Will WTI Stabilize At $50 Per Barrel?

- 14 Feb 2020

USD/JPY

The USD/JPY pair has pulled back from the 110.19 price level with bearish moves towards the 109.61 support level which resulted in a price action being held up before any real test or break of the support level. Momentum indicators have flattened in bullish territory.

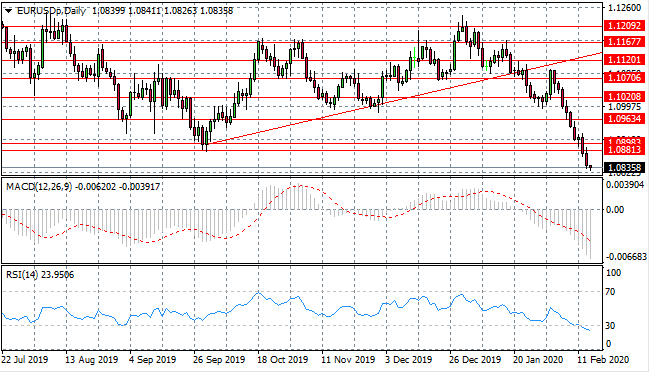

EUR/USD

The Eurodollar has hit a multi-year price low having broken the 1.088 support level in the most recent bearish move. Nine of the last ten trading sessions have been bearish underlining seller dominance and sustained bearish bias. Momentum indicators support the bearish sentiment with RSI pushing beyond the 30 oversold support level.

GBP/USD

The GBP/USD pair has broken back above the 1.295 support level, as well as the ascending trendline, with price action heading back towards the 1.309 resistance level. A break of the trendline may prove significant indicating the end of a longer term downtrend. Momentum indicators have upward trajectories.

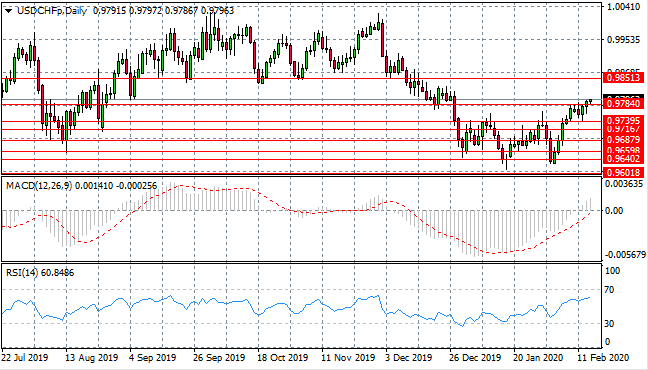

USD/CHF

The USD/CHF pair has managed to push beyond the 0.978 resistance level, with rising buying pressure. The question is whether US Dollar buyers have the conviction to sustain the rally. Further bullish moves may be made taking price action back towards the 0.985 resistance level. Momentum indicators have upward trajectories.

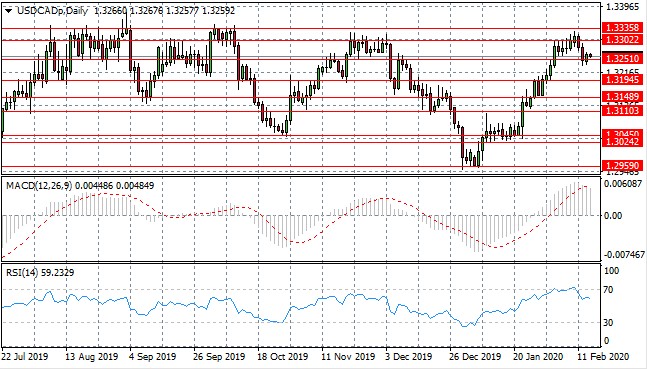

USD/CAD

The USD/CAD pair has rebounded from the 1.330 resistance area, to take price action back towards the 1.325 support level. The pair was unable to break the support level with yesterday’s trading session closing above the 1.325 price line. Momentum indicators are pulling back from strongly bullish positions.

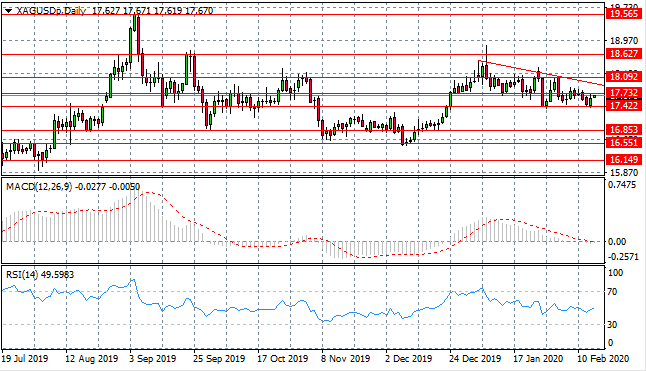

SILVER

Silver has rebounded from the 17.42 price floor and is now testing the 17.73 resistance level. The move may represent an oscillation within the downtrend. If a break of the 17.73 resistance level materializes, the pair may struggle to move beyond the descending trendline. Momentum indicators have flattened in neutral territory.

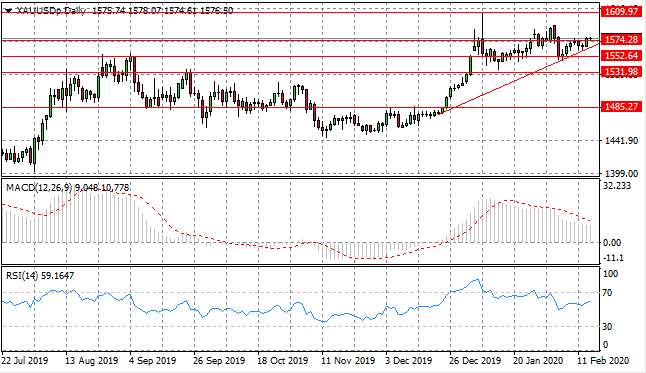

GOLD

Gold continues to test the 1574.28 resistance line yet, once again, has been unable to break the price level. There is a well established long-term uptrend and considering there has been no break of the ascending trendline, the rally may continue. Momentum indicators have flattened in bullish territory.

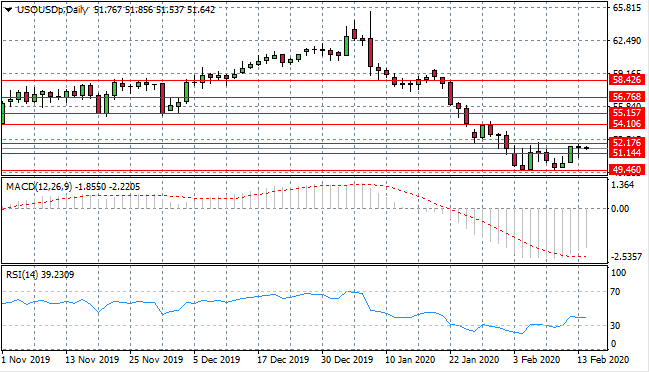

OIL

WTI is undergoing a bullish reversal, however, price action has stalled after a bullish break of the 51.14 price level. A series of doji candles represent a lack of conviction from buyers to really drive the rally. Price action may stabilize around the $50 per barrel mark. Momentum indicators have flattened in bearish territory.