USD/CHF Pair Reaching New Highs?

- 9 May 2019

Be The 1st To Redeem $50 Cash Rebates! Limited-time offer! Get it now!

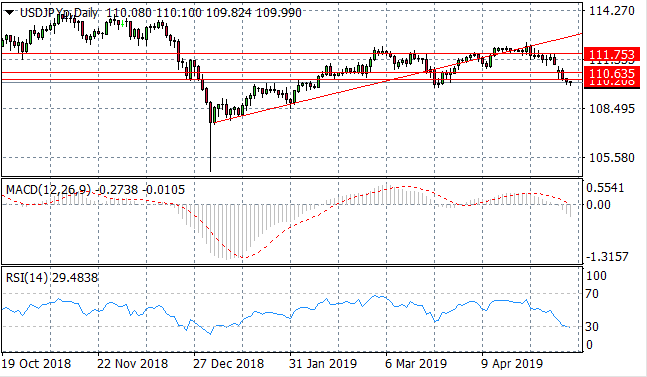

USD/JPY

The USD/JPY pair has fallen to the 110.20 support level where price action is being held. Sentiment appears significantly bearish and momentum indicators reflect the bearish bias. MACD has broken the zero line, however, RSI has reached the 30 oversold level which may be one indication of a potential reversal.

EUR/USD

The EUR/USD pair continues to test the 1.119 support level having broken the descending trendline to the upside. A series of doji candles represnet indecision and that neither buyers nor sellers are dominating the pair. MACD appears to be undergoing a moderate bullish reversal yet RSI is languishing in bearish territory.

GBP/USD

The GBP/USD pair has undergone yet another sell-off taking the pair back towards the 1.297 price level and volatility in the pair will likely continue. The pair will probably remain within the 1.297-1.314 price levels. Momentum indicators have turned bullish with a reversal taking place on MACD, however, RSI has flattened in bullish territory.

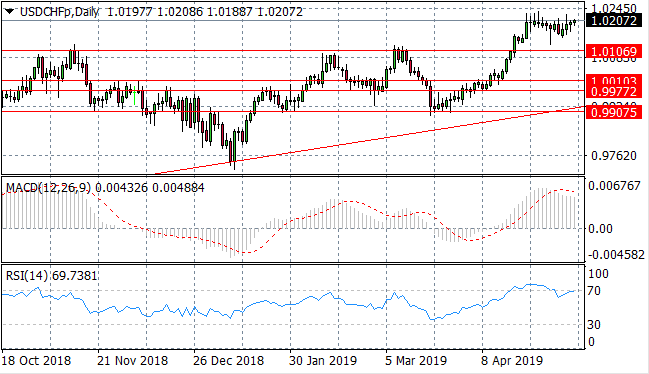

USD/CHF

The USD/CHF pair has climbed further after a pullback in the pair. The USD has found some support and new highs maybe created. Momentum indicators remain in bullish territory although MACD is pulling back and RSI has hit the 70 overbought line.

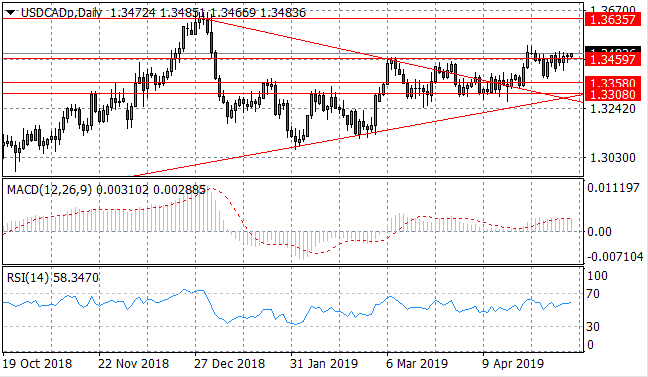

USD/CAD

The USD/CAD pair is returning to a previous trading range between the 1.335 and 1.345 price levels. The pair is struggling to gain any traction in the break of the 1.345 resistance level. Momentum indicators support the bullish sentiment.

SILVER

Silver’s break of the 14.76 support line was short-lived as buyers have driven price action back up above the support level once more. The metal is likely to remain within the 14.76 and 15.23 trading range in the near-term. Momentum indicators are mixed representing the the fact that sellers are still active.

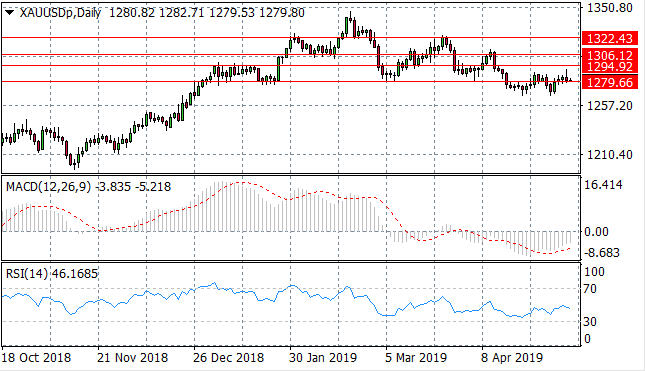

GOLD

Gold has broken the 1279.66 price level which is a key support level for the pair, although the break lacks real conviction currently. Momentum indicators support the bullish sentiment with RSI bouncing back from the 30 support level and MACD approaching the zero line.

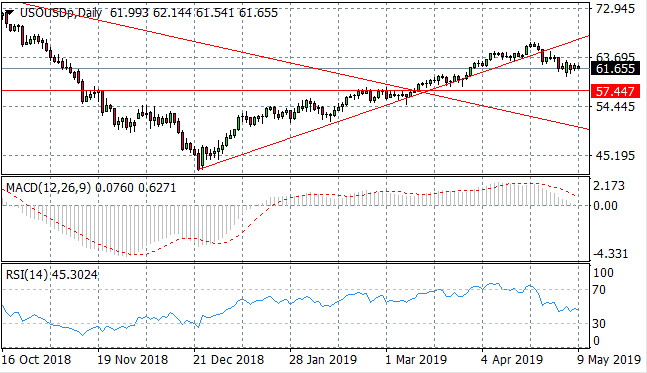

OIL

WTI has pulled back significantly to test the lower range close to $60 per barrel despite OPEC reducing output. Fundamental factors are playing a larger role in price action currently, most specifically geopolitical tensions. RSI is oscillating in a downward direction and MACD is approaching the zero line.

Follow Us on Facebook: