Eurodollar Approaches Key Support Area

- 17 Jan 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

The USD/JPY pair appears to be gaining some bullish momentum. Price action has broken the 108.73 price level after series of doji candles. The next target for buyers is the 109.26 price level. MACD has begun a bullish reversal and RSI has broken the zero line to the upside.

EUR/USD

The EUR/USD pair has retraced to break the 1.145 price level which may take price action back towards the ascending trendline. Momentum indicators reflect the bearish sentiment; as MACD appears to be undergoing a momentum reversal and RSI has begun a downward trajectory.

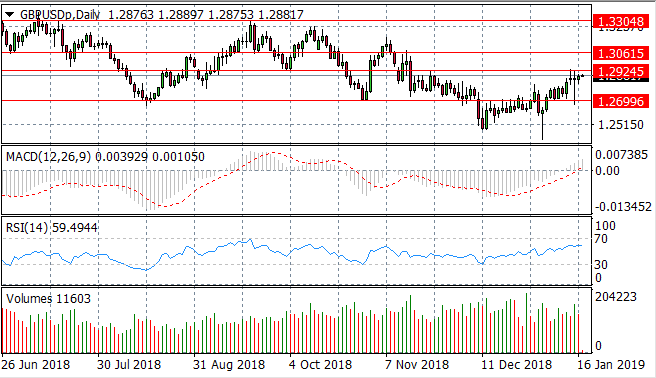

GBP/USD

The GBP/USD pair has made a recovery and strong bullish moves have resulted in the pair moving to test the 1.292 price level on several occasions, however, price action has been unable to break this resistance level. MACD has broken the zero line which suggests that momentum remains with buyers, however, with RSI approaching overbought conditions, the rally may be short-lived.

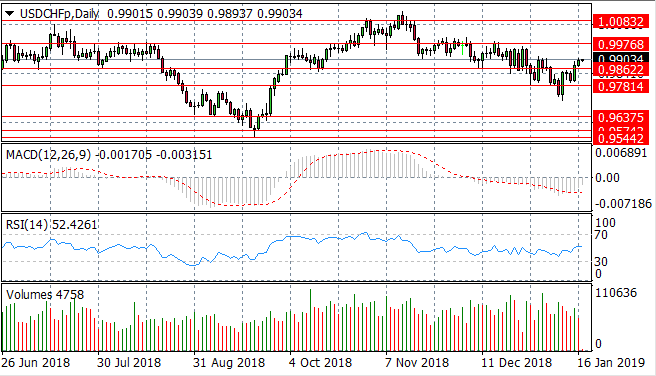

USD/CHF

The USD/CHF pair has rallied once again to break of the 0.986 resistance line. Momentum indicators have turned bullish with MACD undergoing a bullish momentum reversal and RSI beginning an upward trajectory. Volume has been declining into the move, however, which may suggest a lack of appetite from buyers to drive price action higher.

USD/CAD

The USD/CAD pair has pulled back from a long-term uptrend and as a result has broken several support levels and now price action has stalled at the 1.326 price level. Momentum indicators remain somewhat bearish; as RSI continues to bounce along the 30 support line and MACD is on the verge of breaking the zero line to the downside.

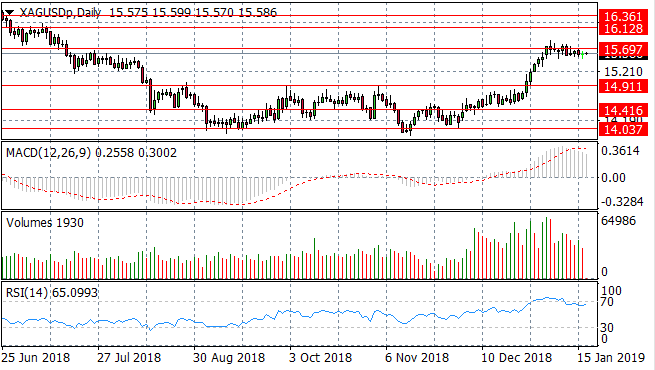

SILVER

A series of doji candles represent indecision as Silver struggles to break through the 15.69 price level. A reversal may be imminent as the pair is unable to break the resistance line. Momentum indicators also suggest a reversal is likely with MACD beginning a momentum reversal and RSI pulling back to break the 70 resistance level.

GOLD

Gold has also stalled after a significant rally, still falling short of a recent price high of 1303.94. The metal appears to be taking a pause in the rally as denoted by a series of doji candles. Sentiment may be turning more bearish as MACD is beginning a momentum reversal and RSI pulls away from overbought conditions.

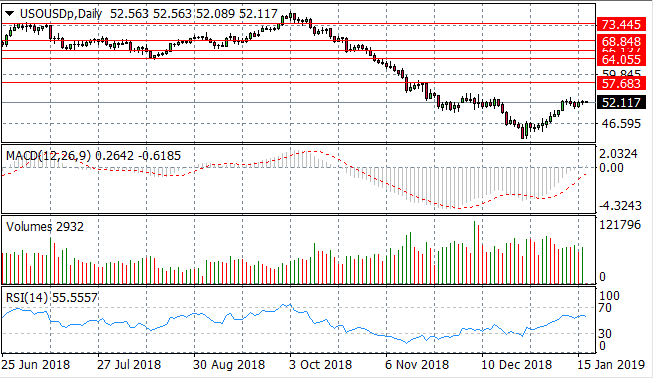

OIL

WTI buyers appear to be taking a pause mid-rally as denoted by a series of small-bodied candles where neither buyers nor sellers dominated the trading session. Momentum remains bullish however; with MACD breaking the zero line and and RSI forming an upward trajectory.