U.S. Dollar Weakness In Mid-Week Trading

- 15 Apr 2020

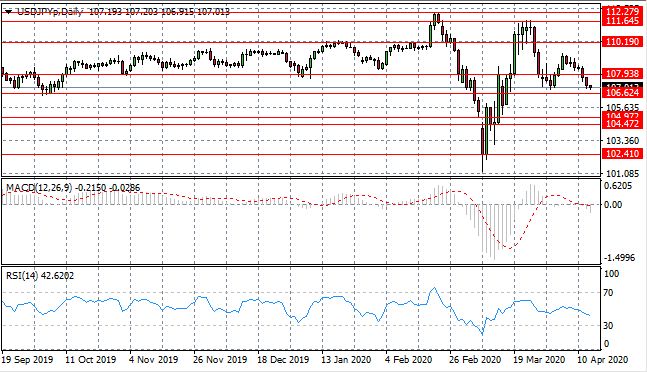

USD/JPY

The USD/JPY pair has broken the 107.93 price level, with sellers facilitating a break. The next target is the 106.62 support level which has also represented an obstacle for sellers in the past. Momentum indicators reflect the bearish sentiment with downward trajectories.

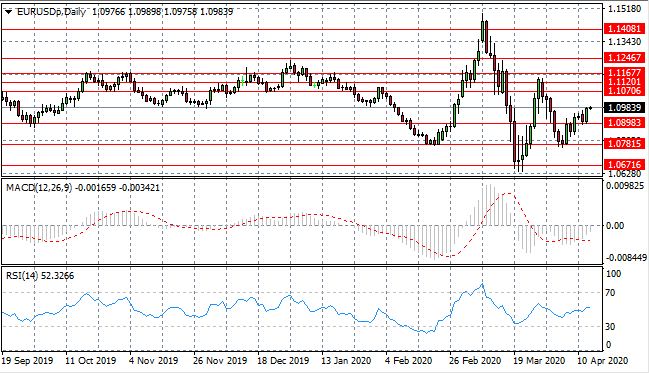

EUR/USD

The Eurodollar has moved to break the 1.089 price level, as buyers’ conviction begins to rise. The next target is the 1.107 resistance line which represents the return to a previous trading range. Both MACD and RSI have flattened in bearish/neutral territory.

GBP/USD

The GBP/USD pair has broken the 1.251 price line, as buyers return once again to drive the rally. A target remains at the 1.280 resistance level which represents the floor of a previous trading range. Momentum indicators reflect the bullish sentiment, with MACD on the verge of a bullish break of the zero line.

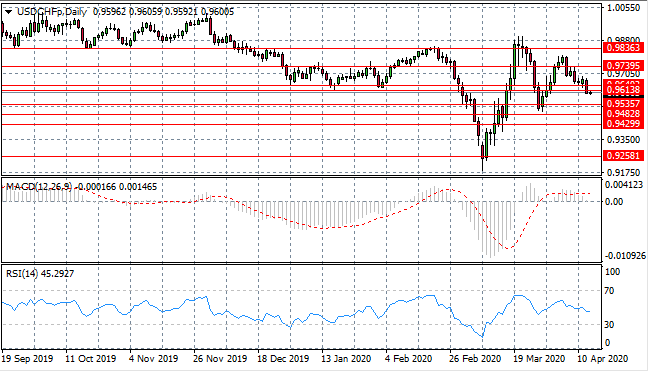

USD/CHF

The USD/CHF pair has once again pulled back, resulting in a break of the 0.961 support level. The 0.953 price level represents a rebound area where buyers have returned. If sellers manage to drive price action towards this support area, buyers may return. Momentum indicators are mixed; with RSI turning bearish and MACD remaining neutral/bullish.

