Do XAUUSD Buyers Have The Conviction To Sustain The Rally?

- 22 Apr 2021

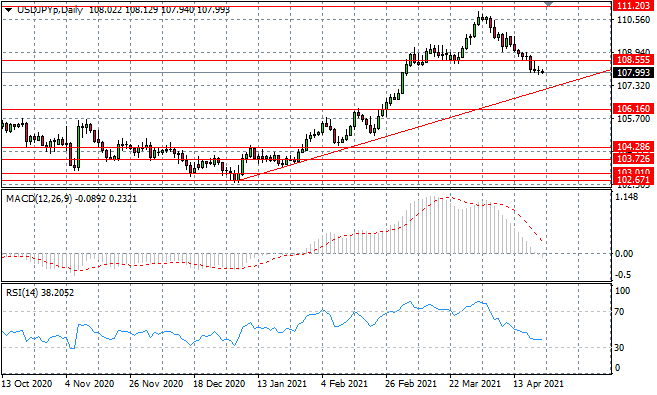

USD/JPY

USDJPY price action has begun to flatten after the break indicating a drop in bearish momentum. Doji candles typically collect ahead of a breakout and the pair is heading towards an ascending trendline which has represented a strong support area. Momentum indicators remain in bearish territory.

GBP/USD

GBPUSD price action is pulling back towards the ascending trendline, yet remains above the 1.380 support level. The move therefore suggests that the pair may consolidate within this trading range, tracing the trendline. Momentum indicators are bullish.

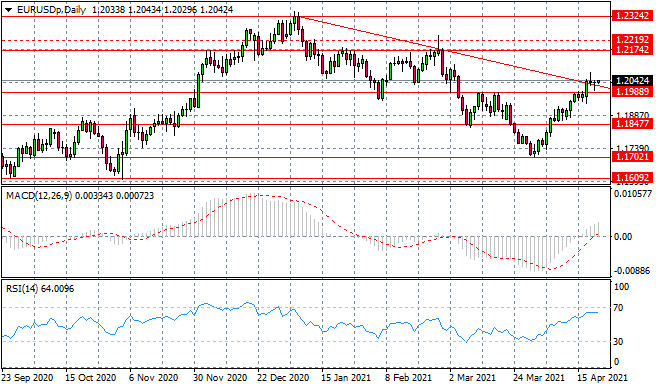

EURUSD

The Eurodollar continues to test the trendline with neither buyers nor sellers willing to dominate price action. The stall represents a break in a well-established bullish move that has carried on largely unobstructed for the last month. Momentum indicators are bullish with RSI flattening just below overbought conditions.

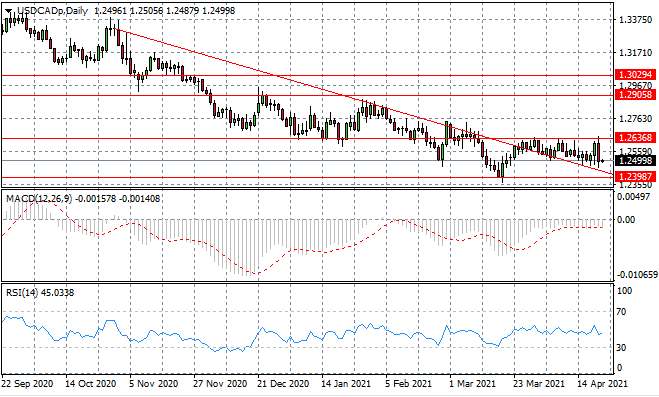

USDCAD

The USDCAD continues to oscillate between the the descending trendline and the 1.263 resistance area and notably, the oscillations are widening, therefore a break out of this range may be on the cards and will be determined by which side has the most conviction. Momentum indicators have flattened in neutral/bearish territory.

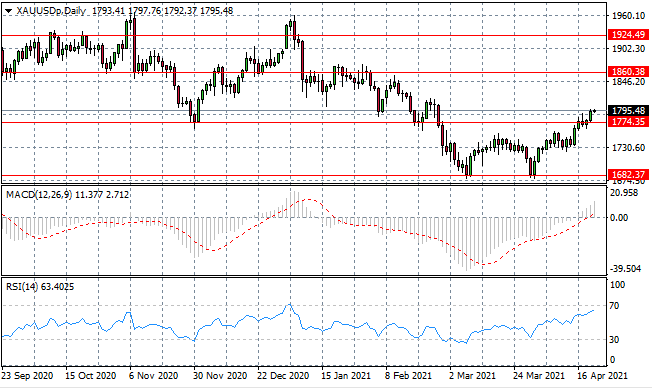

XAUUSD

XAUUSD has started to pull away from the 1774.35 resistance line, as buyers attempt to build momentum to sustain the move. Significant conviction will be required to pull off a rally especially considering the metal has been in a downtrend since early July 2020. Momentum indicators are bullish with RSI fast approaching overbought conditions.

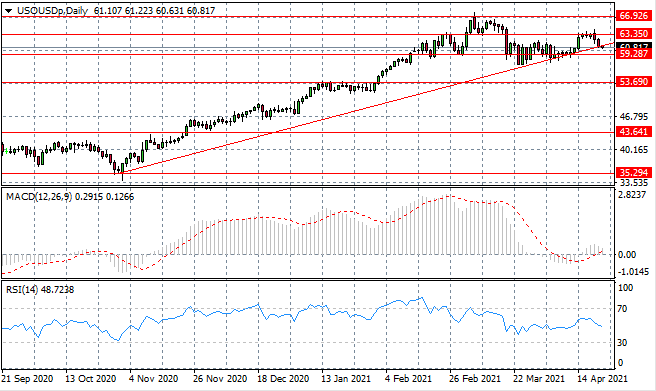

USOUSD

USOUSD has pulled back again, only as far as the ascending trendline as sellers returned at the 63.35 price level. A break of the trendline would be significant as it has held since late October 2020. Momentum indicators have turned bearish with MACD testing the zero line.

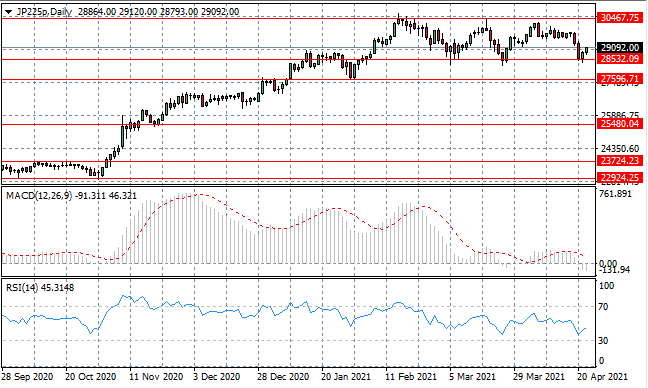

JP225

The JP225 index has once again rebounded from the 28,532 support area and therefore another attempt at the 30,467 resistance area may be made. The index has been consolidating within this range since January this year, however, the lack of conviction from buyers has contained price action below the 30,467 ceiling. Momentum indicators remain in bearish territory.