USD/CAD On The Verge Of A Breakout?

- 28 Mar 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

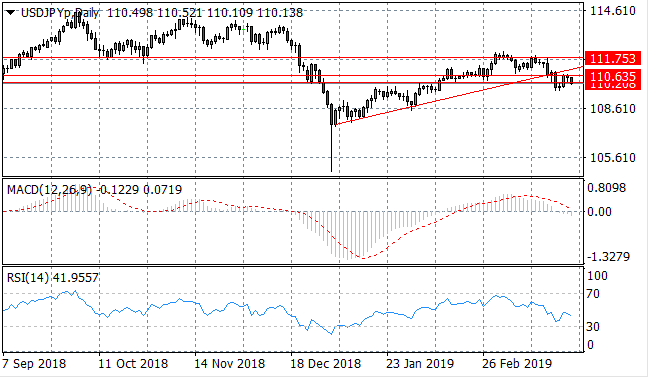

USD/JPY

The USD/JPY pair has been held back by a key resistance area at the 110.63 level. Momentum indicators are bearish; with MACD breaking the zero line and RSI beginning a momentum reversal.

EUR/USD

The EUR/USD pair has broken the descending trendline and the 1.125 price level. This represents a key support area for the pair which on previous occasions has resulted in a bullish reversal. Momentum indicators remain bearish with MACD breaking the zero line and RSI heading towards the 30 support level.

GBP/USD

The GBP/USD pair has returned to break the 1.319 price level which appears to only represent a pullback in the longer-term uptrend. A series of small- bodied candles indicate relative indecision and fundamental factors are likely to play a big role. Momentum indicators have assumed a neutral, slightly bullish position.

USD/CHF

The USD/CHF pair has broken a series of support levels, as the dollar suffered against the Swiss Franc. A dollar recovery has resulted in the pair heading towards the 0.997 price level. Momentum indicators are mixed; MACD has broken the zero line (although is a lagging indicator) and RSI has begun a bullish reversal.

USD/CAD

The USD/CAD pair continues to test the upper trendline of a symmetrical triangle after breaking the 1.335 price level. The recent move has not resulted in a meaningful break of the upper trendline. Momentum indicators are moderately bullish.

SILVER

Silver’s break of the 15.42 price level was short-lived as sellers have almost immediately returned to the metal. A trading range remains between the 15.23 and the 15.71 price levels. Momentum indicators are bearish; remaining in negative territory.

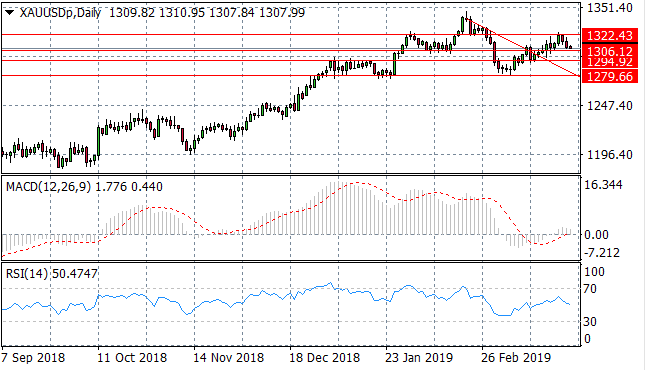

GOLD

Gold sellers have returned since the metal hit the 1322.43 price level. The next price target for sellers is the 1306.12, as volatility continues in global markets . Momentum indicators are mixed with MACD breaking the zero line to the upside and RSI beginning a bearish trajectory.

OIL

WTI buyers are still alive as the commodity continues a moderate uptrend, with several tests of an ascending trendline that has been acting as a support level. WTI is once again testing the $60 per barrel range however given persistent oversupply has struggled to stabilize at this price. RSI also continues to test the 70 overbought area whilst MACD is flat in bullish territory.

Follow Us on Facebook: