Bearish Reversal Underway For GOLD

- 25 Feb 2020

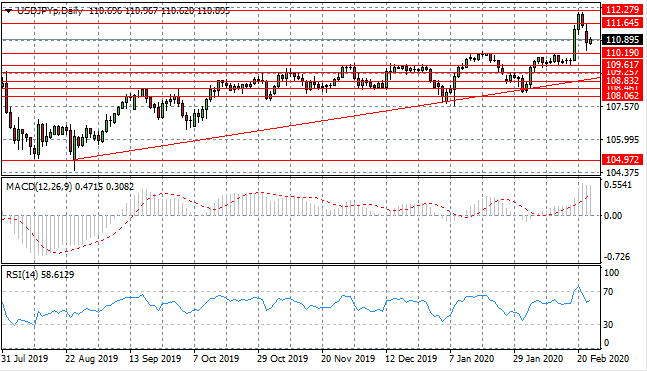

USD/JPY

The USD/JPY pair ended the previous trading session back below the 111.64 support level yet price action pulled up short of the 110.89 support level; where buyers returned. Some indecision is apparent as neither buyers nor sellers are dominating price action. Momentum reversals have taken price action back below the overbought resistance area.

EUR/USD

The Eurodollar is making a recovery as buyers return to the pair taking price action back towards the 1.08 resistance level. If the pair is able to return to the previous trading range, the bullish reversal is confirmed. Momentum indicators suggest a slowdown in bullish sentiment.

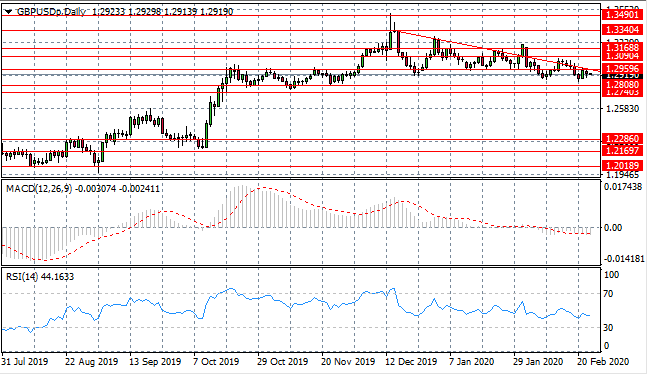

GBP/USD

The GBP/USD pair continues to hug the descending trendline which is acting as a resistance area. The pair has entered into a descending triangle pattern which may suggest that a bearish breakout is on the cards. Momentum indicators have flattened in bearish territory.

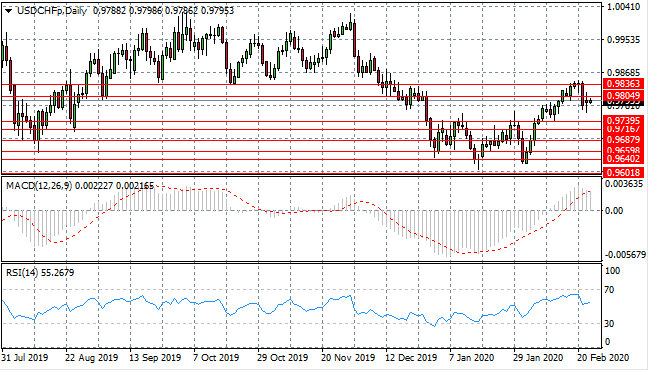

USD/CHF

The USD/CHF pair has stalled just below the 0.980 support level after a strong bearish move in recent trading. The break has been met with indecision as sellers appear to lack the conviction to drive price action lower. The recent bearish move may therefore represent just a pullback. Momentum indicators remain bullish.

