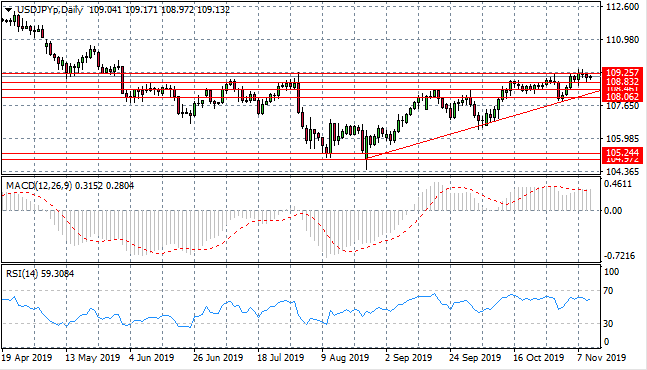

USD/JPY

The USD/JPY pair has reverted after testing the 109.25 resistance level. Despite a spike through the resistance area, price action has rebounded. Sentiment appears to have turned bearish and the pair will likely return to the 108 price range. Momentum indicators have flattened in bullish territory.

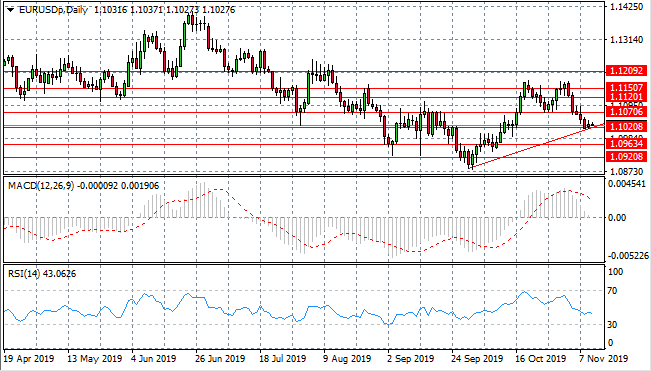

EUR/USD

The Eurodollar has continued to sell-off taking price action back to test both the 1.102 support level and the ascending trendline. The pair appears to have stalled at this price level, indicating a lack of conviction from sellers. Momentum indicators have turned sharply bearish with RSI approaching oversold conditions.

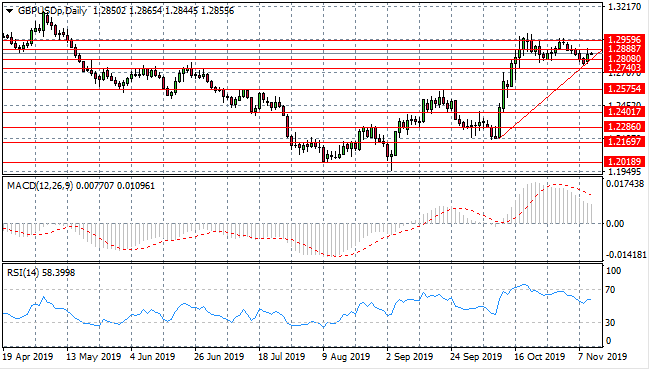

GBP/USD

The GBP/USD pair has rebounded from the 1.295 resistance level, however a break of the 1.280 support line has inspired buyers to return. Price action will likely remain in the 1.274- 1.295 range. Geopolitical developments are most likely to govern near term price action. Momentum indicators are pulling back from overbought conditions.

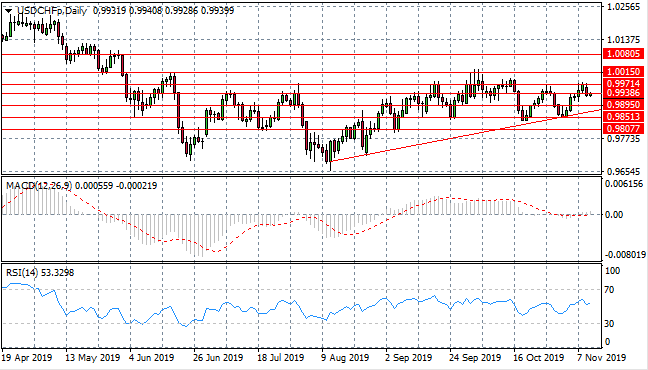

USD/CHF

The USD/CHF pair has touched and pulled back from the 0.997 resistance level and is once again testing the 0.993 support level. The overall trend remains bullish with an ascending trendline acting as a strong support line. Momentum indicators are bullish; with RSI moving into the buy channel and MACD bouncing along the zero line.

