Buyers Return To Precious Metals

- 23 Sep 2019

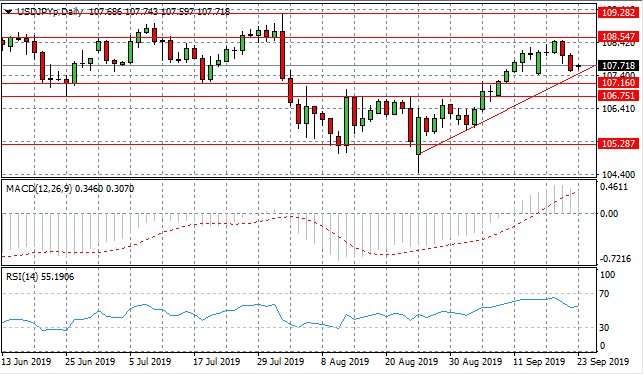

USD/JPY

The USD/JPY pair has fallen to the ascending trendline before reaching the 108.54 resistance level. The pair appears to be experiencing some bullish momentum since approaching the trendline, where on previous occasions price action has rebounded. Momentum indicators have retraced from bullish positions with RSI pulling away from overbought conditions.

EUR/USD

The Euro once again has rejected the resistance area at the descending trendline, which represents a ceiling for the pair. A bearish breakout may be imminent as the pair moves towards the apex of a descending triangle which will likely take price action below the 1.095 support level. Momentum indicators have stalled in bearish territory.

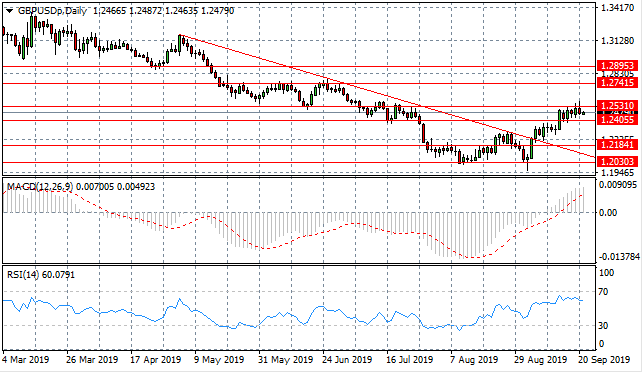

GBP/USD

The GBP/USD pair has been unable to break the 1.253 resistance area in recent trading, with price action falling back towards the 1.240 support level. Geopolitical events are likely to impact the pair going forward. Momentum indicators are bullish, however, RSI is pulling back from overbought conditions.

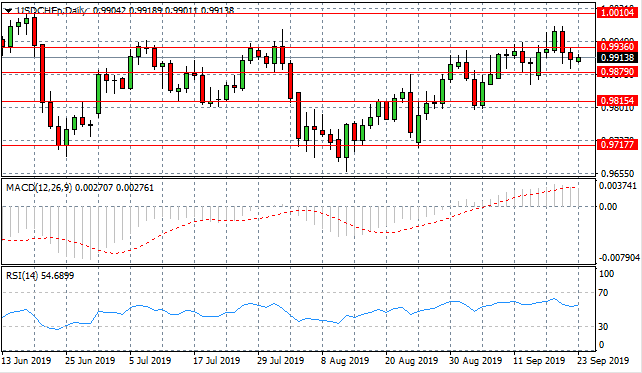

USD/CHF

The USD/CHF pair has reversed the break of the 0.993 resistance line with bearish price action rising, taking the pair back below the resistance level. Buyers have returned since the break and price action may remain between the 0.987 and the 0.993 price levels. Momentum indicators are pulling back from bullish territory suggesting the rally has come to an end.

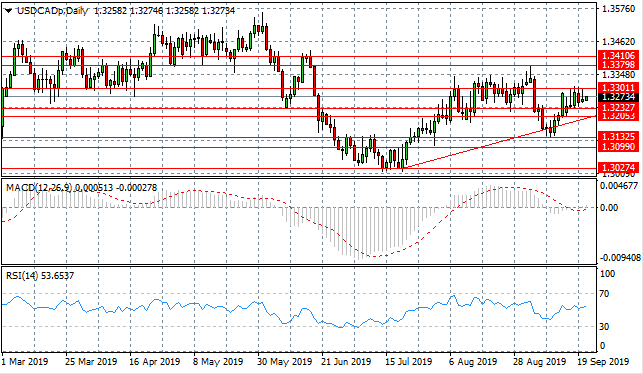

USD/CAD

The USD/CAD pair has once again pulled back from the 1.330 resistance line as selling pressure rises. A trading range between the 1.233 and 1.330 price levels may be established. Momentum indicators have flattened in neutral/bullish territory with MACD testing the zero line and RSI moving into the buying channel.

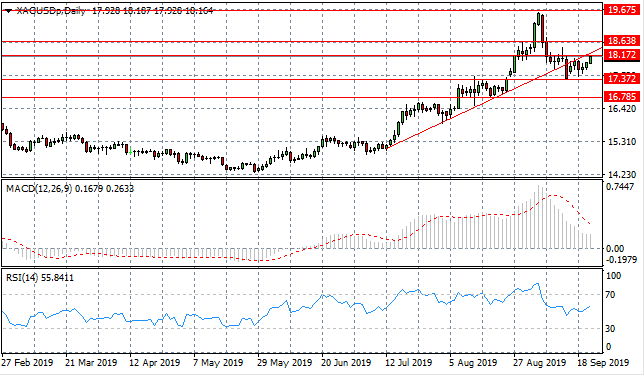

SILVER

Silver’s price volatility has been narrowed where oscillations in price action have become tighter moving into a tighter trading range between the 17.37 and 18.17 price levels. Currently, price action is testing the 18.17 price level as buyers return to the metal. Momentum indicators are mixed; with MACD heading towards the zero line, however, RSI has moved into the buying channel.

GOLD

Gold has started to pull away from the 1497.19 support level as buyers return to take price action towards the 1524.27 resistance line. The metal is trading sideways with a trading range between the 1497.19 and the 1549.95 price levels. Momentum indicators are bullish, with MACD rising from the zero line and RSI moving into bullish territory.

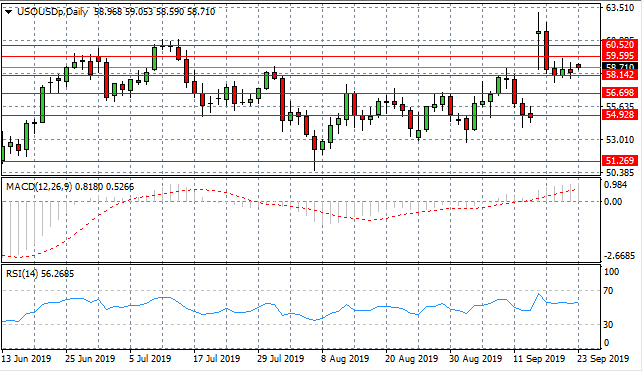

OIL

A full bearish reversal has taken place and WTI price has now moved to test the $58 per barrel price area. Although sentiment is bearish, overall, price action is beginning to move away from the $58 per barrel area. Momentum indicators are bullish with MACD breaking the zero line to the upside yet RSI has flattened in the bullish channel.