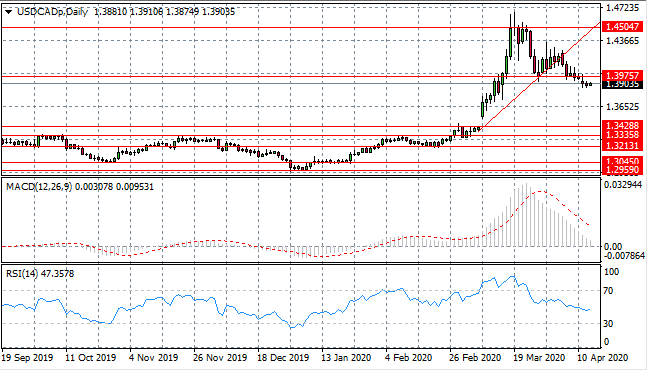

USD/CAD

The USD/CAD pair has finally broken the 1.397 support level indicating a trend reversal for the pair, as bearish sentiment begins to dominate. Doji candles indicate a lack of conviction from sellers. A support level exists at the 1.342 price line. Momentum indicators have downward trajectories.

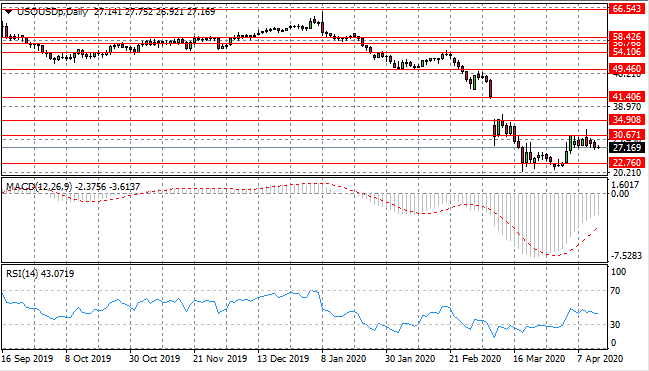

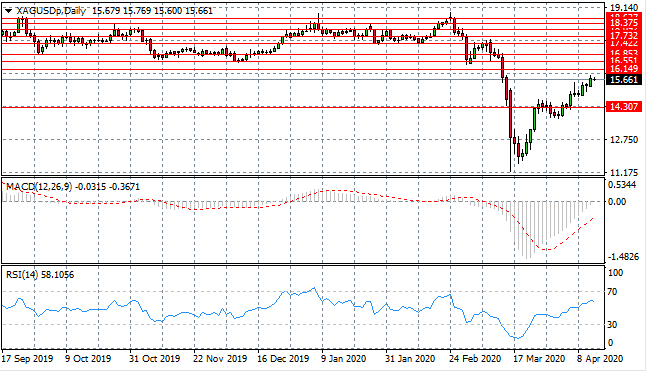

SILVER

The Silver revival has found support and price action has now pushed beyond the 14.30 resistance line towards the 16.14 price area. Although a moderately paced rally, buyers appear to have steady conviction. Momentum indicators have upward trajectories reflecting the bullish bias.

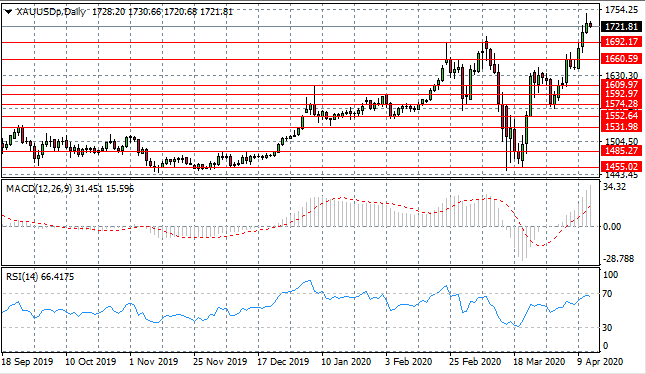

GOLD

Gold has surged in recent trading yet the surge appears to have stalled in yesterday’s trading, with rising selling pressure and bearish moves at the open today. This may be a break in the rally or price action may continue to move towards the 1692.17 price line. Momentum indicators support the bullish bias, yet RSI is testing overbought conditions.

OIL

WTI has stalled just below the $30 per barrel mark as a series of doji candles indicate indecision. The 30.67 resistance area has proved to be an obstacle for the commodity. A new range may be established between the 22.76 and 30.67 price levels. Momentum indicators have stalled in bearish territory.