A Trend Reversal For Gold?

- 27 May 2020

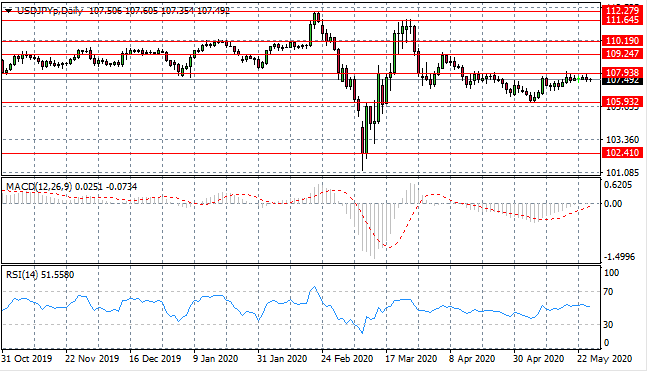

USD/JPY

The USD/JPY pair has failed to push beyond the 107.93 resistance level, where a series of doji candles have gathered, indicating a lack of conviction from buyers. The pair seem likely to take the previous horizontal price pattern in the near-term. Momentum indicators have moderate upward trajectories.

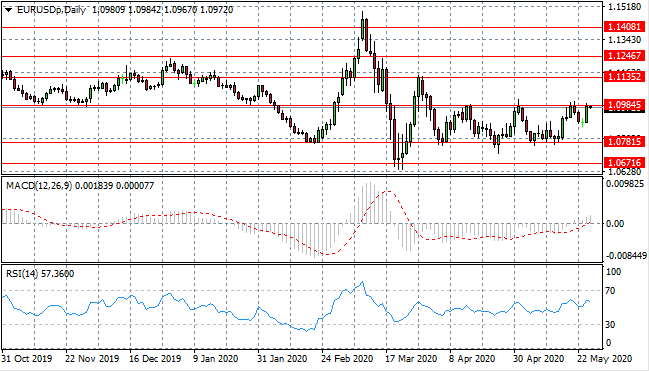

EUR/USD

Eurodollar buyers’ persistence has taken the pair back towards the 1.098 resistance line and as yet, the pair has been unable to break. In the absence of a break, price action will likely remain in range between the 1.078 and 1.098 price levels. Momentum indicators have turned bullish with a zero line break on MACD.

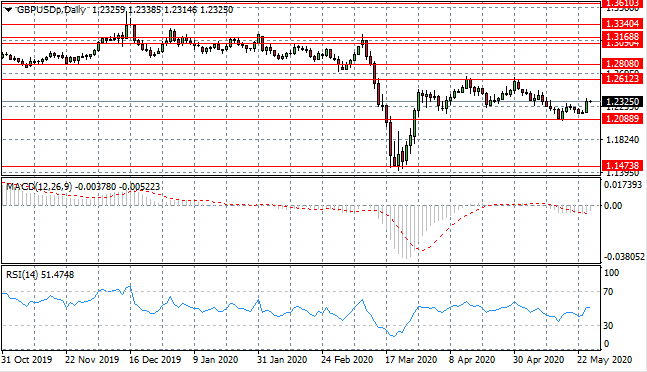

GBP/USD

The GBP/USD pair has rebounded from 1.208 price level after an extended bearish bias. Going forward, the pair will likely continue to oscillate between the 1.208 and 1.261 price levels. Momentum indicators are undergoing moderate reversals.

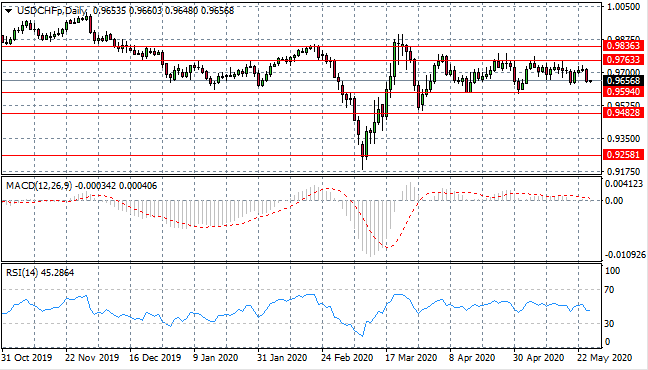

USD/CHF

The USD/CHF pair has failed several times at the 0.976 price level. Oscillations are beginning to narrow in a tighter trading range between the 0.965 and 0.976 price levels. Momentum indicators are languishing in neutral territory.

