Silver Tests New Highs

- 18 Jul 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

The USD/JPY pair has broken the resistance line at the 108.54 price level and is heading back towards the descending trendline. A trading range between the 107.16 and 108.54 price levels may have been established, considering price action has struggled to move beyond the 108.54 price level on numerous occasions. Momentum indicators remain in bearish territory.

EUR/USD

EUR/USD continues to test and then rebound from the 1.119 support level. Price action will likely climb back towards the ascending trendline which has become a resistance area for the pair recently. Momentum indicators remain bearish; with MACD breaking the zero line and RSI remaining in the bearish channel.

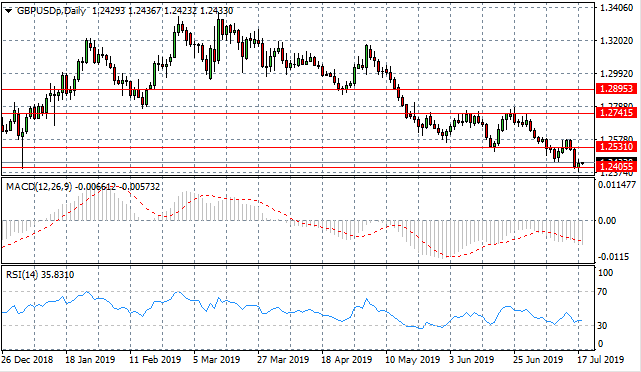

GBP/USD

The GBP/USD pair has suffered another sell-off taking price action to a new price low at the 1.240 price level. A rebound from this price level could be on the cards, as the pair has been unable to break this support level. Momentum indicators suggest that a momentum reversal may be underway as the pair has pulled back from the 30 support level.

USD/CHF

The USD/CHF pair is once again testing the 0.987 resistance line as well as the descending trendline, where previously, price action has rejected the trendline as a strong resistance area. A rejection would keep the longer-term downtrend intact. Momentum indicators remain bearish.

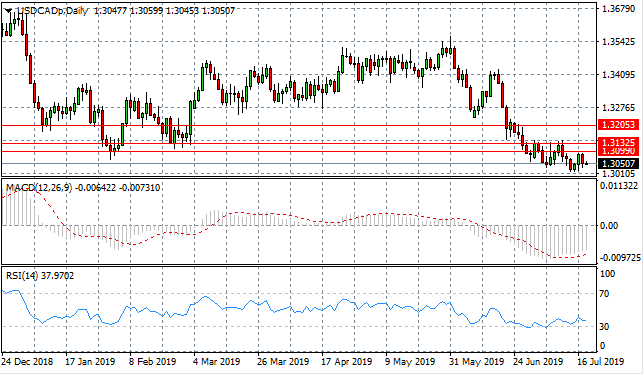

USD/CAD

The USD/CAD pair is recovering with buyers taking price action back towards the 1.309 price level. However, the pair may have established a new trading range, as the horizontal trading pattern continues. Momentum indicators are neutral, remaining in bearish territory.

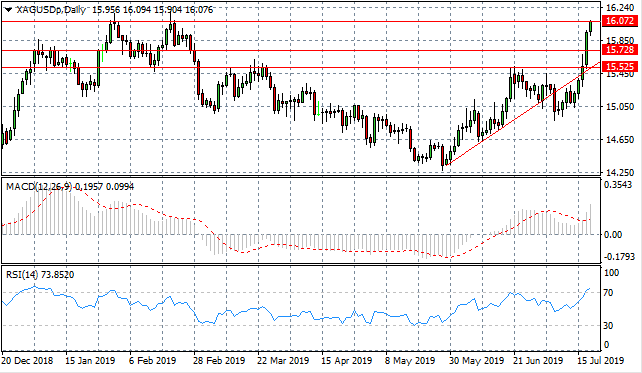

SILVER

Silver is testing a previous price high around the 16.00 price level, where on previous occasions price action has been rejected. Momentum indicators support the bullish sentiment, however, RSI has moved past the 70 resistance line which signals an imminent reversal.

GOLD

Gold continues to test the ascending trendline as momentum remains with buyers, despite a bearish break. Price action may next head towards the 1439 resistance line. Momentum indicators have pulled back from strongly bullish positions. RSI has broken below the 70 resistance line indicating a momentum reversal.

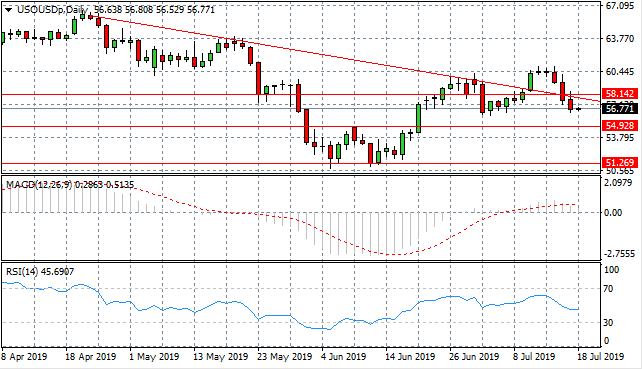

OIL

WTI has once again retraced from the $60 per barrel range and a sell-off has taken price action to break both the descending trendline and the 58.14 support level. Sellers may take price action back to the 54.92 support level, either way, volatility will likely continue. Momentum indicators are mixed, with MACD breaking the zero line to the upside and RSI forming a downward trajectory.

Follow Us on Facebook: