Reversal Imminent For Precious Metals?

- 14 Aug 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

The USD/JPY pair has broken the descending trendline with a strong bullish move. The move has ignited sellers to return to the pair, however, before the 107.16 resistance line was met. Momentum indicators have reverted back to more bearish positions.

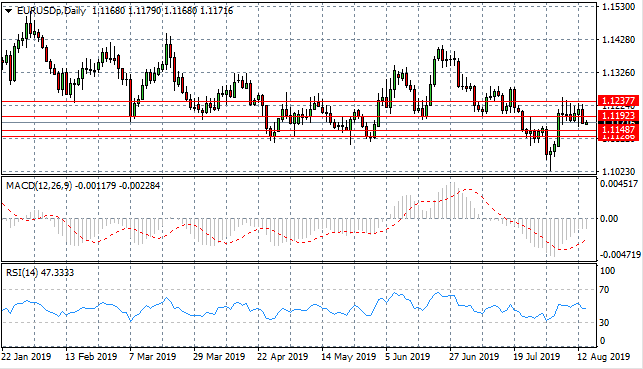

EUR/USD

The Euro has retraced to break the 1.119 support level as bearish sentiment rises in the pair. The next target is the 1.114 support level. A trading range between the 1.112 and 1.123 will likely be established as neither buyers nor sellers are dominating. Momentum indicators are somewhat neutral.

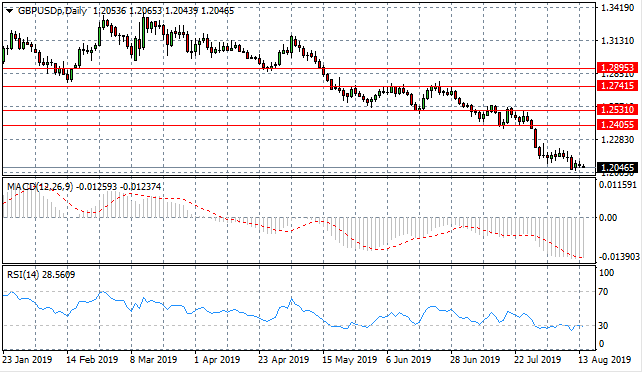

GBP/USD

The GBP/USD pair continues to move lower with intermittent breaks where sellers appear to lose steam. Each slowdown in the trend has resulted in rising selling action. The pair continues to be impacted by political developments. Momentum indicators have flattened in negative territory, with RSI bouncing along the 30 support level.

USD/CHF

The USD/CHF pair has broken the 0.971 support level as well as the descending trendline. Recently the descending trendline has been acting as a resistance area for the pair, taking prices lower each time price action approaches. The break could take price action to the 0.987 resistance line. Momentum indicators remain bearish.

USD/CAD

The USD/CAD pair has spiked through and rejected the 1.330 resistance line as selling pressure has risen at this resistance area. Price action looks to be forming a “cup and handle” pattern and the bearish move may be the beginning of the handle of the pattern. This pattern is often an indication of bullish continuation. Momentum indicators are becoming less bullish.

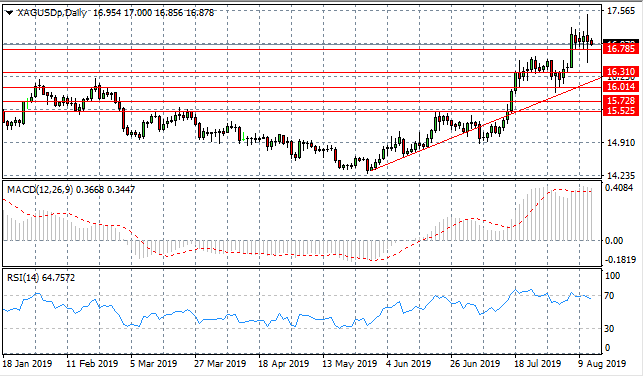

SILVER

Silver has continued the rally after some exhaustion in the uptrend. A series of small-bodied candles followed a strong bullish move which has since resumed. This is one indication that the rally may not last. Momentum indicators are beginning to pull back from strongly bullish/overbought conditions.

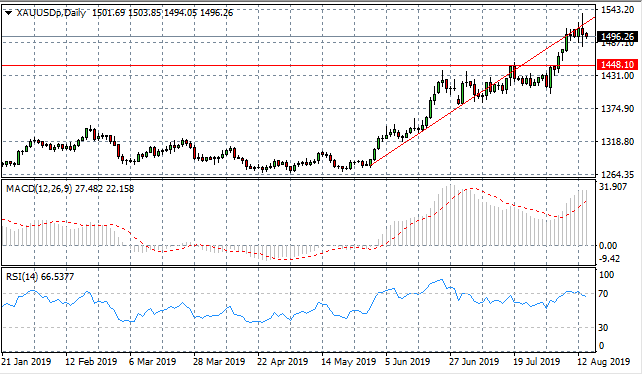

GOLD

Gold continues to test the ascending trendline which is currently acting as a resistance level in the pair. A series of doji candles may indicate a slowdown in the rally as the metal pulls back from the trendline. Momentum indicators are beginning to retrace and pull back from overbought conditions. A reversal may be imminent.

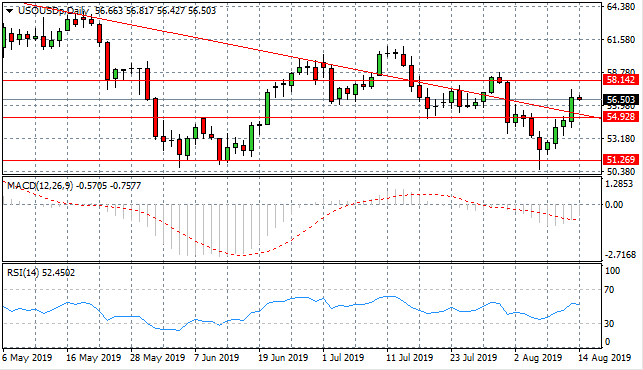

OIL

WTI has broken the 54.92 resistance line and the descending trendline in a strong bullish move. The next target is the 58.14 resistance line. Geopolitical tensions are more likely to have an impact on the commodity in the near-term. Momentum indicators are turning more bullish trajectory with MACD approaching the zero line and RSI entering the bullish channel.

Follow Us on Facebook: