USDJPY Breaks Key Support Level

- 9 Nov 2021

USD/JPY

The USDJPY has finally broken the lower bound of the current trading range, as a spike in selling activity has seen a bearish bias begin to influence price action. If the break is sustained, it represents a return to a period of post-pandemic stabilization.

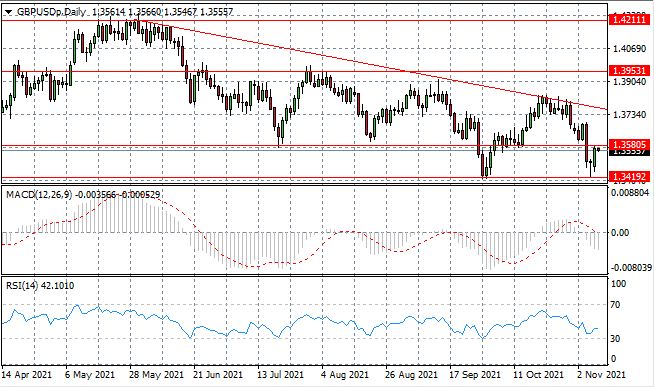

GBP/USD

The GBPUSD pair is making an attempt at the 1.358 resistance area as a rally appears to be forming. Strong bullish momentum in yesterday’s trading signals appetite from buyers and hence the pair may now return to a previous consolidation range between the 1.358- 1.395 price levels.

EURUSD

EURUSD oscillations have narrowed to the point where price action is trading horizontally, moving closer towards the apex of the triangle. Given the lower highs and lack of bullish conviction, a bearish breakout becomes increasingly likely.

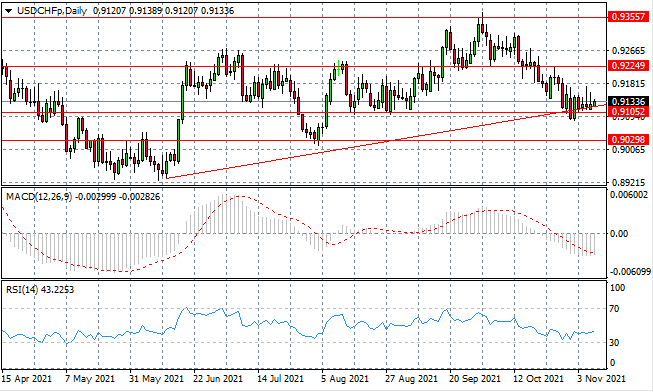

USDCHF

The USDCHF pair has stalled at the ascending trendline which is a well-established support level for the pair. Despite selling pressure in the last two trading sessions a break did not materialise and a signal of a potential reversal becomes apparent.

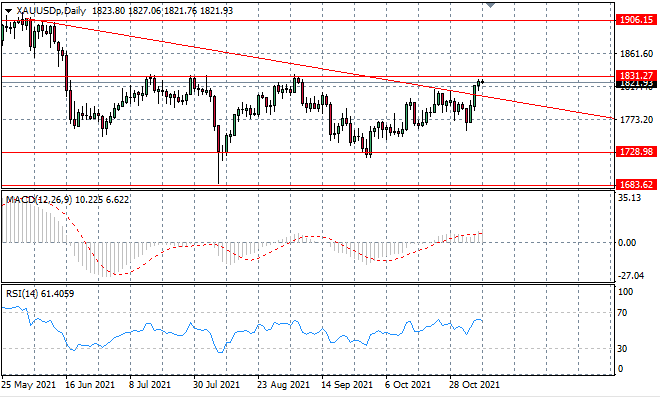

XAUUSD

The XAUUSD has broken the descending trendline which has held since May. Clearly, the break is significant and may signal support for a rally. Another obstacle for the metal is the 1831 resistance line and momentum does appear to be waning as price action moves closer.

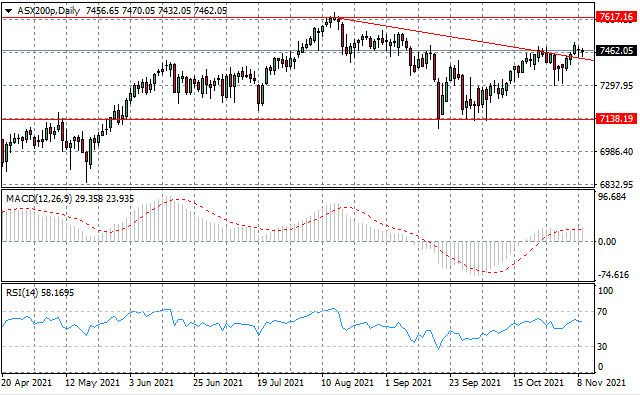

ASX200

The ASX200 index appears to have lost steam in the rally and as such, is beginning to float sideways as neither buyers nor sellers appear to have the conviction to drive price action. Doji candles further confirm indecision from market participants and therefore price action is likely to trace the trendline downwards.

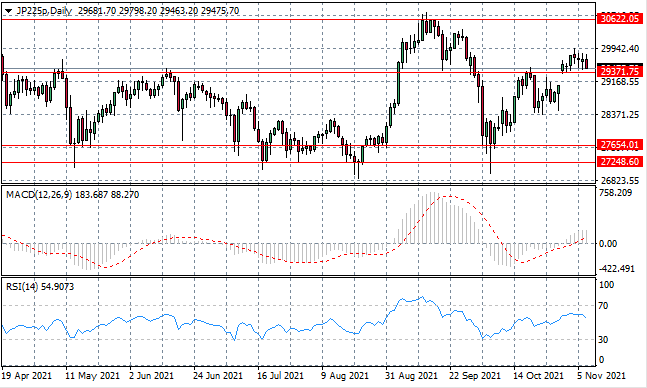

JP225

The JP225 looks to be pulling back after a strong bullish move last week. A rise in selling activity in today’s trading could signal another test of the 29,371 support line. Doji candles suggest that a reversal may be underway after a breakdown in the rally and therefore we say a return to the previous consolidation channel.