Dollar Weakens Against Major Peers

- 1 Nov 2019

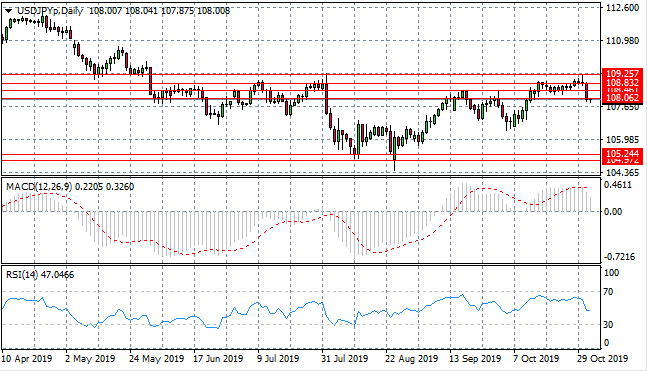

USD/JPY

Sellers have returned to the USD/JPY pair taking price action back towards the 108.06 support level. The pair has not yet broken the price line even though sentiment has turned significantly bearish. A previous trading range may be reestablished between the 105 and 108 price levels. started to dominate the pair. Momentum indicators are pulling back from bullish territory.

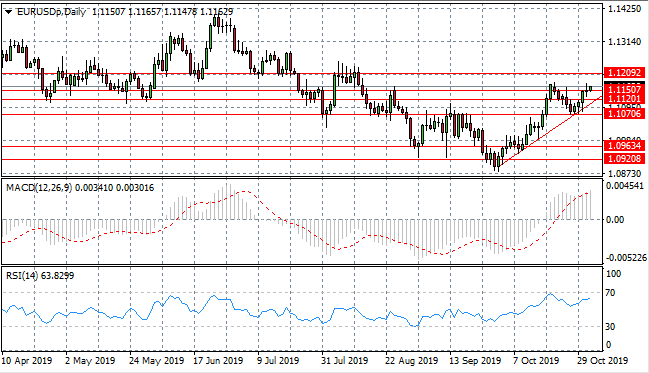

EUR/USD

The Eurodollar has rebounded from the ascending trendline, breaking the 1.115 resistance level, representing the resumption of the previous uptrend. The next target for buyers is the 1.120 price level. Momentum indicators are continuing with their bullish trajectories.

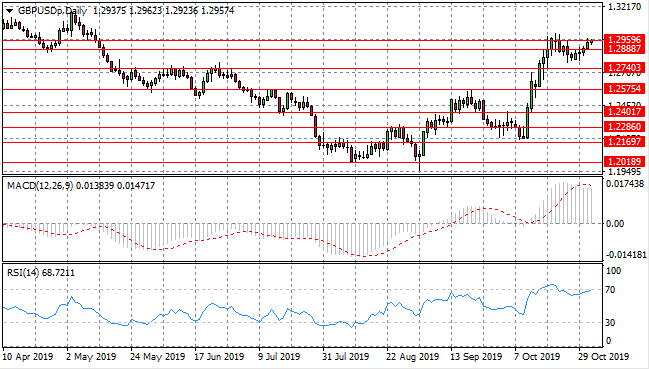

GBP/USD

The GBP/USD pair has cleared the 1.288 resistance level, with buyers returning driving price action towards the 1.295 resistance line. The move indicates a return to the previous rally. Momentum indicators remain in bullish territory with RSI continuing to test oversold conditions.

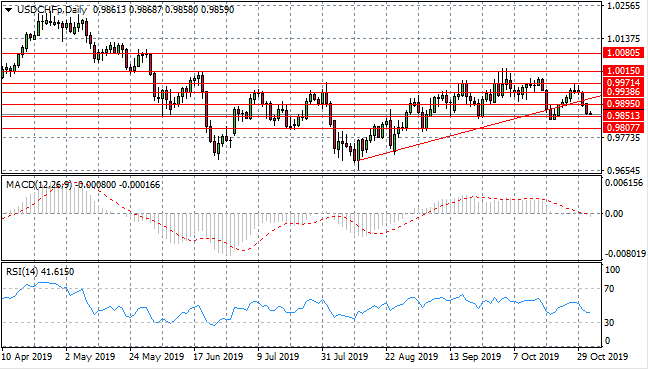

USD/CHF

The USD/CHF pair has broken both the ascending trendline and the 0.989 support level, with price action approaching the 0.985 support level. A rebound has taken place at this price level on previous occasions. Momentum indicators have turned bearish with MACD testing the zero line and RSI continuing a downward trajectory.

