Gold Reaches Recent Price Ceiling

- 19 Feb 2020

USD/JPY

The USD/JPY pair has been held up at the 109.61 support level. A long lower shadow candlestick in yesterday’s trading indicates a rise in buying pressure, followed by some buying activity in early trading today. Price action may head back towards the 110.19 resistance line. Momentum indicators remain in bullish territory with moderate upward trajectories.

EUR/USD

The Eurodollar pair seems to still have plenty of sellers driving price action lower. However, there has been some return of buyers in today’s trading. This could be the first signal of a slowdown in the sell-off indicating that a reversal is on the cards. Momentum indicators have stalled in bearish territory with a reversal underway for RSI.

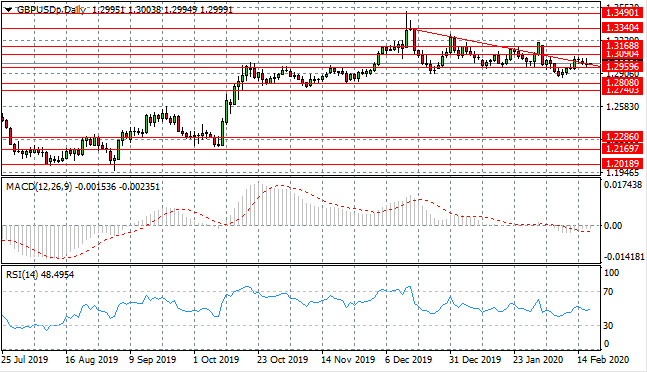

GBP/USD

The GBP/USD pair has been unable to move beyond the descending trendline. A series of doji candles in recent trading represent a lack of appetite from buyers with price action held at the trendline. Selling pressure has risen therefore price action is now testing the 1.295 support level. Momentum indicators have moved into bearish territory.

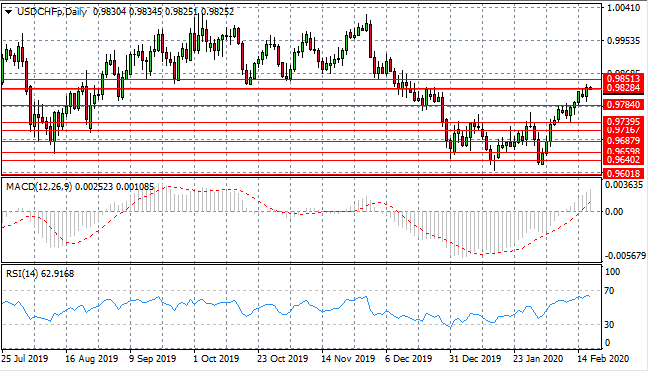

USD/CHF

The USD/CHF pair has failed to move beyond the 0.982 resistance level. Buyers have pushed price action to the resistance area once again, but lack the appetite to break the price level. Significant momentum will be required to maintain the pace of the rally, which may result in a pullback. Momentum indicators have upward trajectories, however, RSI is fast approaching overbought conditions.

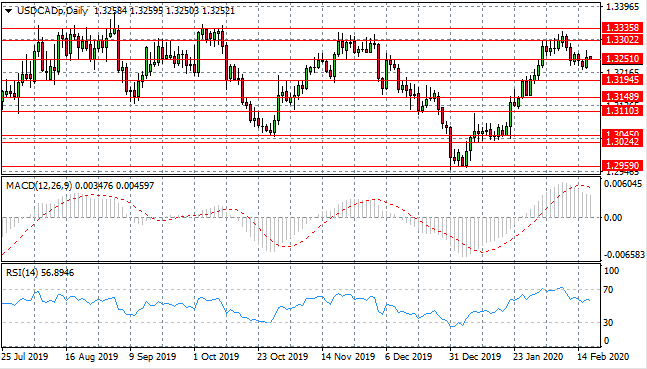

USD/CAD

The USD/CAD pair has pulled back from the 1.330 resistance area and is now testing the 1.325 support area where buyers and sellers appear to be grappling for control. An attempted break resulted in rising selling pressure which gives an indication that bearish sentiment is beginning to dominate. Momentum indicators are pulling back from strongly bullish positions.

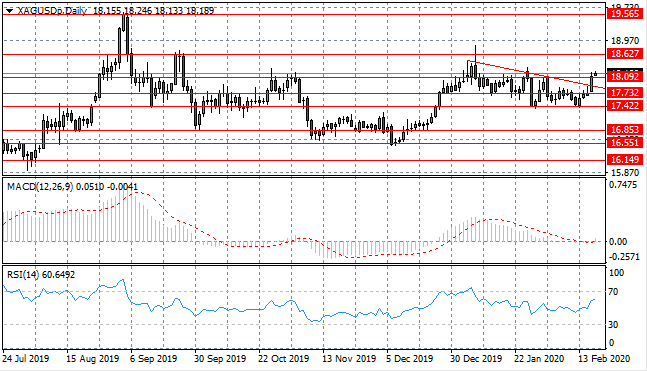

SILVER

Silver has found significant support from buyers which has resulted in a break of the descending trendline and the 18.09 price line. The next target is the 18.62 resistance level which price action recently spiked through but was unable to close. Momentum indicators have turned bullish with MACD breaking the zero line to the upside.

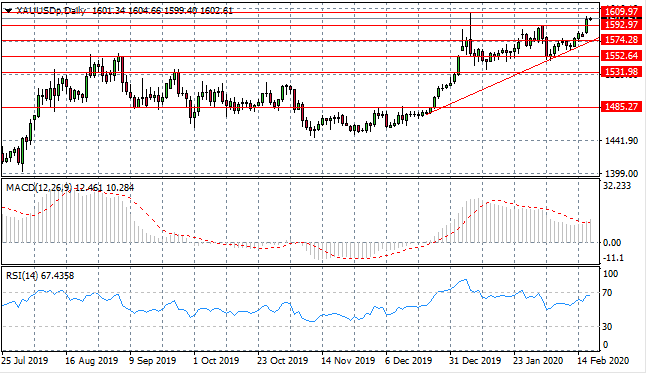

GOLD

Gold buyers have returned with a break of the 1592.97 resistance level, taking price action towards the 1609.97 ceiling. If buyers are able to force a break of this key psychological level, the current rally would gain significant weight. Momentum indicators have upward trajectories with RSI flattening just below the 70 overbought resistance line.

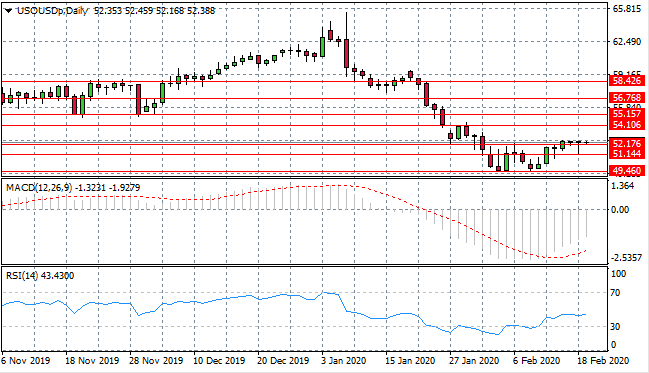

OIL

WTI price action has flat-lined in the last few trading sessions as market participants take a breather. The market is going through a quieter period after initial fears related to macroeconomic events. Price action is likely to remain in the $50 per barrel range for the near-term. Momentum indicators have upward trajectories with RSI pulling away from oversold conditions.