GBP/USD Testing Key Support Level

- 11 Feb 2019

USD/JPY

The USD/JPY pair has bounced along the 109.87 price level for the last week or so as a series of doji candles represent indecision. Momentum indicators are bullish as MACD approaches the zero line with a potential upside break and RSI begins to test the default line. The next target for buyers is the 110.56 price level.

EUR/USD

The EUR/USD pair has rejected the 1.145 price level once again. At the same time, price action has broken the ascending trendline and as such is approaching the 1.129 support level. A break of this support level would provide weight to the downtrend. Momentum indicators are bearish with RSI approaching the 30 oversold area and MACD testing the zero line.

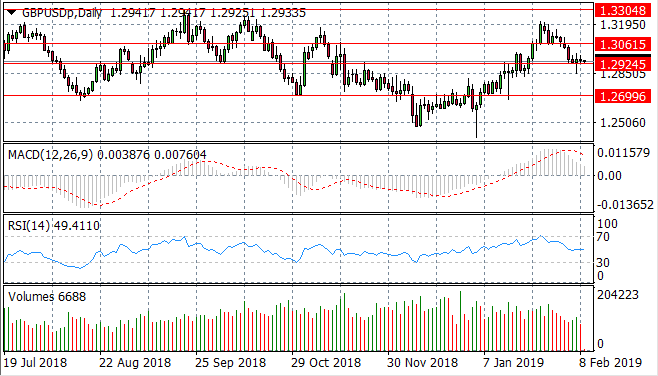

GBP/USD

The GBP/USD pair has returned to the 1.292 price level, however, price action has been held up at the support level. A break would likely send the pair towards the 1.269 price level. Momentum indicators have turned bearish in support of the move and selling pressure has risen in today’s trading.

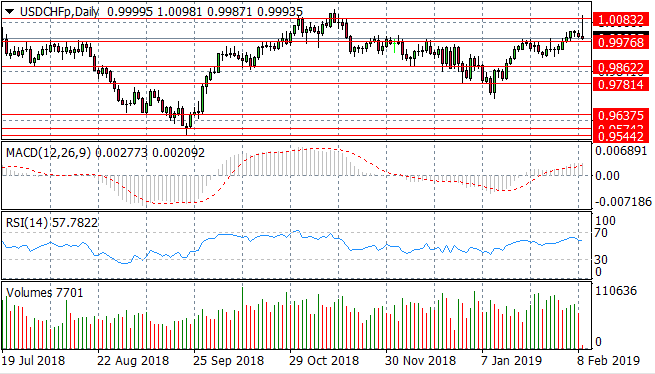

USD/CHF

Despite spiking through the recent high at 1.008, the USD/CHF pair has once again been pulled back towards the 0.997 resistance level. The inverted hammer candle is an indicator of the change in price trend. Momentum indicators indicate deceleration of the uptrend. Selling pressure is rising.

USD/CAD

The USD/CAD pair remains volatile in response to volatile oil prices. The pair is once again testing the 1.326 price level with no clear trend established. Momentum indicators are somewhat bearish and as such, are divergent from price action. A break of the support area will likely send the pair towards the 1.316 support level.

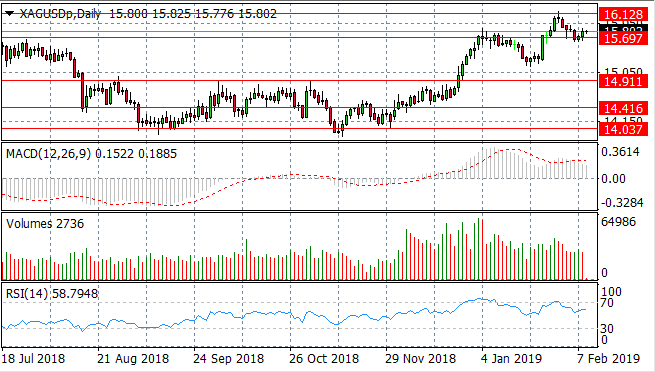

SILVER

The pullback for Silver appears to have been short-lived as the metal rebounds from the 15.69 resistance line. This area will represent a support going forward. Given the lack of support from neutral momentum indicators, it appears unlikely there will be enough conviction to send the metal back to the 16.12 price line.

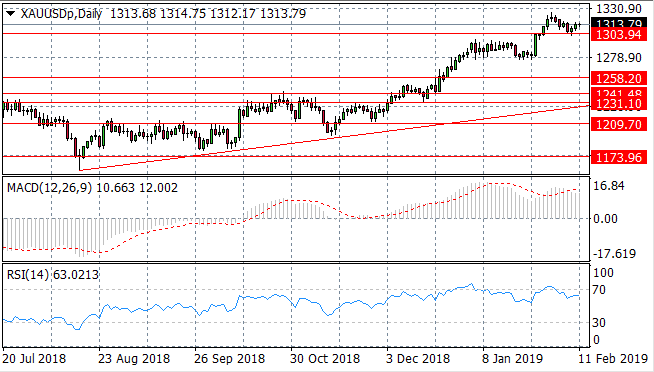

GOLD

Gold has broken the 1303.94 price level and despite a few tests; continues to climb beyond this recent price high. Momentum indicators remain bullish, however, there are indications that the metal is overbought.

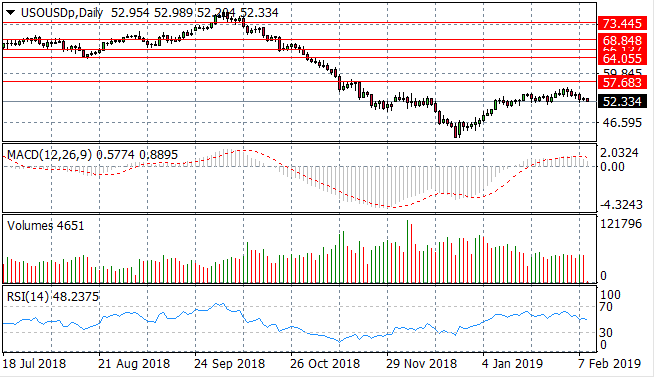

OIL

WTI buyers have returned with moderate bullish moves to take WTI beyond $50 per barrel. A key resistance area lies at $57 per barrel. There appears to be rising bearish momentum however, with MACD testing the zero line and RSI forming a moderate bearish trajectory.