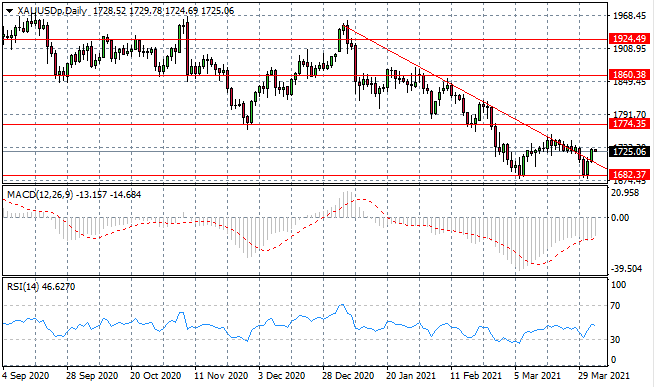

A Trend Reversal For XAUUSD?

- 5 Apr 2021

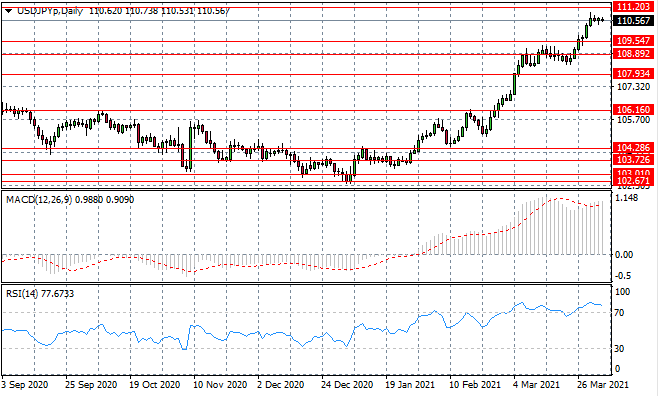

USD/JPY

The USD/JPY pair has stalled just before the 111.20 resistance line. Doji candles indicate indecision and neither buyers nor sellers are dominating price action. Momentum indicators have flattened in bullish territory, with RSI pulling back towards the 70 overbought line.

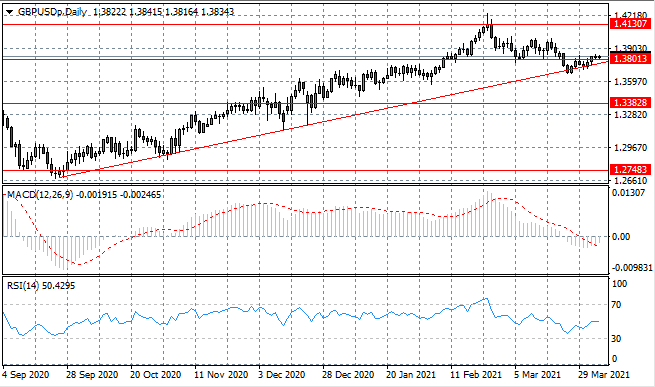

GBP/USD

The GBPUSD has rebounded from the ascending trendline, resulting in a break of the 1.380 resistance line. Conviction from buyers currently remains low. The pair will oscillate between the 1.380 and 1.413 price levels. Momentum indicators have moderate upward trajectories.

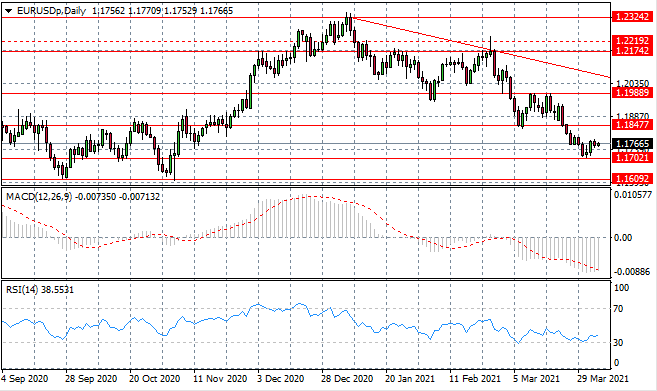

EURUSD

The Eurodollar has rebounded from the 1.170 support area yet sellers remain active and the pair continues to languish mid range between the 1.170-1.184 price levels. Momentum indicators appear to be beginning upward trajectories though currently remain in bearish territory.

XAUUSD

The XAUUSD has broken the descending trendline, in the first sign of a potential trend reversal. Bullish momentum has been strong and the metal may now return to the 1774.35 price line which represents the lower bound of a previous range. Momentum indicators are bullish.

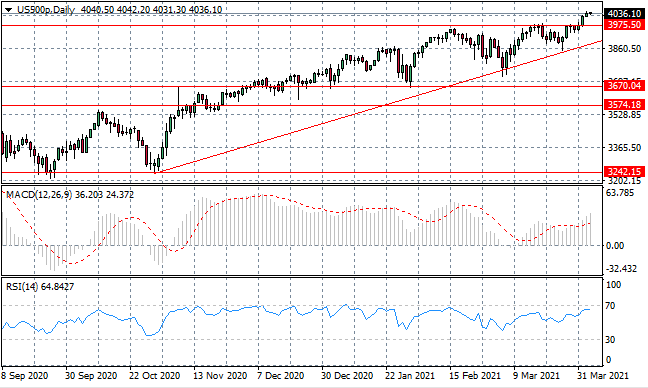

US500

The US500 pair has broken the 3975 resistance line albeit with moderate conviction from buyers. The rally therefore remains intact with the ascending trendline acting as support. Momentum indicators are bullish yet RSI is fast approaching the overbought line.

NDX100

The NDX100 is testing the 13309 resistance line which has been a hurdle in recent trading. A break would see the index return to a previous range established during the breakdown of the previous rally. Buyers’ conviction will be tested. Momentum indicators have upward trajectories.