Gold Buyers Return

- 14 Jun 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

The USD/JPY pair has dropped below the 108.78 price level and has essentially flat-lined just below this resistance level with a series of doji candles. The pair is likely to remain in this neutral zone until some fundamental news elicits a response from buyers or sellers. Momentum indicators reflect the lack of direction in price action as both MACD and RSI flat-line in bearish territory.

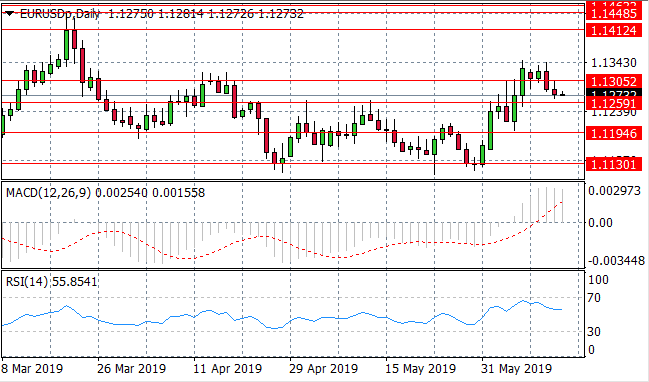

EUR/USD

The EUR/USD pair has broken a resistance level at the 1.130 price level which has resulted in the return of sellers. At present, the mostly likely course of price action is to return to the 1.125 support level. RSI is showing a slowdown in the uptrend; pulling away from overbought conditions. MACD has flattened in bullish territory.

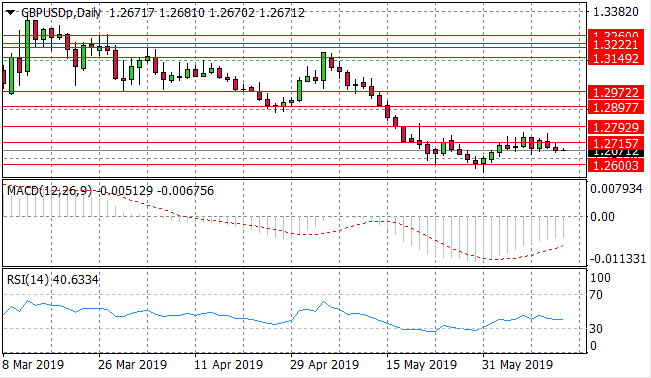

GBP/USD

The 1.260 price level represents a strong support area for the GBP/USD pair as a bullish reversal has taken price action to the 1.271 resistance line. This has proven to be a strong resistance area for the pair as price action has struggled to break n several occasions. Momentum indicators have a neutral trajectory and remain in bearish territory.

USD/CHF

The USD/CHF pair has broken the 0.990 price level to the upside and price action is headed towards the 0.997 resistance area. The break has inspired sellers to return to the pair. A bullish momentum reversal is underway on MACD and RSI is pulling away from bearish/oversold conditions.

USD/CAD

The USD/CAD pair has reversed the previous bearish sentiment to break the 1.330 price level with buyers eyeing the 1.335 resistance line. Momentum indicators have begun bullish reversals with RSI forming an upward trajectory and MACD climbing towards the zero line.

SILVER

Silver is being held up at the 14.76 price level as sellers struggle to sustain a break of the support line, as such, buyers have returned to the commodity. A new trend may be developing to replace a previous sustained downtrend. Momentum indicators are bullish with MACD breaking the zero line and RSI continuing a sharp upward trajectory.

GOLD

Gold has found resistance at the 1339.49 price level which also represents a recent price high. A pullback was short-lived as the metal tests the previous price high once more. Momentum indicators suggest that the commodity is overbought with MACD flattening in bullish territory and RSI testing the 70 overbought line.

OIL

WTI sellers have taken price action to the $50 per barrel mark where buyers soon returned. However, the rally has been short-lived with sellers again dominating price action, taking the commodity back to the lower bound of the $50 per barrel range. Volatility will likely continue. Momentum indicators have stalled in bearish territory.

Follow Us on Facebook: