WTI Sellers Return

- 7 Sep 2020

USD/JPY

The USD/JPY pair continues to track the 106.05 price level, as small-bodied candles indicate a lack of conviction from buyers to drive a rally after the break. Horizontal price action will likely continue with the descending trendline acting as resistance. Momentum indicators have stalled in neutral territory.

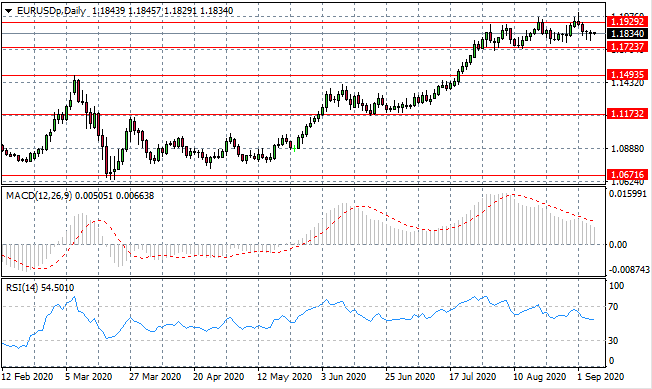

EUR/USD

The Eurodollar pulled back appears to have lost momentum as buying pressure has risen and doji candles indicate a lack of appetite from both buyers and sellers. The 1.172-1.192 range will likely remain intact as an exhaustion period in the middle of the long-term rally. Momentum indicators reflect the switch to bearish sentiment.

GBP/USD

The GBP/USD pair has also pulled back to the 1.320 support level and despite an attempted break, sellers were held in range. A previous period of consolidation exists at the 1.311-1.320 range and therefore price action may return to this level in the absence of buying pressure. Momentum indicators are bullish yet RSI is pulling away from overbought conditions.

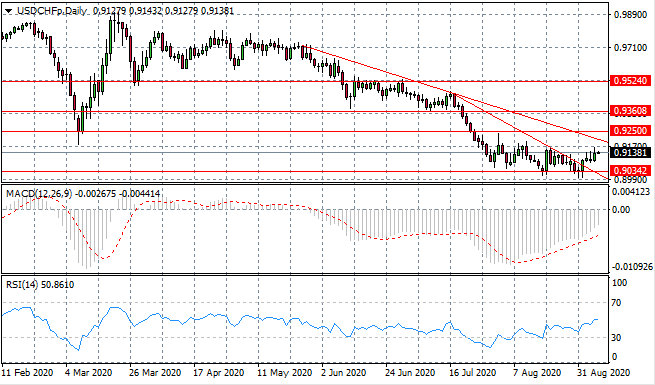

USD/CHF

The USD/CHF reversal is gaining strength after an initial stall with the 0.925 resistance level in sight. The descending trendline marks the trajectory of the longer-term downtrend and it remains to be seen whether buyers have the conviction to drive a trend change. Momentum indicators have upward trajectories.

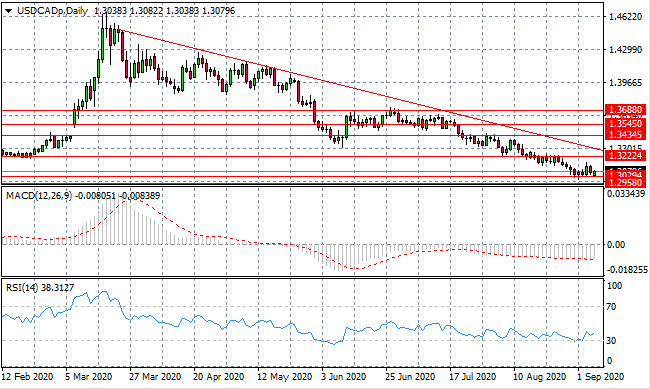

USD/CAD

The USD/CAD pair has failed to push beyond the 1.302 support level. Buyers and sellers appear to be tussling for control but sentiment remains bearish. A long-term downtrend is well established. Momentum indicators remain in bearish territory.

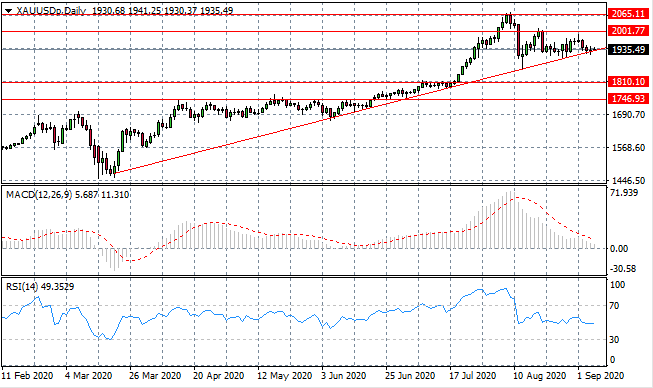

GOLD

Gold sellers are driving price action which has the metal testing the ascending trendline. A rebound generally takes place at the trendline yet currently there is little conviction from buyers. Given current economic conditions and the trajectory of the long-term rally we may expect bullish momentum to continue. Momentum indicators have flattened in neutral territory.

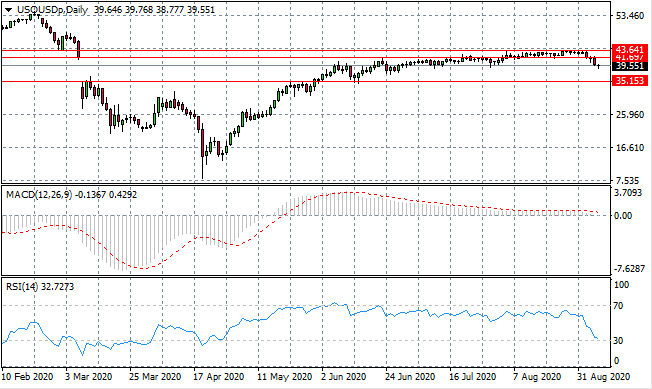

OIL

WTI has broken several support levels to return to the $30 per barrel range with the 35.15 support level in sight. A slow rally has been completely undone in the space of three trading sessions. The commodity may now remain within the 35.15-41.69 range. Momentum indicators have bearish trajectories with RSI testing the 30 support level.