The Swiss Franc Remains Weak

- 25 Sep 2020

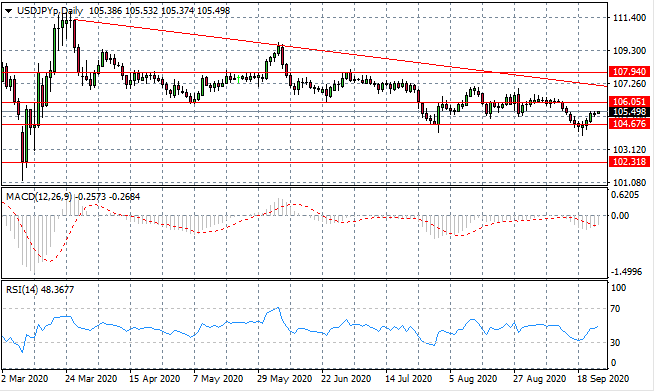

USD/JPY

The USD/JPY pair has rebounded from the 104.67 support level, stalling mid-range. Bullish momentum is currently not strong enough to take the pair towards the range ceiling let alone drive a break. The long-term downtrend remains intact. Momentum indicators have begun upward trajectories.

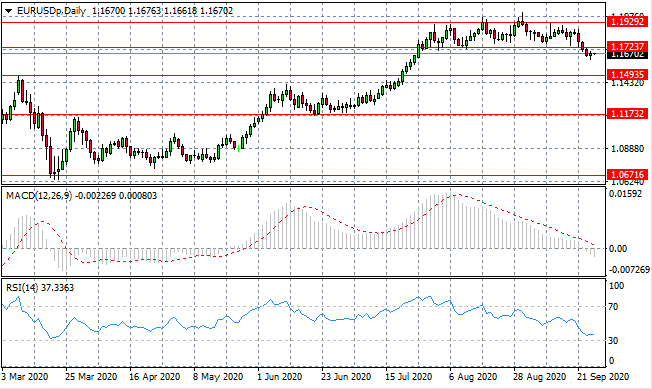

EUR/USD

The Eurodollar has broken range after a few months of consolidation. The break has inspired the return of buyers with a doji candle potentially signaling the end of the pullback. A new range may be established between the 1.149- 1.172 price levels. Momentum indicators have downward trajectories.

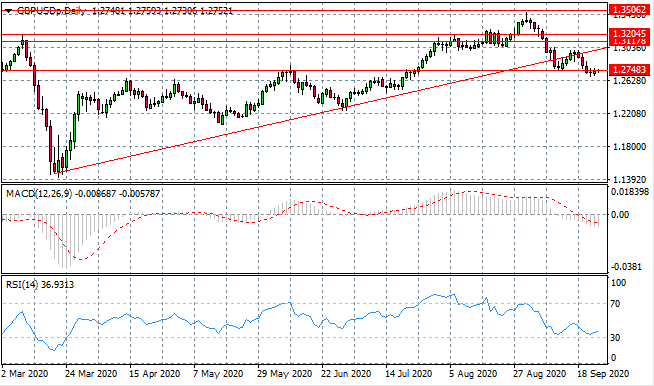

GBP/USD

The GBP/USD pair continues to test the 1.274 support level with a series of doji candles indicating indecision. The stall in momentum reflects the lack of appetite from both buyers and sellers to drive price action. Momentum indicators have flattened in bearish territory.

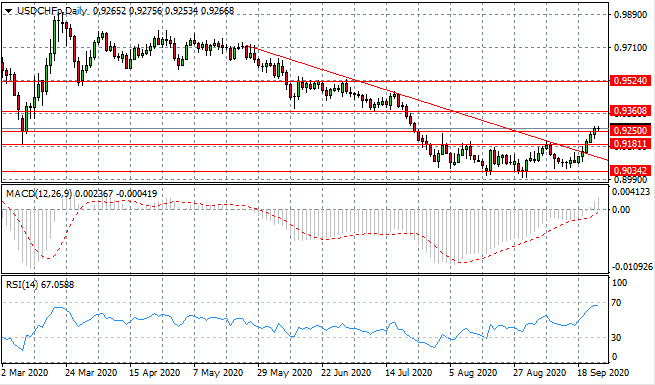

USD/CHF

The USD/CHF continues to break resistance levels, moving beyond the 0.925 price level. Bullish momentum remains strong with the 0.936 resistance area in sight. The pair is on course to return to pre- Covid levels. Momentum indicators have upward trajectories, with RSI testing the 70 overbought zone.

USD/CAD

The USD/CAD rally is showing signs of slowing. Sellers have returned in early trading at the 1.343 resistance area. The longer-term downtrend therefore may remain intact, albeit at a more moderate pace. Momentum indicators still have upward trajectories, though RSI has flattened just below the overbought zone.

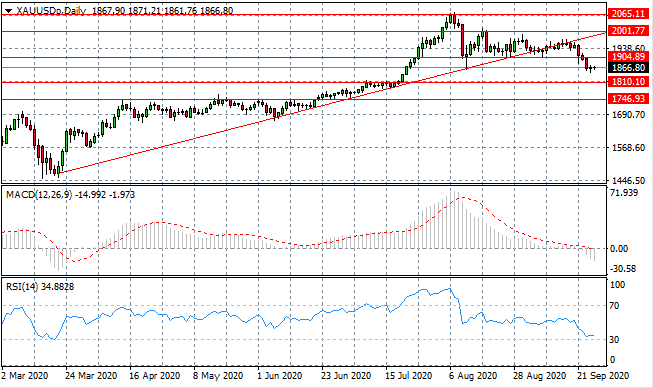

GOLD

Gold sellers established some dominance earlier in the week, however, after the break of the 1904.89 price level, bearish momentum appears to be waning. A new trading range has nw been established between the 1810.10 and 1904.89 price levels. Momentum indicators have turned bearish, with RSI testing the 30 support level.

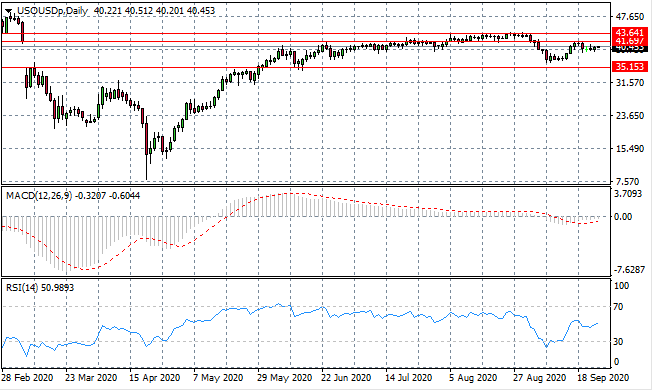

OIL

WTI has flattened out once again at the $40 per barrel price level. There is once again a lack of conviction from both buyers and sellers to drive a trend, therefore, the commodity is likely to move sideways in the near-term, or at least until there are some new developments in fundamentals. Momentum indicators have flattened in neutral territory.