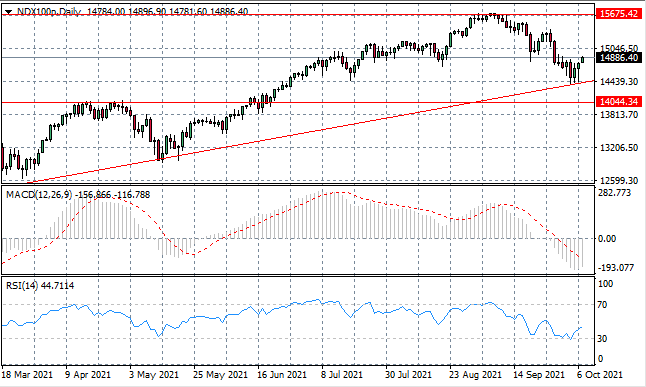

Bullish Reversal For NDX100?

- 7 Oct 2021

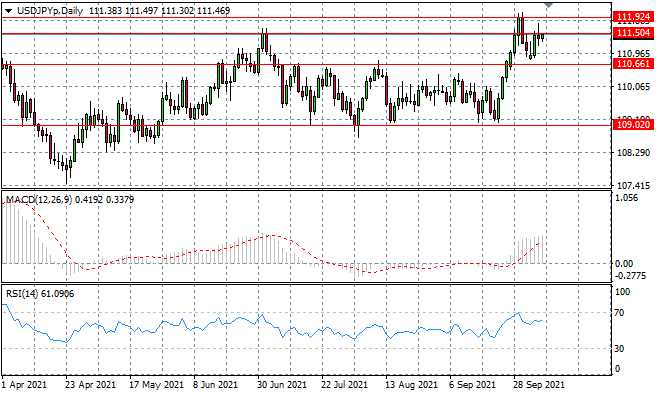

USD/JPY

The USDJPY pair has stalled at the 111.50 resistance line as selling pressure began to rise as the price line was being tested. The pair may now oscillate within a new range between the 110.66-111.50 price levels. Momentum indicators suggest there is further upside potential.

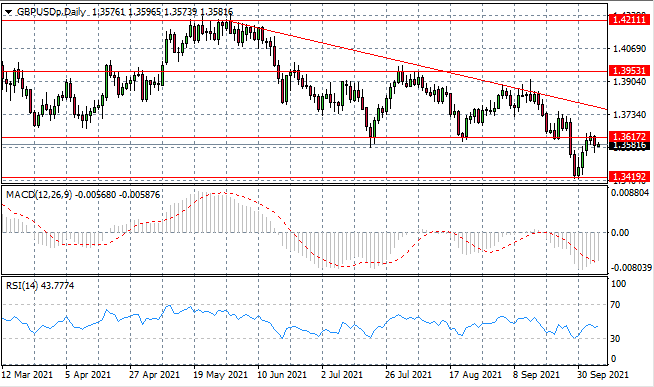

GBP/USD

The GBPUSD pair has rejected the 1.361 resistance line which represents a previous support level for the pair. Given that the longer-term bias is bearish, the pair may now consolidate within the current range with the 1.361 price line now acting as a ceiling.

EURUSD

The Eurodollar is following a bearish flag formation indicating the continuation of the longer-term downtrend. Lower highs have been established by buyers which are almost immediately followed by strong bearish candles. The pattern will continue without any material change in fundamentals.

USDCAD

The USDCAD has only had a moderate sell-off despite spiking oil prices, indicating little appetite from CAD buyers, as fundamentals do not support bullish moves. A series doji candles represent indecision and a lack of appetite from sellers to drive price action.

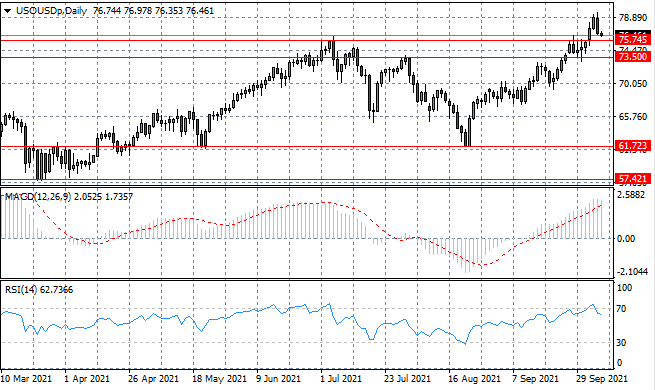

USOUSD

The USOUSD rally has lost steam and sellers have returned to bring price action back towards the 75.74 support line. The support level represents a previous obstacle for buyers and therefore, price action may now stabilize in the mid $70 per barrel range.

NDX100

The NDX100 has bounced off the ascending trendline as buyers have returned with conviction to the index and the previous uptrend resumes. A target exists at the 15,675 resistance line which represents a price ceiling for the index. Momentum indicators are undergoing bullish reversals.

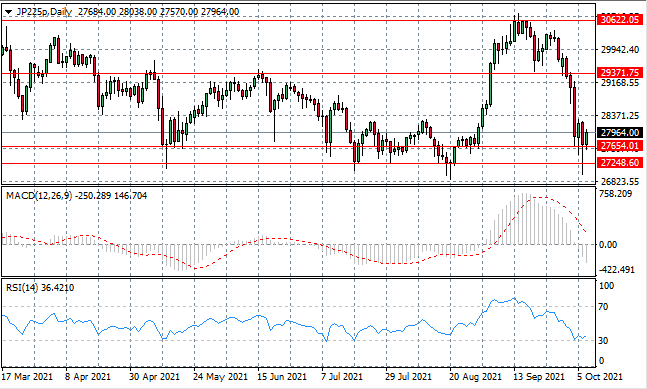

JP225

The JP225 has rebounded from the 27,654 support level as the extended sell-off appears to have slowed. The index will now likely maintain the current range with the 29,371 price level acting as a ceiling. In the longer-term, the index appears to be entering into a consolidation phase.