USOUSD Returns To $80 Per Barrel Range

- 13 Jan 2022

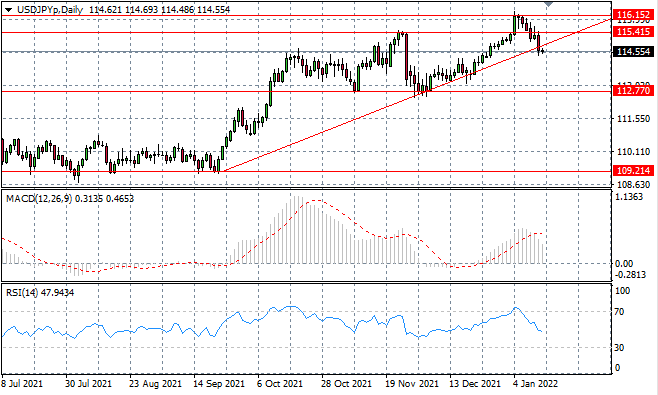

USD/JPY

The USDJPY pair has broken the ascending trendline in the first indication of a change in sentiment. If the break is sustained it could signal a longer-term bearish trend for the pair. The next support line is the 112.77 price level. Momentum indicators have downward trajectories.

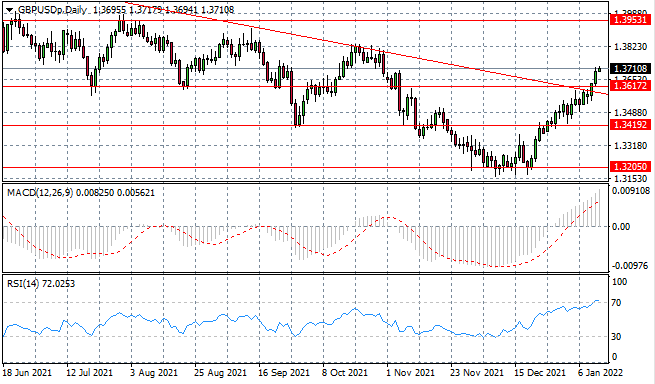

GBP/USD

The GBPUSD pair continues to climb after a break of the 1.361 resistance line. Bullish conviction has been strong with buyers dominating since mid-December and the 1.395 price ceiling remains in sight. Momentum indicators signal that the pair has reached overbought conditions, therefore a reversal may be on the cards.

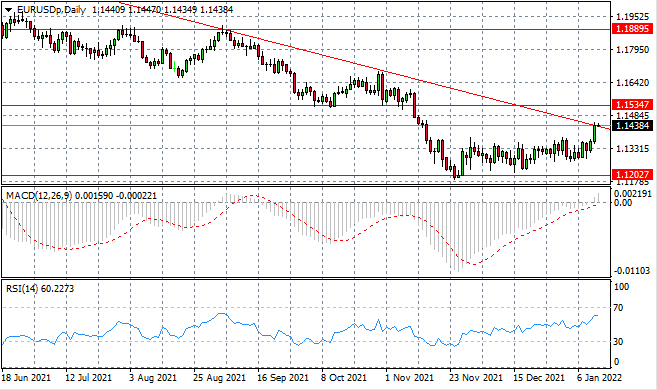

EURUSD

The EURUSD is testing the descending trendline which has typically resulted in bearish pullbacks in the past. The next target is the 1.153 resistance line and buyers’ appetite will need to be strong to maintain the break given the longer-term downtrend. Momentum indicators are bullish.

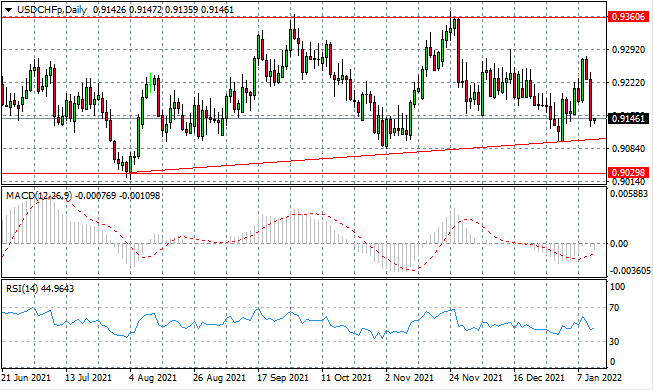

USDCHF

The USDCHF is plummeting back towards the ascending trendline, as a sharp rise in selling activity in the last two trading sessions reversed the most recent rally attempt. Momentum indicators have flattened in neutral/bearish territory.

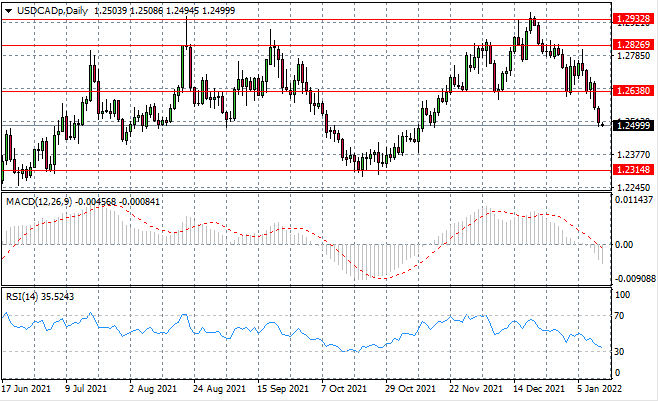

USDCAD

The USDCAD pair has broken the 1.263 support line as sellers begin to dominate price action. Strong selling activity has the pair moving back towards a recent low at the 1.231 support line. Momentum indicators have downward trajectories with RSI fast approaching the 30 oversold line.

XAUUSD

XAUUSD price action has moved towards the 1831 resistance line, once again, which has been an obstacle for buyers in the past. Given the waning bullish momentum into the move, a break seems unlikely at this present test of the resistance line. Momentum indicators are bullish.

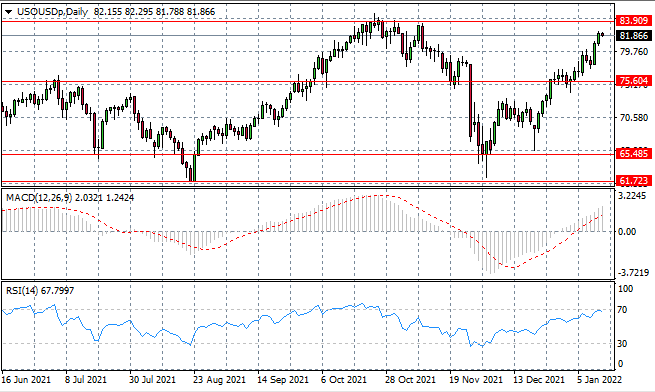

USOUSD

USOUSD has found support and is moving back towards a price ceiling at the 83.90 price line. The recent move has taken the commodity back to the $80 per barrel range as demand remains elevated. Previous tests of this resistance area have resulted in bearish pullbacks. Momentum indicators suggest the asset is overbought.