Bearish Reversal Underway For Gold?

- 27 Jun 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

Dollar weakness has subsided and hence the USD/JPY pair has moved beyond the 107.61 price level to test the 108.07 resistance line. A reversal appears to be underway in the pair which also confirmed by a momentum reversal on RSI. MACD is also moving towards the zero line as bullish sentiment begins to strengthen.

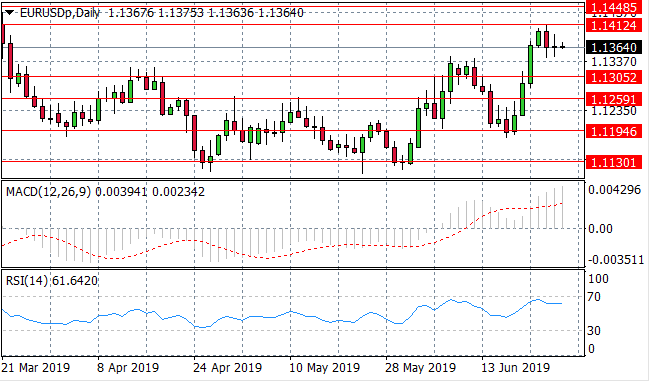

EUR/USD

The EUR/USD pair has once again rebounded from the 1.141 price level as the Euro strength against the dollar begins to wane. However, a new trading range may be established between the 1.130 and 1.141 price levels. Momentum indicators have flattened in bullish territory.

GBP/USD

A trend change is underway for the GBP/USD pair with price action returning from the 1.271 resistance line. Selling pressure is rising which may take price action towards the 1.260 support level. Momentum indicators have flattened in bearish territory.

USD/CHF

The USD/CHF pair has made a recovery to break the 0.974 price level to the upside. Price action will reflect sentiment in the dollar, as the greenback begins to strengthen, price action will move towards the 0.980 resistance line. Momentum indicators are in bearish territory, however, RSI is recovering from oversold conditions.

USD/CAD

The USD/CAD pair has plummeted to the 1.312 support level after a strong dollar sell-off last week. Price action has failed to break this support level, despite heavy selling in yesterday’s session. RSI has flattened in oversold conditions with MACD indicating residual bearish sentiment.

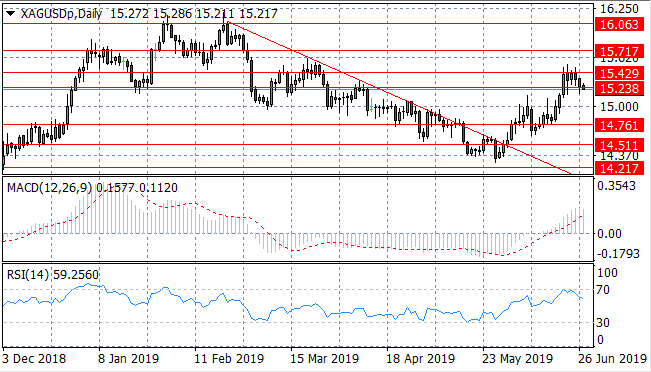

SILVER

Silver’s rally appears to have lost steam, with a push back in price action taking the metal towards the 15.23 support line. Fundamental factors are likely to come into play in terms of the future direction of price action. RSI has pulled away from the overbought 70 resistance line.

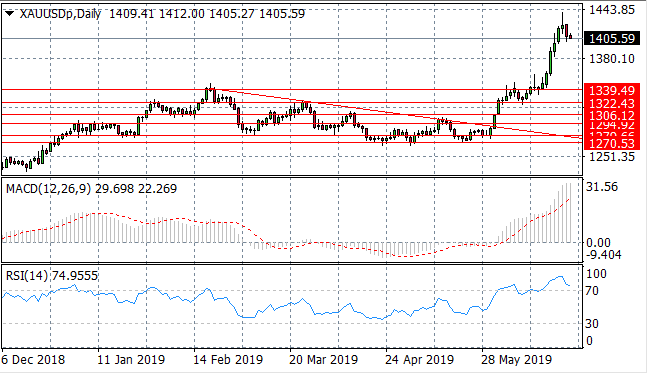

GOLD

Gold is coming under pressure from rising selling activity as buyers lose the battle mid-rally. A bearish candle in today’s trading may mark the beginning of a reversal. MACD continues to extend into bullish territory however a RSI is heading back towards the 70 overbought line; indicating a reversal.

OIL

WTI has found support in recent trading as geopolitical issues begin to heighten and the market anticipates further production cuts from the upcoming OPEC meeting. As such this has resulted in price action returning towards the $60 per barrel range which is widely considered a stabilising price for the commodity. Momentum indicators are bullish.

Follow Us on Facebook: