The End Of The Sterling Rally?

- 23 Oct 2020

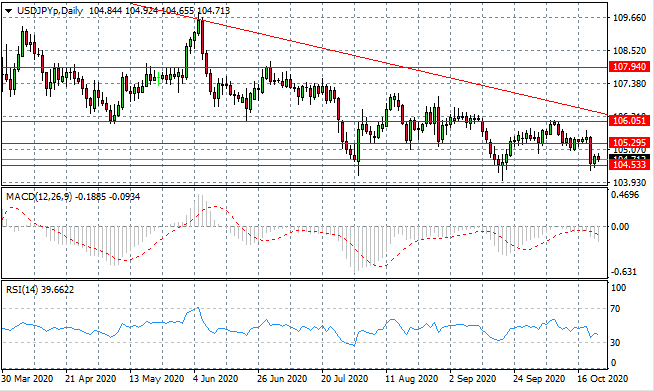

USD/JPY

USD/JPY sellers have once again failed to move price action beyond the price floor at the 104.53 support level. The long-term bearish trend remains intact, confirmed with lower highs. Despite oscillations, the current bearish trajectory will likely continue in the near-term. Momentum indicators remain in bearish territory.

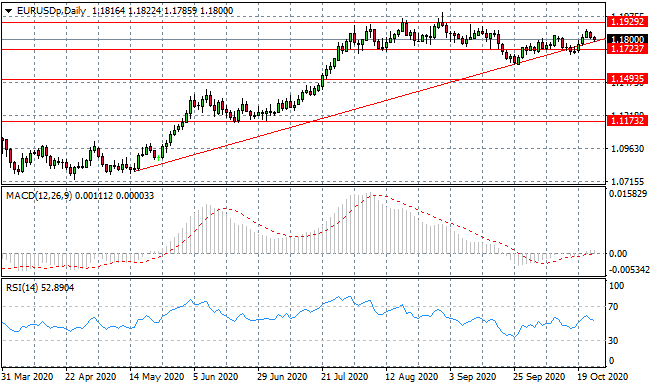

EUR/USD

The Eurodollar continues to trace the ascending trendline and despite oscillations a break has not yet materialised. This indicates that bullish momentum dominates the pair as sellers currently lack conviction. Once again, the 1.192 resistance area remains a target. Momentum indicators have upward trajectories.

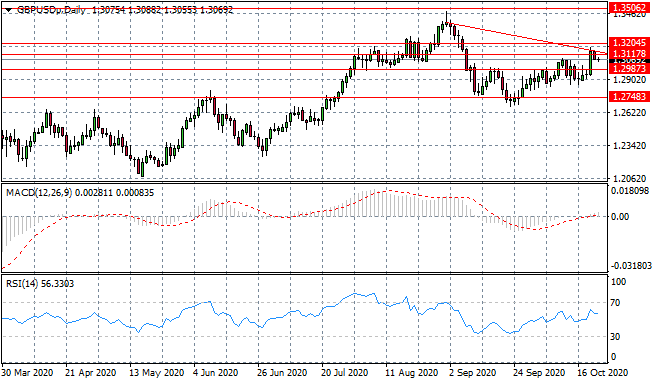

GBP/USD

GBP/USD sellers have returned mid-rally after the break of the 1.311 resistance level, the move may be part of a pullback before the rally continues. The current trajectory of the pair does not seem to be supported by fundamentals. Momentum indicators have upward trajectories.

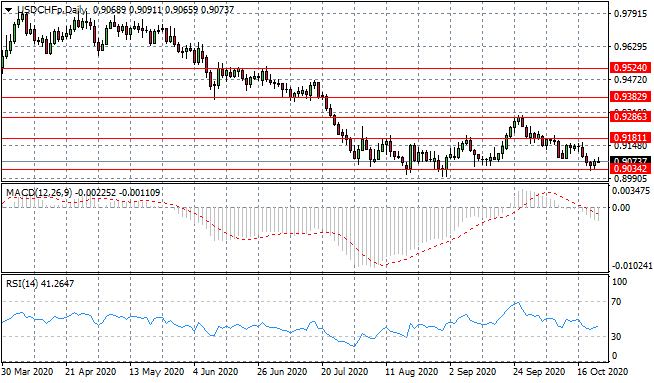

USD/CHF

The USD/CHF pair is starting to climb away from the 0.903 price low. A channel exists between the 0.903 and 0.918 price levels where the pair may remain in the near-term. Momentum indicators remain in bearish territory.

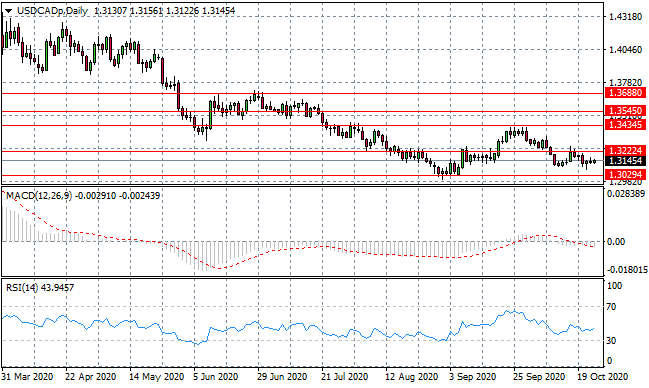

USD/CAD

The USD/CAD has stalled mid-range between the 1.302 and 1.322 price levels and given the current level of conviction, price action is likely to remain within this area of consolidation. Price action will likely continue to move sideways. Momentum indicators remain in bearish territory.

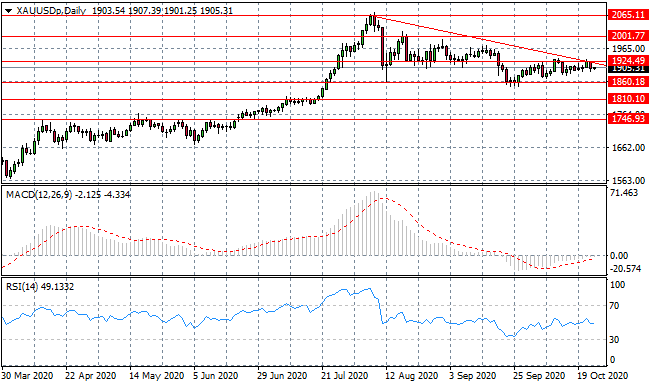

GOLD

Gold has repeatedly failed to break the 1924.49 price level, indicating a lack of appetite/rationale from buyers. The descending trendline has formed as a strong resistance area for the metal. The metal is moving closer to the apex of a descending triangle. Momentum indicators have begun upward trajectories.

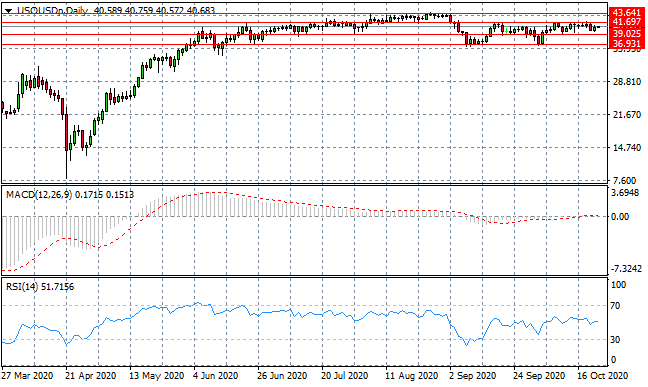

OIL

WTI is moving away from the 41.69 price ceiling, as the current trading range remains intact. Oscillations are narrowing yet there appears to be no build-up in momentum that may suggest a potential breakout. The commodity will likely float sideways in the near-term. Momentum indicators have flattened in neutral/bullish territory.