Sellers Begin To Dominate USD/CAD

- 7 Apr 2020

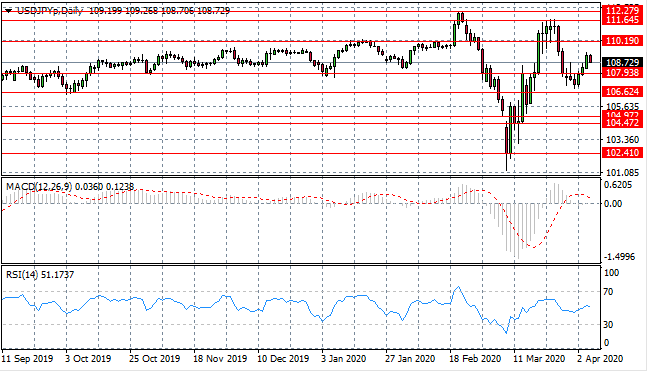

USD/JPY

The USD/JPY pair has reverted back to break the 107.93 price level as buyers returned before price action hit the 106.62 support level. The pair may now oscillate between the 107.93 and 110.19 price levels. Momentum indicators remain neutral/bullish territory.

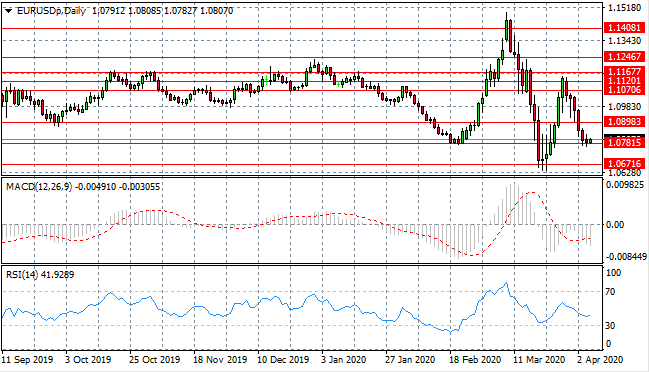

EUR/USD

The Eurodollar has managed to break the 1.089 support level and has now stalled at the 1.078 support level, where buyers have returned. Small-bodied candles may represent a point of exhaustion for sellers. Another rally may ensue as volatility in the pair continues. Momentum indicators have also stalled in bearish territory.

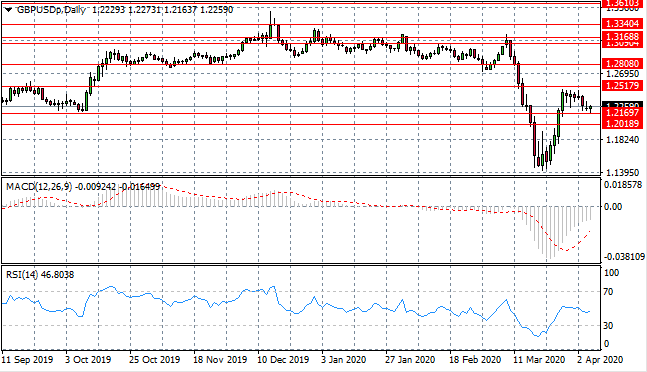

GBP/USD

The GBP/USD pair failed just before the 1.251 price line and as such, has pulled back towards the 1.216 support level. Neither buyers nor sellers are dominating price action currently, as the rally has lost steam. Momentum indicators have also flattened in neutral/bearish territory.

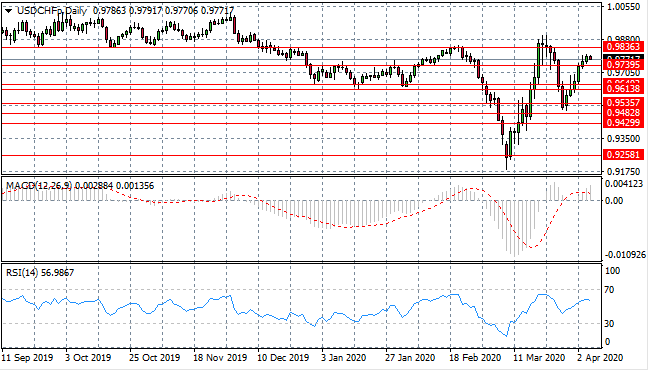

USD/CHF

The USD/CHF pair has pushed past the 0.973 resistance line however, the break has been met with indecision as small-bodied candles represent a lack of appetite from buyers to drive the rally. Momentum indicators have stalled in neutral/bullish territory.

USD/CAD

The USD/CAD pair has broken the ascending trendline in the first sign that sellers have begun to dominate price action. The next target is the 1.397 support level and a break of this price line would be significant. Momentum indicators have flattened after reversing overbought positions.

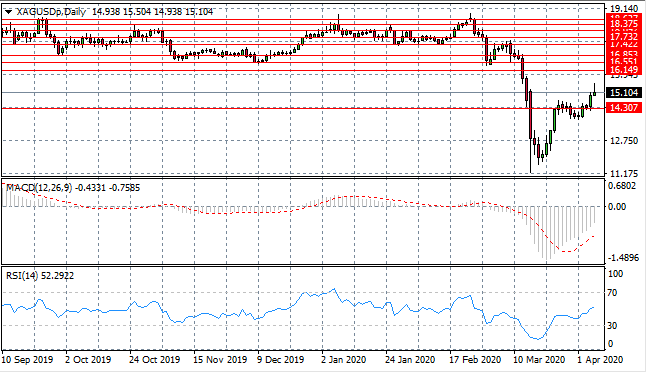

SILVER

The Silver revival has found support and price action has now pushed past the 14.30 resistance line. Selling activity still remains as denoted by the long upper shadow in today’s trading. The next target is the 16.14 resistance line. Momentum indicators have sharp upward trajectories in support of the bullish bias.

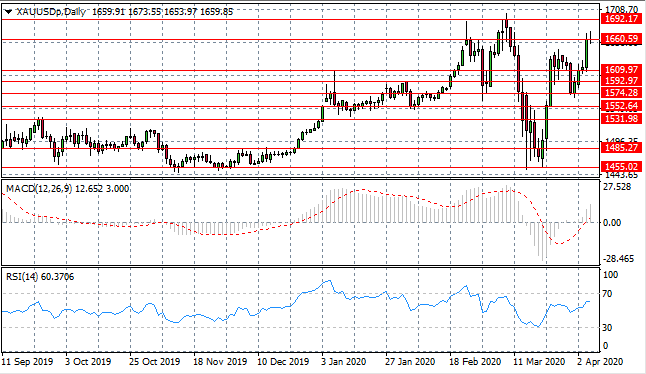

GOLD

Gold has climbed past the 1609.97 resistance line and is now testing the 1660 price range. The test has inspired the return of sellers as downward pressure limits bullish price action. Momentum indicators support the bullish bias with MACD breaking the zero line to the upside.

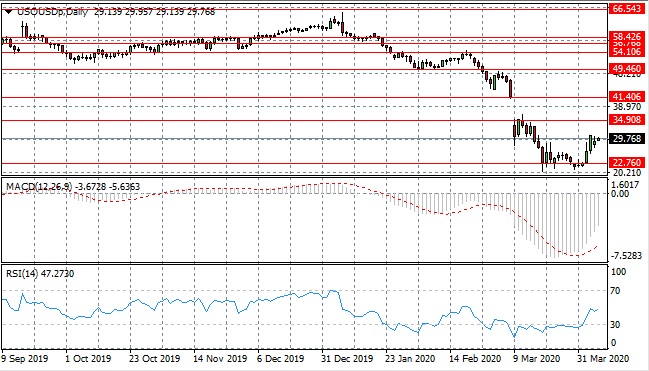

OIL

WTI price appears to be making a recovery with buyers returning to the commodity. Buyers’ conviction is strong with significant bullish moves forming in recent trading. A target exists at the 34.90 resistance area, representing the gap-fill line. Momentum indicators have upward trajectories.