The Eurodollar Takes Flight

- 5 Jun 2020

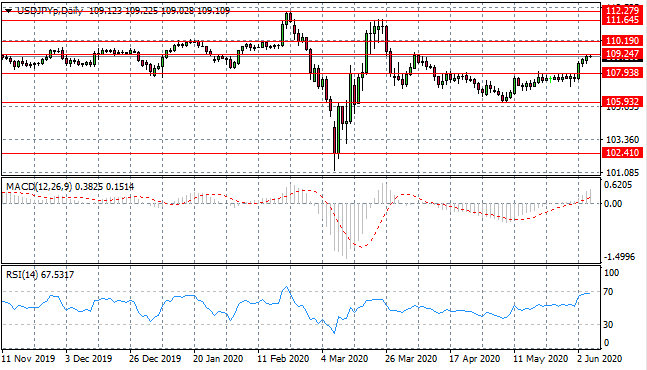

USD/JPY

The USD/JPY pair is testing the 109.24 resistance level as the rally begins to gain traction. After the break of the 107.93 price level momentum has begun to slow. Momentum indicators remain in bullish territory, with RSI continuing to test overbought conditions.

EUR/USD

The Eurodollar has pushed beyond the 1.124 resistance line, as the rally begins to build momentum. A target exists at the 1.140 price level yet buyers’ conviction already appears to be waning. Momentum indicators have turned bullish with RSI moving beyond the overbought ’70’ line.

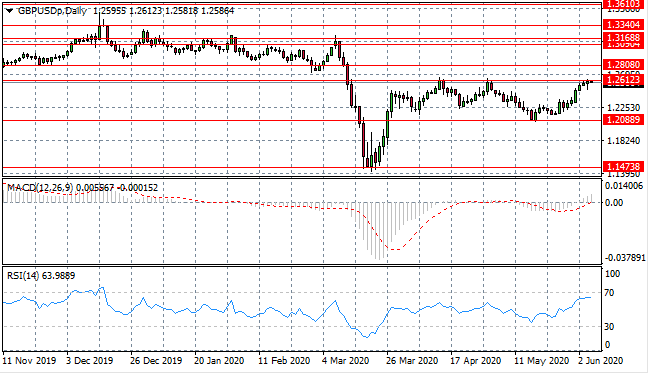

GBP/USD

The GBP/USD pair has not given up on the 1.261 resistance level despite sellers attempting a pullback yesterday. Going forward, the pair seems likely to continue to oscillate between the 1.208 and 1.261 price levels. Momentum indicators remain in bullish territory though RSI has fallen short of the overbought resistance line at 70.

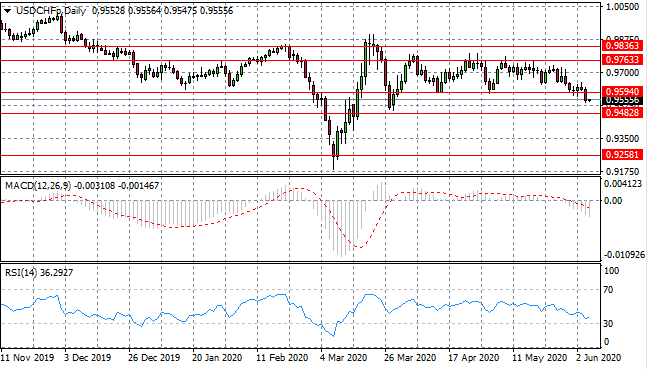

USD/CHF

The USD/CHF pair has returned to break the 0.959 support level as sentiment has turned bearish in recent trading. This represents a break of a price floor in the 0.959- 0.976 trading range and the next support level is at 0.948. Momentum indicators confirm the bearish bias with downward trajectories.