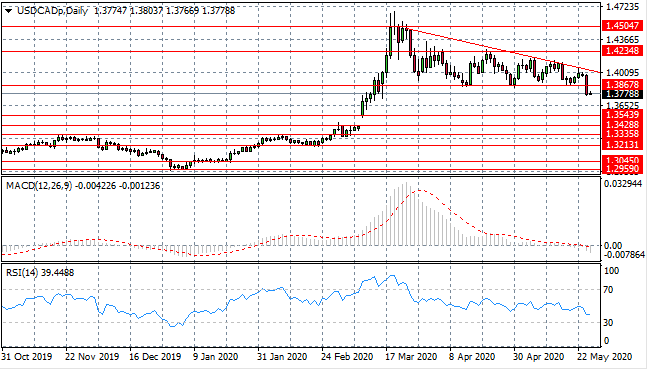

USD/CAD

The USD/CAD breakout has arrived and given the pattern of price action we may suspect the bearish move to continue. A target exists at the 1.354 support level and the next few trading sessions will determine the conviction of sellers. Momentum indicators have downward trajectories.

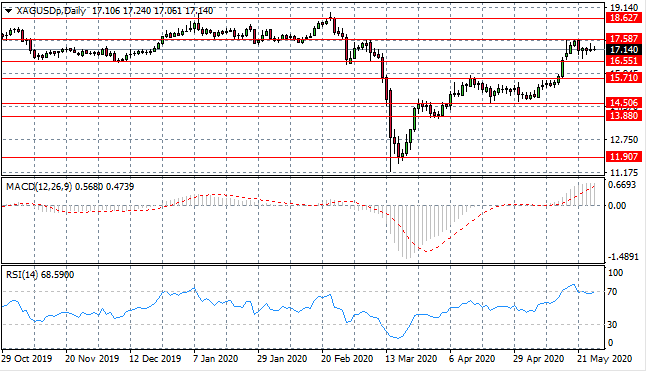

SILVER

Silver has stalled just below the 17.58 resistance level with a series of doji candles indicate indecision. The metal may remain in range between the 16.55 and 17.58 price levels in the near-term. Momentum indicators have stalled in bullish territory with RSI testing the overbought line.

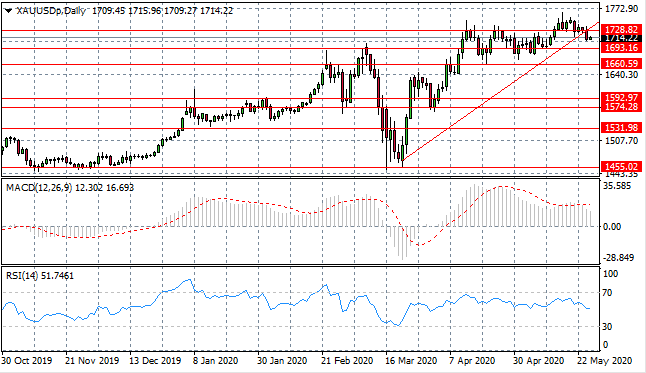

GOLD

Gold has broken the 1728 resistance level, as well as the ascending trendline, which perhaps is more significant and suggests a trend reversal. A move towards the 1693.16 support level would provide weight to the downtrend. Momentum indicators support the bearish bias.

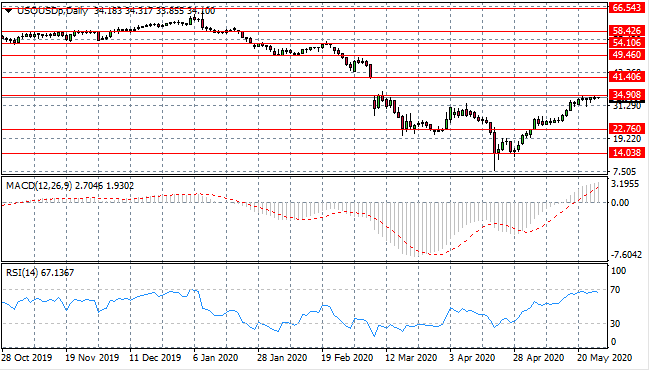

OIL

WTI has spent the best part of a week testing the 34.90 resistance level. A break has still not materialised and candle bodies are becoming smaller and smaller indicating waning conviction from both buyers and sellers. Momentum indicators have sharp upward trajectories, yet RSI is testing overbought conditions.