GBP/USD Pair Tests Key Resistance Level

- 19 Nov 2019

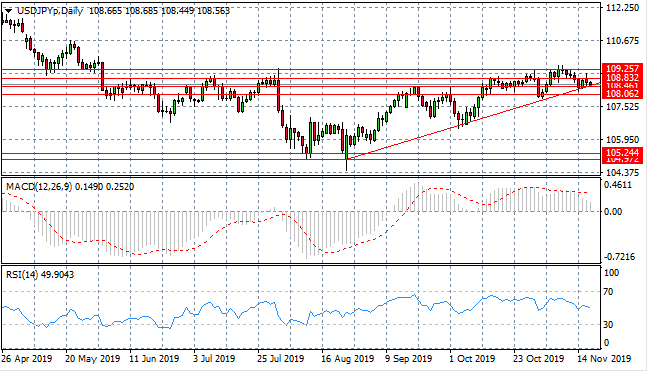

USD/JPY

The USD/JPY pair is testing the ascending trendline once again as well as the 108.46 support level. On previous occasions, price action has rebounded from this support area. However, the 108.83 resistance line has served as an obstacle for the pair. Momentum indicators have downward trajectories.

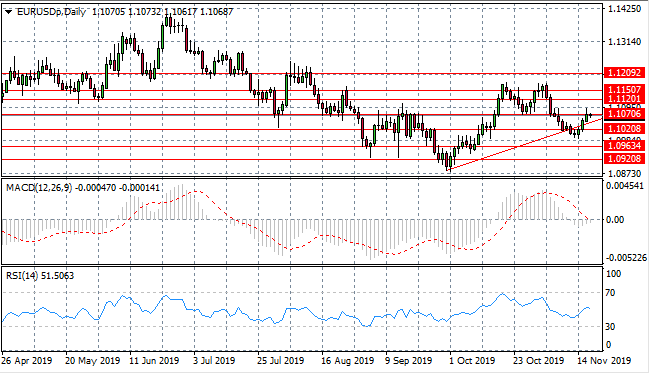

EUR/USD

The Eurodollar has also made a recovery breaking back above the ascending trendline as buyers return to test the 1.107 resistance line. This price level represents a hurdle for the pair. A break would provide weight to a longer term uptrend. Momentum indicators have begun upward trajectories.

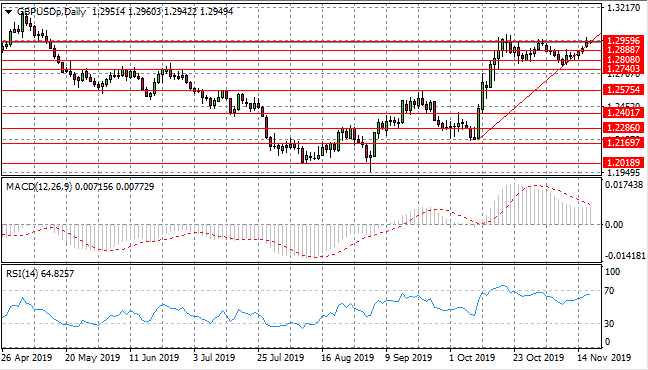

GBP/USD

The GBP/USD pair continues to hug the ascending trendline as bullish sentiment continues. Buyers have returned to test the 1.295 resistance line once again, which has been an obstacle on previous occasions, resulting in a pull back in price action. Momentum indicators remain in bullish territory, however, RSI is approaching overbought conditions.

USD/CHF

The USD/CHF pair is testing the 0.989 resistance level as well as the ascending trendline. Given the small bodied candles and tighter oscillations, we may anticipate a breakout for the pair. On each previous occasion that the pair has tested the ascending trendline, a bullish reversal has taken place. Momentum indicators are neutral.

USD/CAD

The USD/CAD pair has broken back below the 1.323 resistance level as sellers returned to push price action back towards the 1.319 support level. Buyers then prevented a break of the support level. The overall trend is bullish, therefore it appears that the move is a pullback in the longer term trend. Momentum indicators remain in bullish territory.

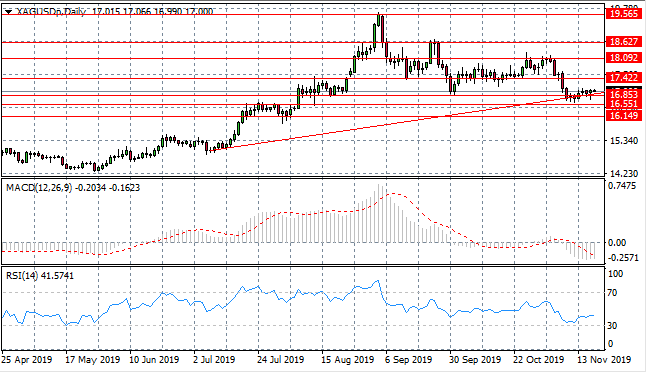

SILVER

Silver is following the trajectory of the ascending trendline as small-bodied candles hug the support level. It appears that for the time being, price action will remain within the 16.83 and 17.42 price levels. Momentum indicators are returning from oversold conditions and beginning upward trajectories.

GOLD

Buyers have returned to the metal as price action climbs away from a key support level at 1446.82. Price action is now testing the 1468.50 resistance level and a break would have the commodity returning to a previous trading range. Momentum indicators are beginning bullish trajectories.

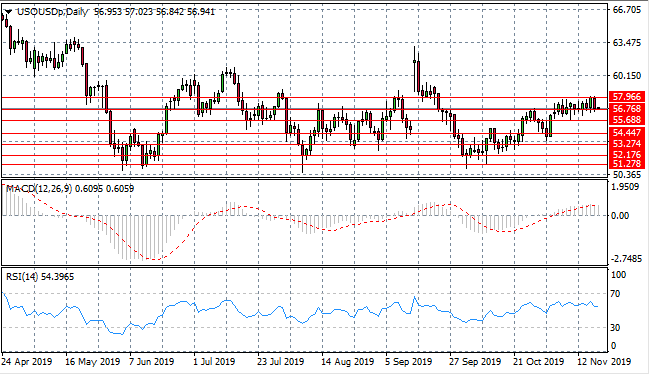

OIL

WTI price action has returned to test the 57.96 price level which represents a strong resistance area for the commodity. As such, price action has reverted, with the return of sellers to now test the 56.76 support level. The overall trend is bullish. Momentum indicators have flattened in bullish territory.