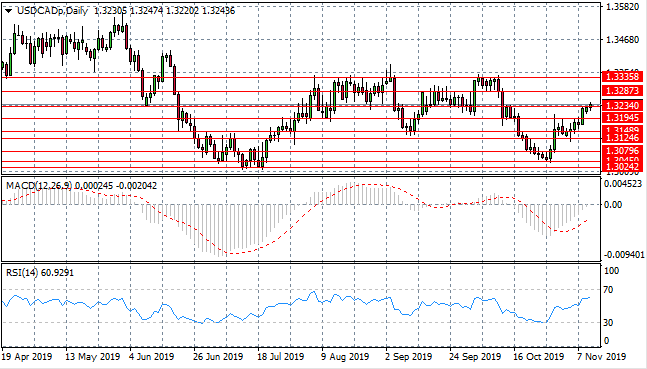

USD/CAD

The USD/CAD pair is testing the 1.323 resistance level after a sustained rally in the pair. A break is yet to materialize for the pair with buyers currently lacking the conviction to drive price action higher. Momentum indicators have upward trajectories indicating a bullish bias.

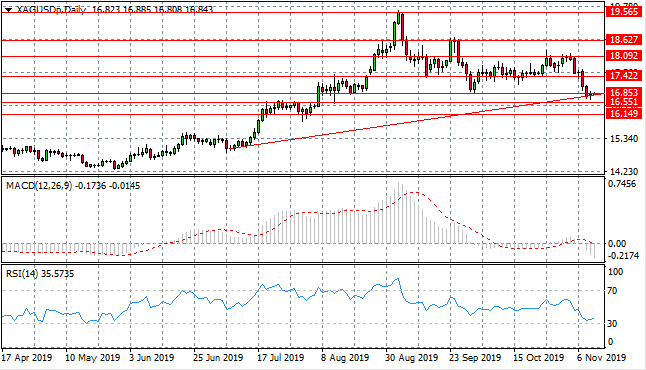

SILVER

Silver has broken several support levels with the bearish move decelerating when price action met the ascending trendline. The metal has now stalled at the 16.85 support level. The metal has oscillated within a tight trading range between the 16.85- 18.09 price levels. Momentum indicators have turned sharply bearish yet RSI has rebounded from oversold conditions.

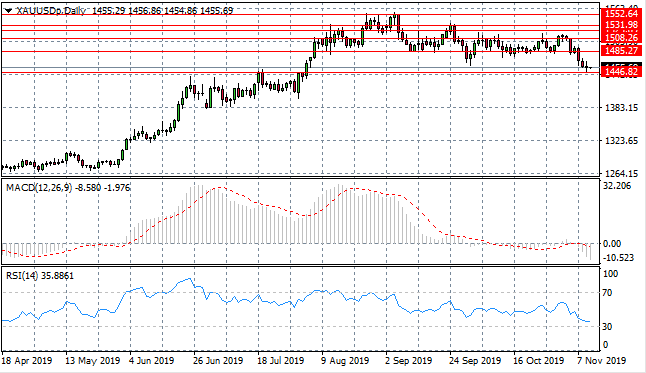

GOLD

Gold sellers are beginning to dominate price action, taking the metal towards the 1446.82 price level and despite a touch, price action has been held above the support level. A doji candle indicates indecision, that sellers may lack conviction to drive the break. Momentum indicators are bearish with RSI approaching oversold conditions.

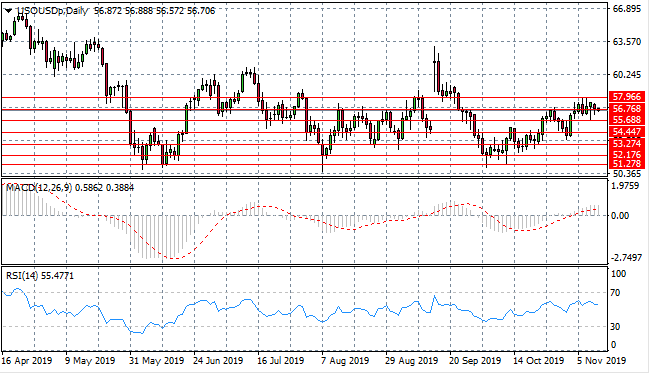

OIL

WTI price action has been volatile, bouncing along the 56.76 resistance line as buyers and sellers tussle to control price action. A couple of tests of the 57.96 resistance level indicates appetite from buyers confirming the clear uptrend. Momentum indicators remain in bullish territory.