Gold Struggles To Break Key Resistance Area

- 22 Oct 2020

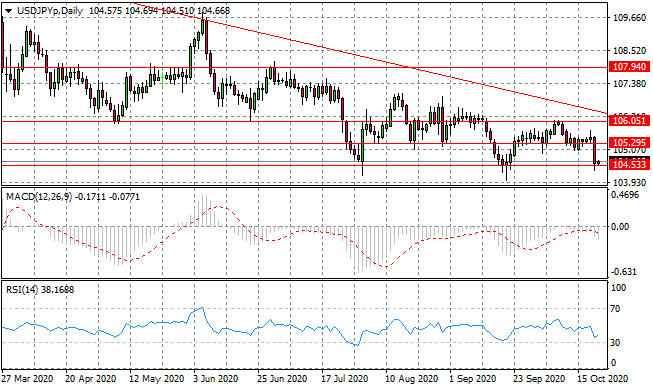

USD/JPY

The USD/JPY pair suffered a sell-off in the last trading session, resulting in a break towards a price low at the 104.53 support level. In early trading, buyers have returned which may suggest another bullish rebound is on the cards. Momentum indicators remain in bearish territory.

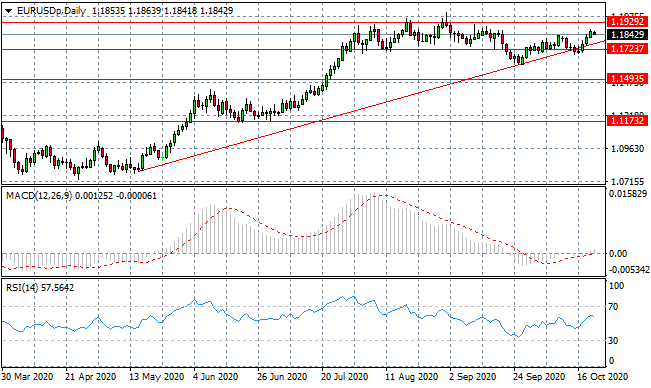

EUR/USD

The Eurodollar has found support at the 1.172 support level and the pair is now making its way towards the range ceiling at the 1.192 ceiling. The rebound from the ascending trendline strengthens the rally. Momentum indicators have upward trajectories.

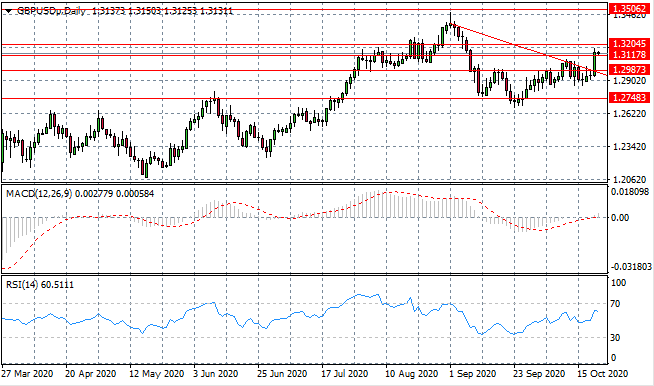

GBP/USD

The GBP/USD pair has found significant support in recent trading breaking several resistance levels as well as the descending trendline. The pair has stalled at the 1.311 resistance level. If the pair is able to return to the 1.320- 1.350 range, a longer-term rally seems likely. Momentum indicators are bullish.