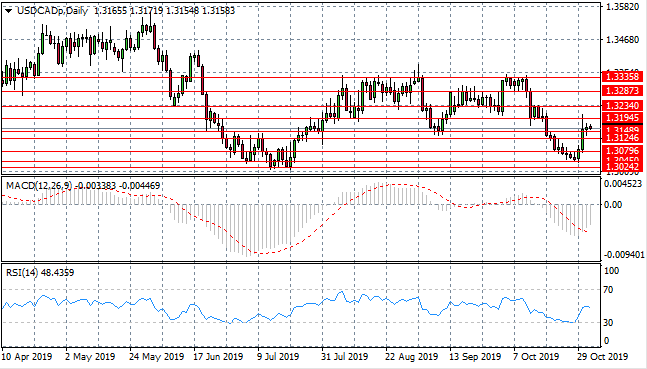

USD/CAD

The USD/CAD pair has almost completed a bullish reversal after a sell-off which began towards the end of September. The pair spiked through the 1.319 resistance level before selling pressure resulted in the pair steadying at the 1.314 support level. Momentum indicators are also undergoing bullish reversals.

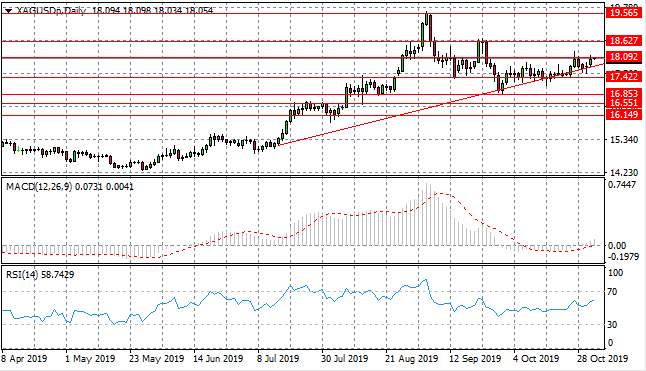

SILVER

Silver continues to test the ascending trendline and despite price spiking through the support level, a break is yet to take place. The metal continues to hug the ascending trendline as bullish sentiment continues, with the 18.09 resistance line proving an obstacle. Momentum indicators have established upward trajectories.

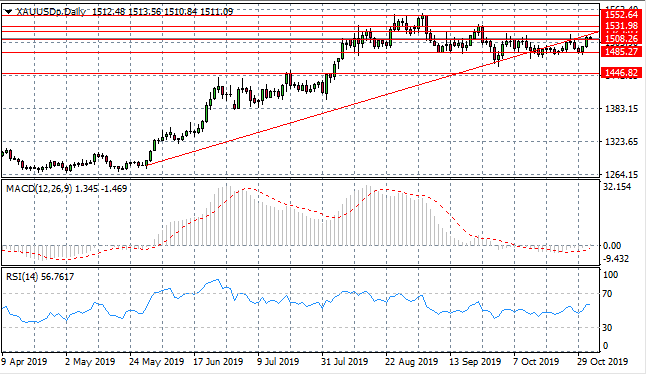

GOLD

Gold has finally broken the 1508.26 resistance line and is now testing the ascending trendline to the upside. On previous occasions, the metal has been unable to break this resistance area. A break would represent the return to the previous uptrend. Momentum indicators have turned bullish.

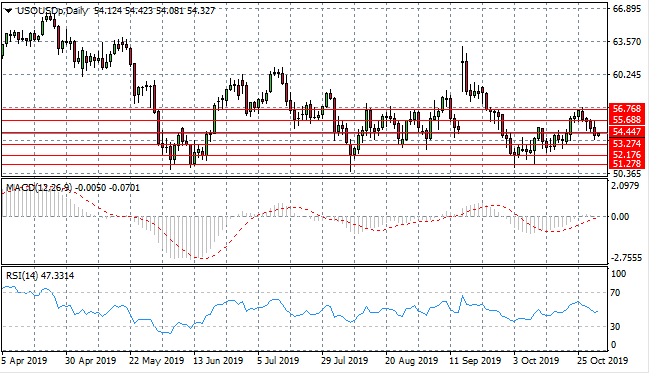

OIL

WTI has pulled back from the 56.76 resistance level and is now testing the 54.44 support level. Price action may stabilize at the $54 per barrel range. Momentum indicators are mixed; with MACD breaking the zero line to the upside and RSI entering the bearish channel.