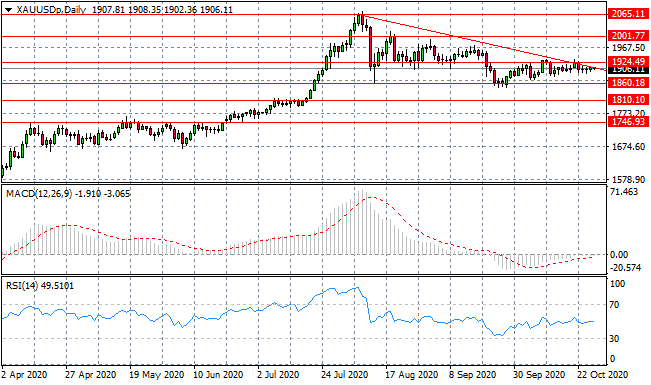

A Bearish Breakout Imminent For Gold?

- 28 Oct 2020

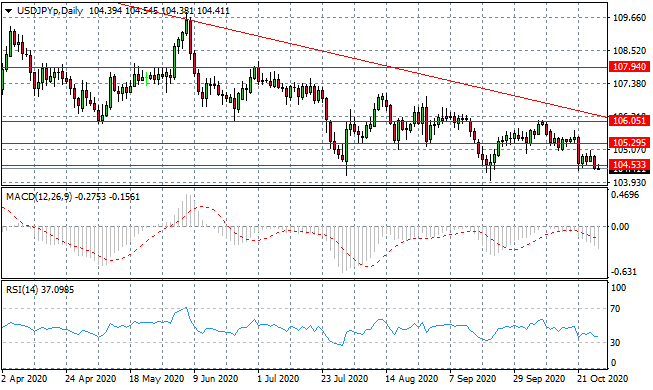

USD/JPY

USD/JPY sellers are still active in the pair yet a sustained break of the price floor has not been established. This price area remains an obstacle for sellers. A longer-term bearish trend is already established and likely to remain intact as the pair reaches lower highs. Momentum indicators are moving further into bearish territory.

EUR/USD

The Eurodollar has broken the ascending trendline in the first sign of waning bullish momentum. If the break is sustained we may see a trend reversal. A support level exists at 1.172. The pair has remained within the 1.172- 1.192 trading range since the end of September. Momentum indicators has begun downward trajectories.

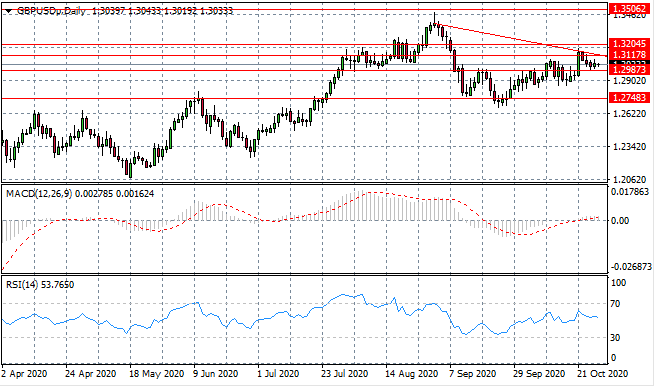

GBP/USD

The GBP/USD price trajectory reflects indecision. The pair has stalled just above the 1.298 support level as price action has retraced mid-rally. Small bodied candle indicate that currently, neither buyers nor sellers are dominating. Momentum indicators have flattened in bullish territory.

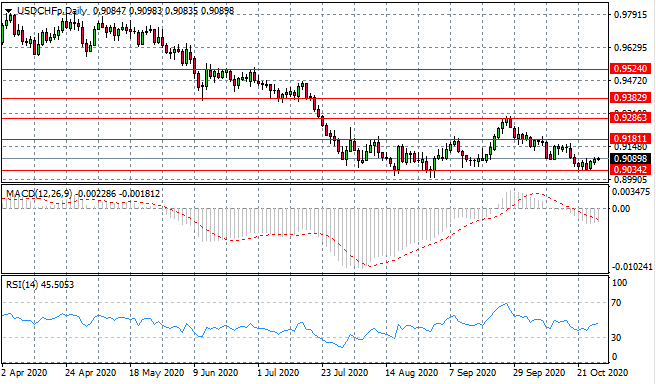

USD/CHF

The USD/CHF pair continues to pull away from the 0.903 support level, although bullish momentum remains moderate. Despite the move higher, the current consolidation channel will likely remain intact. Momentum indicators remain in bearish territory.

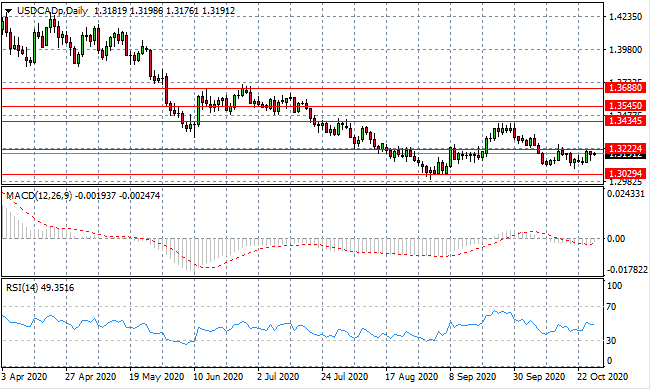

USD/CAD

The USD/CAD pair has failed to move beyond the 1.322 price level. The hammer candlestick in yesterday’s trading could point to further bullish momentum in the next trading sessions and buyers’ conviction will be tested. Momentum indicators remain in bearish territory.

GOLD

Gold oscillations are narrowing and continuous tests of the upper bound of a descending triangle have not resulted in a break. Given the pattern of price action we may anticipate a bearish breakout especially as the metal continues to trade sideways towards the triangle’s apex. Momentum indicators have flattened in neutral/bearish territory.

OIL

WTI has stalled at the 39.02 support level which represents a preliminary support area before the range floor at the 36.93 price area. The stall may indicate that a new range is forming for the commodity. Momentum indicators have flattened in bearish territory.