Commodities Under Pressure At The Start Of The Trading Week

- 29 Oct 2019

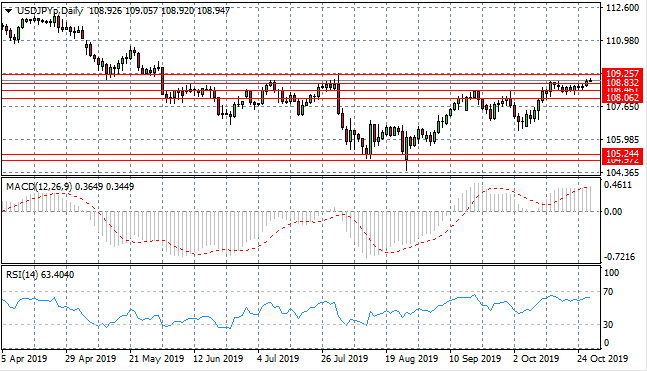

USD/JPY

The USD/JPY pair has moved beyond the 108.83 resistance line which may take price action towards the 109.25 resistance level. There currently appears to be a lack of conviction from buyers denoted by a series of small-bodied candles. Momentum indicators have flattened in bullish territory.

EUR/USD

The Eurodollar has rebounded from both the ascending trendline and the 1.107 support level representing the resumption of the previous uptrend. The next target for buyers is the 1.112 price level. Momentum indicators remain in bullish territory although are beginning downward trajectories.

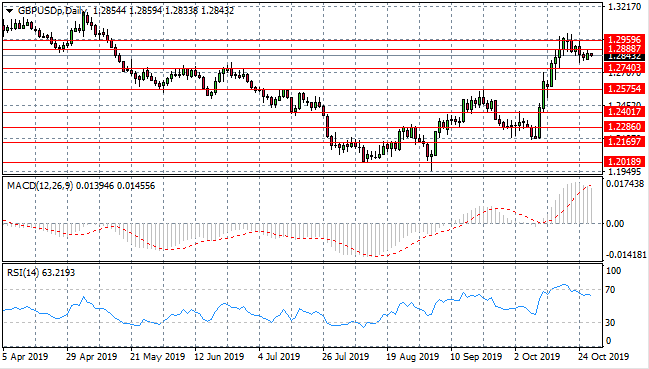

GBP/USD

The GBP/USD pair is moving towards the 1.274 support level but has stalled after the break of the 1.288 support level. Buyers appear to still be active in the pair as political uncertainty result in indecision in price action. Momentum indicators are pulling back from bullish territory.

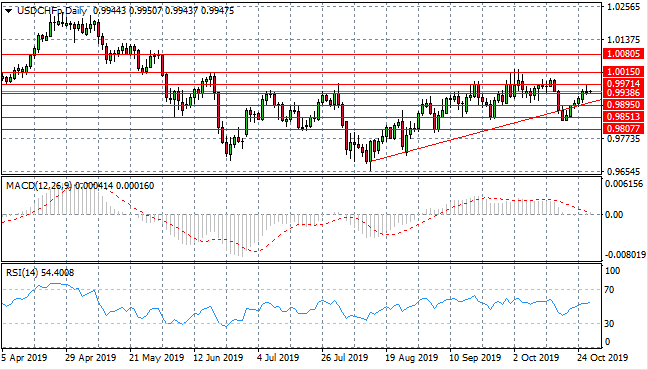

USD/CHF

The USD/CHF pair has stalled at the 0.993 resistance level having broken the ascending trendline, as selling pressure rises. The pair has been languishing around this price level for the last month or so. Momentum indicators are neutral moving towards default levels.

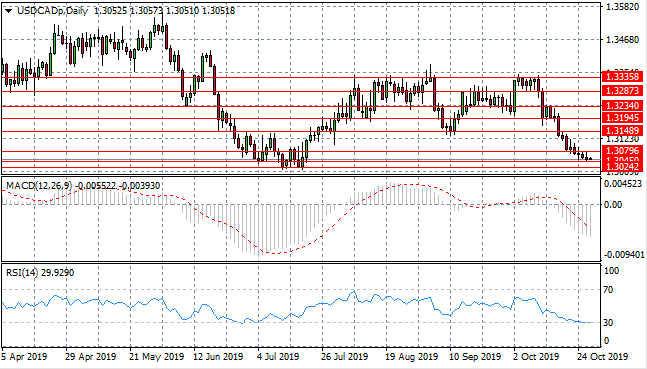

USD/CAD

The USD/CAD pair has broken the 1.307 support level and is now testing the 1.304 support level as bearish sentiment continues and selling pressure remains. A price floor exists at the 1.302 support level. Momentum indicators have flattened in bearish territory with RSI testing oversold conditions.

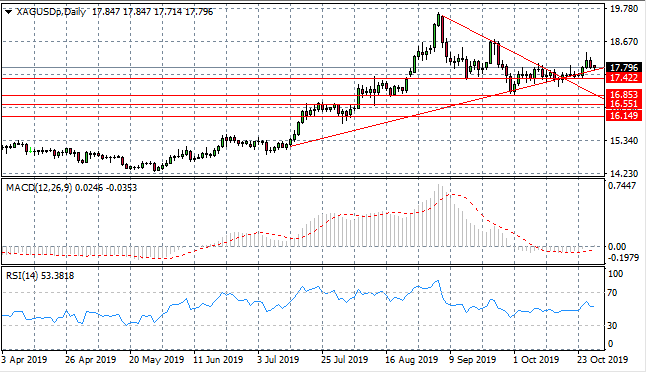

SILVER

Silver continues to test the ascending trendline and despite selling pressure the metal has not broken the support level, resulting in a moderate uptrend. There appears to be more of a bearish bias in price action indicating it may not be long before a break. Momentum indicators are mixed with MACD remaining in bearish territory and RSI moving into the buying channel.

GOLD

Gold has been trading horizontally, within a tight trading range recently. Despite a test, the metal has been unable to fully break the ascending trendline to the upside. A pullback has take price action back to the 1485.27 which represents a strong support level. Momentum indicators have turned bearish.

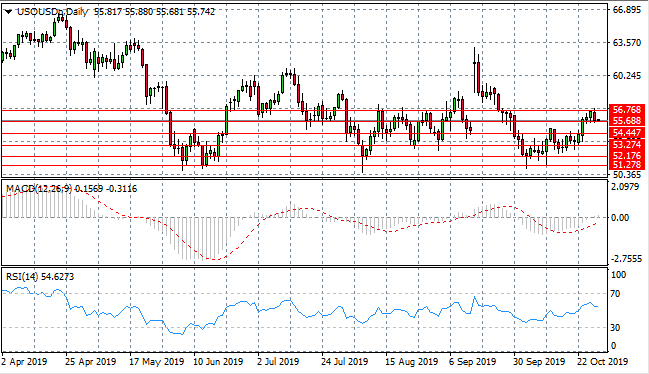

OIL

WTI has pulled back from the 56.76 resistance level as price action may stabilize at the $55 per barrel price range. Despite heavy selling in yesterday’s trading, the commodity was unable to break the 55.68 support level. Momentum indicators have upward trajectories, with MACD breaking the zero line to the upside.