Is A Bearish Breakout Imminent For The GBP/USD Pair?

- 18 Feb 2020

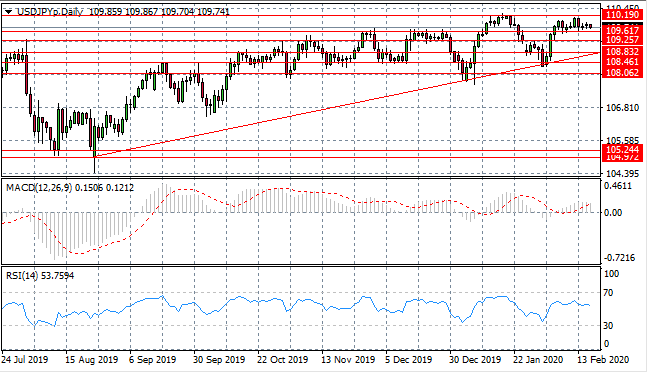

USD/JPY

The USD/JPY pair is bouncing along the 109.61 support level as a series of doji candles indicate there is a lack of appetite from both buyers and sellers, hence uncertainty remains. Price action appears likely to oscillate between the 109.61 and 110.19 price levels in the near-term. Momentum indicators have stalled in bullish territory.

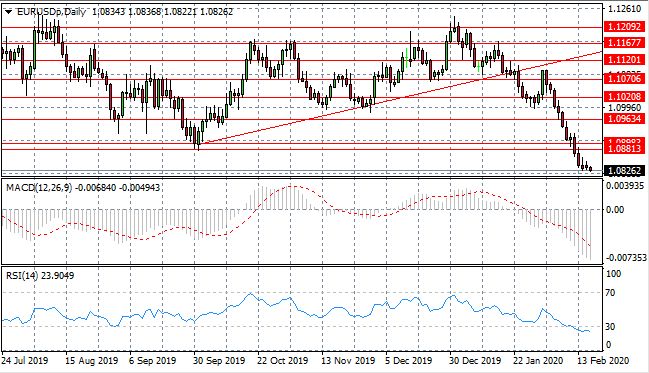

EUR/USD

The Eurodollar sell-off may have decelerated, as denoted by an inverted hammer candlestick indicating a potential trend reversal. Selling pressure remains, however, resulting in three consecutive doji candles. Buyers appear to be struggling to gain control. Momentum indicators remain in bearish territory with RSI bouncing along the 30 oversold level.

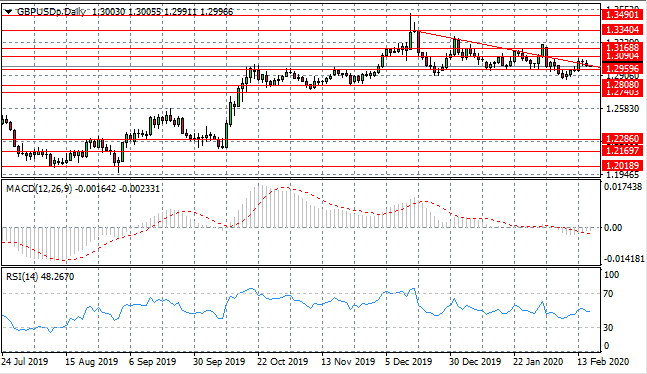

GBP/USD

The GBP/USD pair has been unable to move beyond the descending trendline. A long legged doji in yesterday’s trading could be the first indication of a reversal. A breakout seems to be imminent as oscillations tighten and price action follows a descending triangle pattern. Momentum indicators have moved into bearish territory.

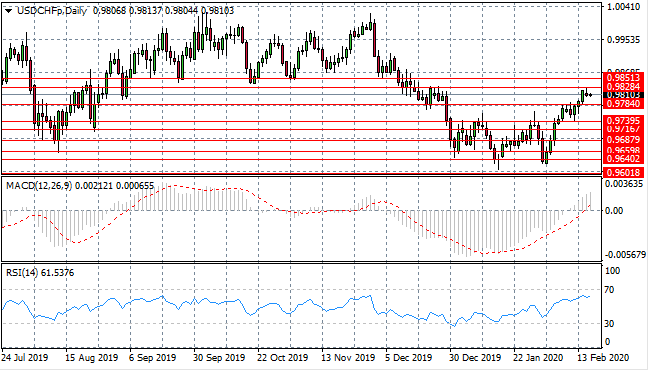

USD/CHF

The USD/CHF pair has failed to move beyond the 0.982 resistance level as the rally seems to have decelerated mid-rally. The pair may find more support from buyers with the current pattern only representing a pullback or a total reversal may begin. Momentum indicators have upward trajectories, however, RSI is fast approaching overbought conditions.

