Bullish Breakout For Silver?

- 10 Oct 2019

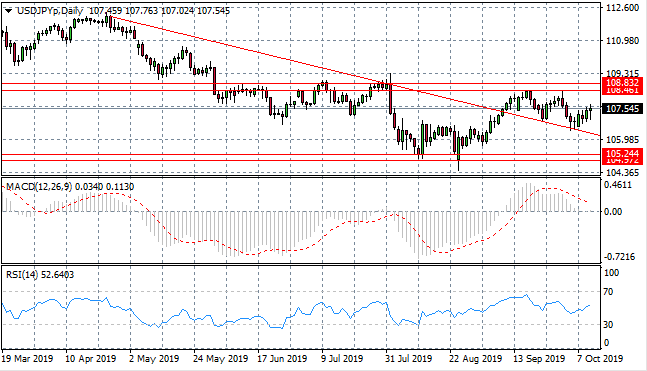

USD/JPY

The USD/JPY pair has rebounded from the descending trendline, with buying pressure rising, taking price action towards the 108.46 resistance line. Momentum indicators remain in bullish territory though have divergent trajectories; MACD with a descending trajectory and RSI moving into the buy channel.

EUR/USD

The Eurodollar continues to test the descending trendline, having broken the 1.096 resistance level. On previous occasions, this has resulted in a rebound in price action. Momentum indicators have mild upward trajectories yet both remain in bearish territory.

GBP/USD

The GBP/USD pair is heading towards the 1.216 support level as selling pressure has begun to rise resulting in a break of the 1.228 support level. The long-term direction of price action is bearish. Momentum indicators are bearish with MACD breaking the zero line and RSI entering into the sell channel.

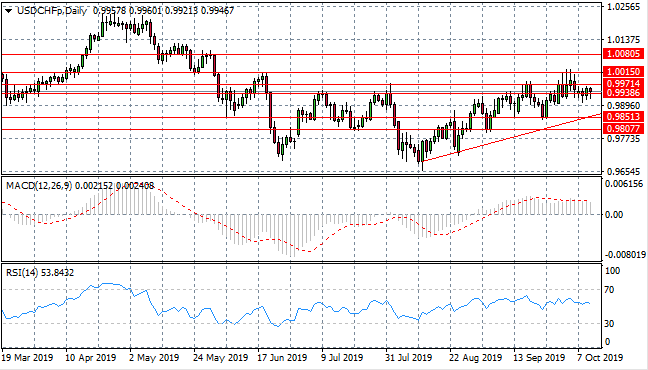

USD/CHF

The USD/CHF pair is continuing to test the 0.993 support level once again as price action pulls back mid-rally. Given the rise in buying pressure, a break of the support level seems unlikely. Momentum indicators are flattening in neutral/bullish territory.

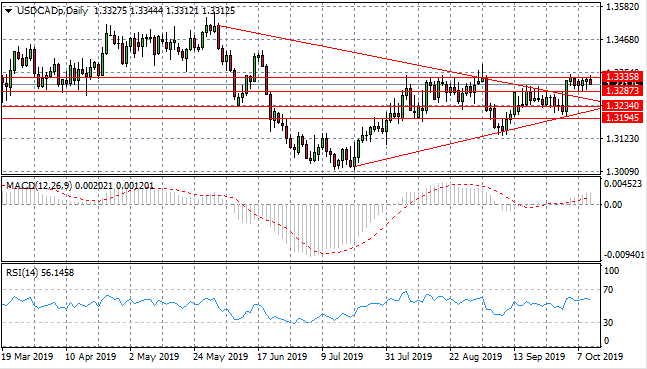

USD/CAD

The USD/CAD pair has undergone a bullish breakout and is now stuck at the 1.333 price level which, as on previous occasions, has resulted in a pullback in price action. The pull back generally goes no further than the 1.328 support level. Momentum indicators have stalled/flattened in bullish territory.

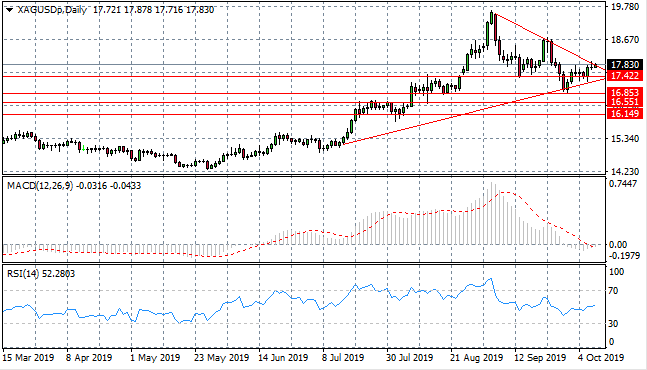

SILVER

Silver has broken the 17.42 resistance area and is now testing the upperbound of a symmetrical triangle at the 17.83 price level. A bullish breakout appears the most likely outcome of the continuation pattern. Momentum indicators remain in neutral territory with upward trajectories.

GOLD

Gold continues to track the ascending trendline despite sellers being active. Price action may head towards the 1523.89 resistance line, although small-bodied candles represent a lack of conviction from buyers and sellers. Momentum indicators remain in neutral territory.

OIL

WTI price is now testing a key support area at $52 per barrel price area. Despite a spike lower towards the $50 per barrel range, price action settled around the 52.17 price level. The commodity is sensitive to geopolitical developments and hence volatility will likely continue. Momentum indicators have bearish trajectories, with further downside potential.