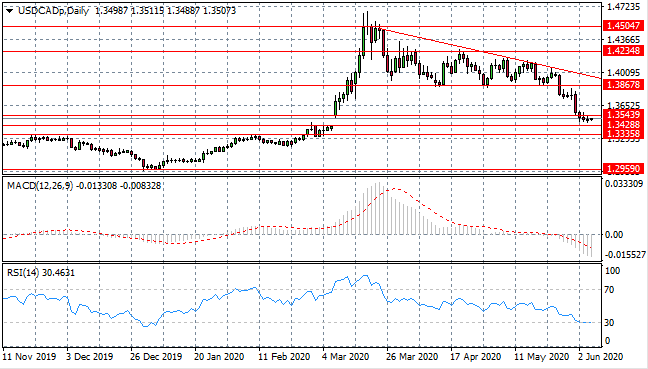

USD/CAD

The USD/CAD breakout has gathered significant support, taking price action towards the 1.342 support level as the pair returns to price levels seen before the Covid-19 breakout. Doji candles represent a break in the move perhaps signifying a potential trend change. Momentum indicators have also stalled at oversold territory.

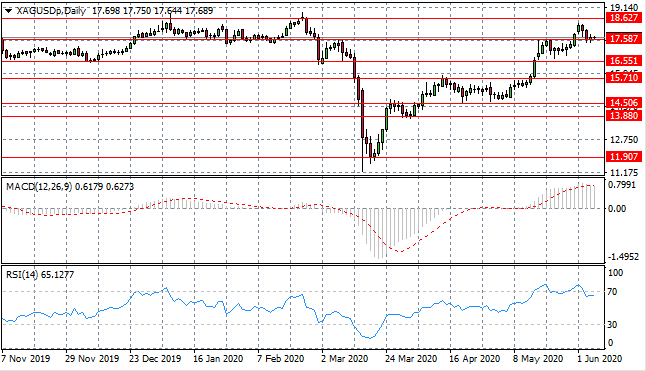

SILVER

Silver has returned to the 17.58 resistance level after a brief break which looked like the metal may take off and reach new highs. The pullback may be a short rest period before another drive higher. Momentum indicators have stalled in bullish territory but RSI suggests the metal is overbought.

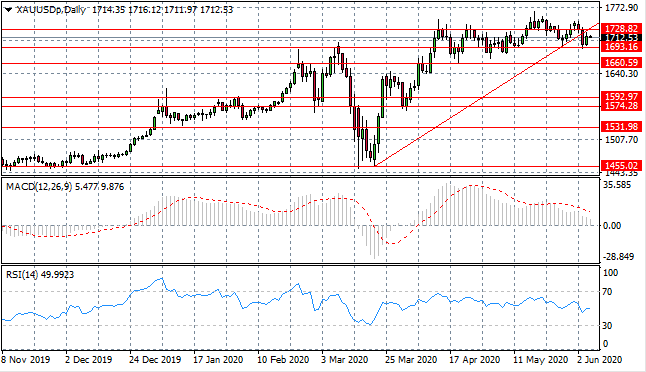

GOLD

Gold sellers have been dominant in recent trading which saw a break in the 1728.82 support level as well as the ascending trendline. Yet a stall occurred at the 1693 price level where another attempt will likely be made by buyers to drive the metal higher. Momentum indicators have bearish trajectories.

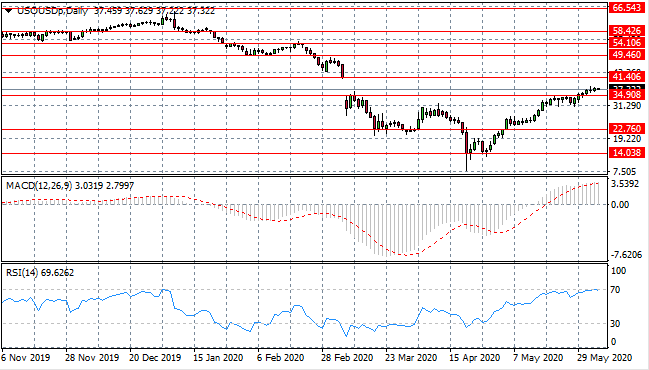

OIL

WTI has finally broken the 34.90 resistance level, which is significant as it represents a gap fill line from the previous downtrend. If price action can reach and break the 41.40 price level we can expect the rally to gain traction. Momentum indicators remain in bullish territory although RSI suggests oil is overbought.