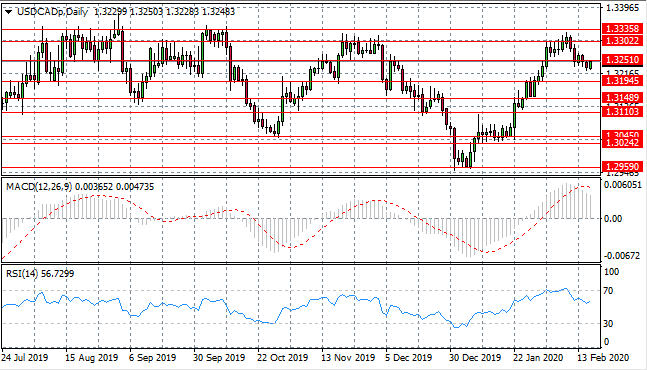

USD/CAD

The USD/CAD pair has pulled back from the 1.330 resistance area and is now testing the 1.325 support area where buyers and sellers appear to be grappling for control. As oscillations begin to widen, the most likely course for the pair appears to be bearish. Momentum indicators are pulling back from strongly bullish positions.

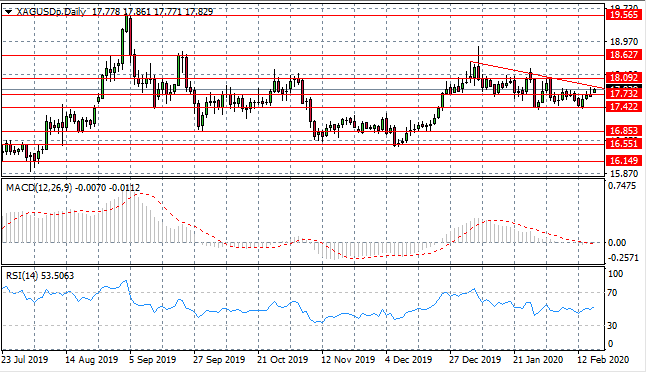

SILVER

Silver has rebounded from the 17.42 price floor and has now pushed beyond the 17.73 resistance level. Price action is heading towards the descending trendline where previously, a bearish pullback has followed. Selling pressure already appears to be rising. Momentum indicators have flattened in neutral if slightly bullish territory.

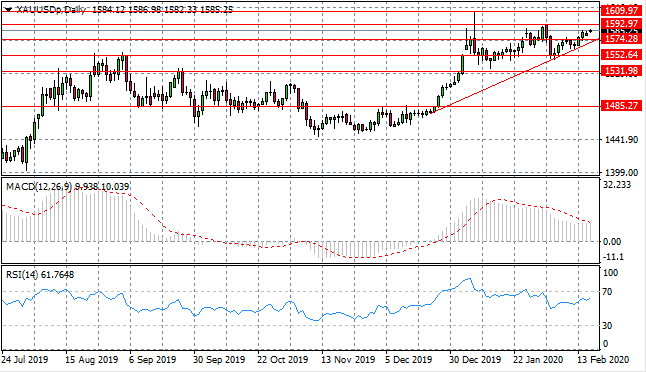

GOLD

Gold buyers appear to be losing a bit of steam, yet the trajectory for the metal is bullish; with the 1592.97 resistance line in sight. Given current pattern of price action, it seems that strides higher are unlikely with a bearish reversal a higher probability. Momentum indicators have moderate downward trajectories.

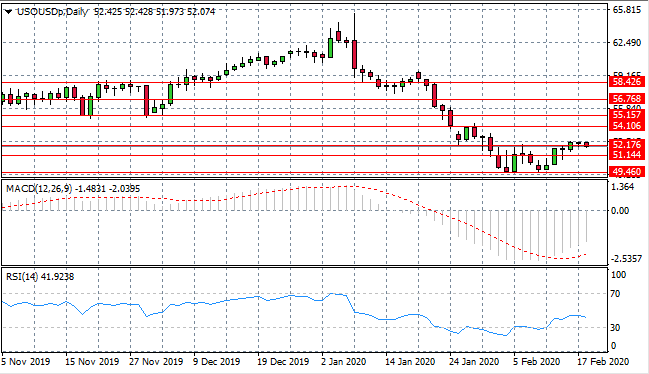

OIL

WTI is undergoing a bullish reversal, which has taken price action to test the 52.17 resistance level. It seems likely that the commodity will remain in the $50 per barrel range for the near-term. Momentum indicators have upward trajectories with RSI pulling away from oversold conditions.