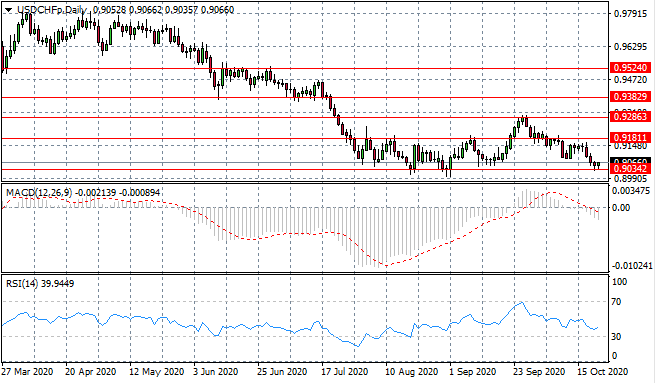

USD/CHF

The USD/CHF pair has failed to breach the 0.903 price low as buying activity has risen. As such, the pair will likely remain in range between the 0.903 and 0.918 price levels. The consolidation channel will remain intact. Momentum indicators remain bearish.

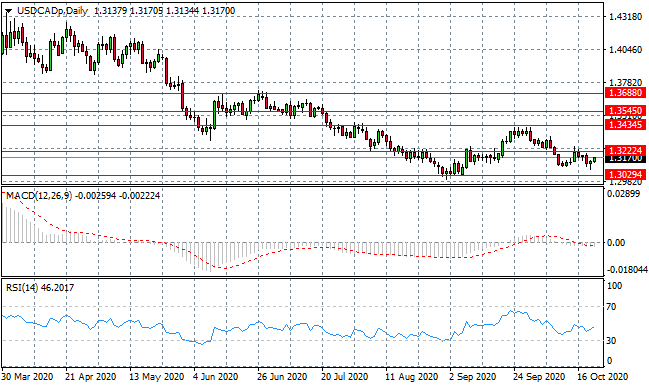

USD/CAD

The USD/CAD pair has been languishing within the current trading range for over a week and despite tests of the 1.322 ceiling, the pair has failed to clear the channel. Price action seems most likely to move sideways in the absence of new fundamentals. Momentum indicators remain in bearish territory.

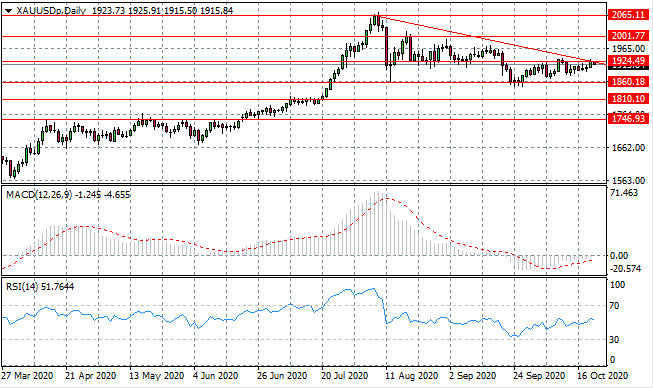

GOLD

Gold continues to test the 1924.49 price level, however, a break is yet to materialise. The descending trendline appears to be a strong resistance area for the metal. Buyers are currently building momentum but need strong conviction to overcome this key resistance area. Momentum indicators have begun upward trajectories.

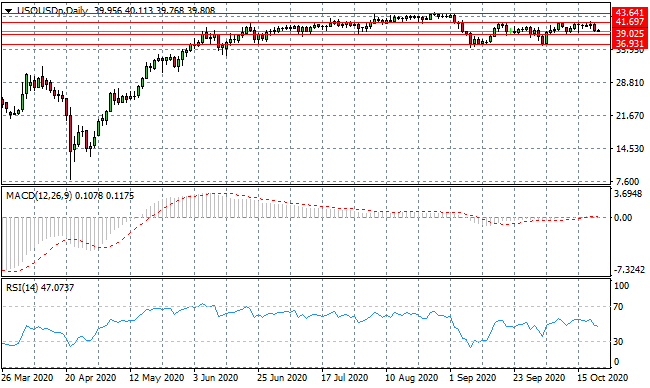

OIL

WTI is moving away from the 41.69 price ceiling, as the current trading range remains intact. Oscillations are likely to remain in this range in the near-term. The commodity will likely remain at the cusp of the $40 per barrel range going forward. Momentum indicators have flattened in neutral/bearish territory.