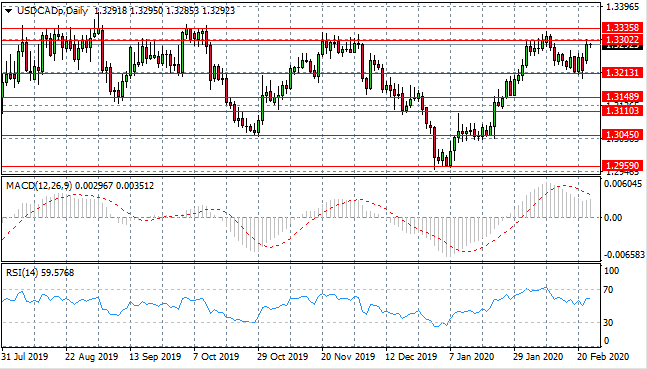

USD/CAD

The USD/CAD pair has found support taking price action back towards the 1.330 resistance line. This resistance area represents a hurdle for buyers on previous occasions. With widening oscillations, we may expect price action to push beyond this resistance area to create new highs. Momentum indicators have upward trajectories and remain in bullish territory.

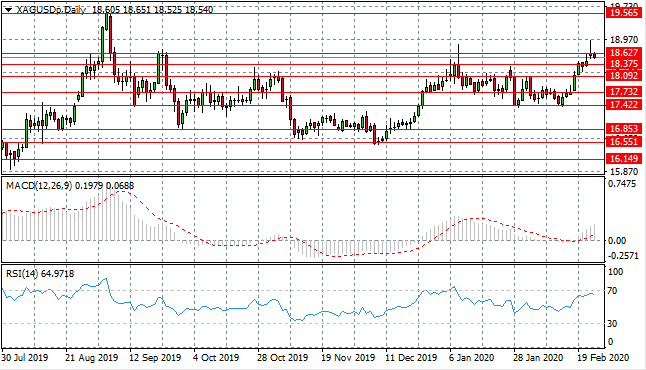

SILVER

Silver is testing a recent high at the 18.62 resistance line though a series doji candle indicate indecision and hence, a potential reversal. Selling activity in today’s trading indicate that sentiment is leaning bearish providing further indication that a trend change could be imminent. Momentum indicators are bullish with RSI approaching overbought conditions.

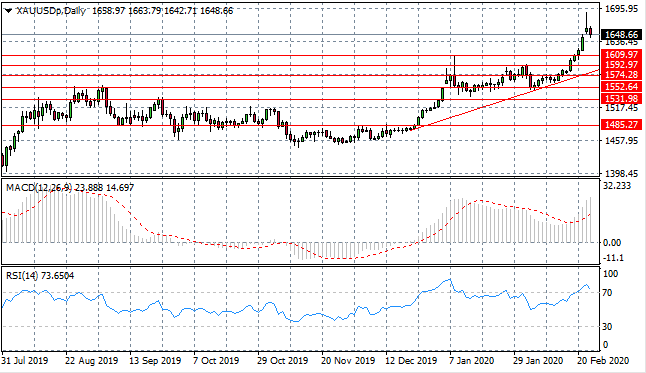

GOLD

Gold buyers have been impeded by a rise in selling action denoted by the long upper shadow in yesterday’s trading followed by further bearish sentiment in today’s session. The shooting star pattern that has formed in the uptrend appears to be playing out hinting to a bearish reversal. Momentum indicators remain in bullish territory, however RSI is undergoing a momentum reversal.

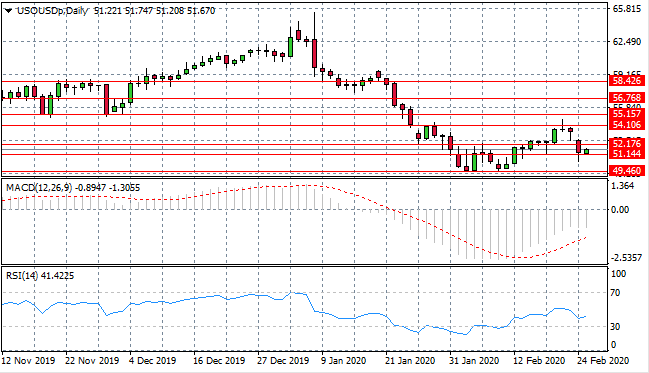

OIL

WTI volatility continues as the commodity struggles to maintain the $50 per barrel range. A test of the 51.14 support level has resulted in the return of buyers. A trading range is being established between the 49.46 price floor and the 54.10 ceiling. Momentum indicators have upward trajectories.