Eurodollar Continues To Weaken

- 25 Jan 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

The USD/JPY pair appears to have stalled just below the 109.87 price level which has formed as a sticking point for the pair, representing a previous support level and therefore a break would prove significant. MACD is continuing a sharp bullish reversal and RSI has a sharp upward trajectory.

EUR/USD

The EUR/USD pair has broken a key support area to test the 1.129 price level and clearly, a break would prove significant. Each time price action has hit this price level, bullish sentiment revives to push the pair higher. However, momentum indicators remain bearish with MACD on the verge of breaking the zero line and RSI continuing a downward trajectory.

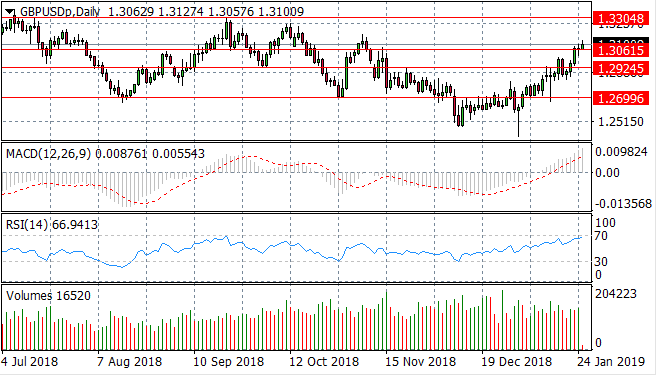

GBP/USD

The GBP/USD pair continues its rally to once again break the 1.292 price level and the 1.306 resistance level. The question remains; can the rally continue to the previous high of 1.330? Momentum indicators support the bullish bias as MACD has extended into bullish territory and RSI is once again approaching the 70 overbought zone.

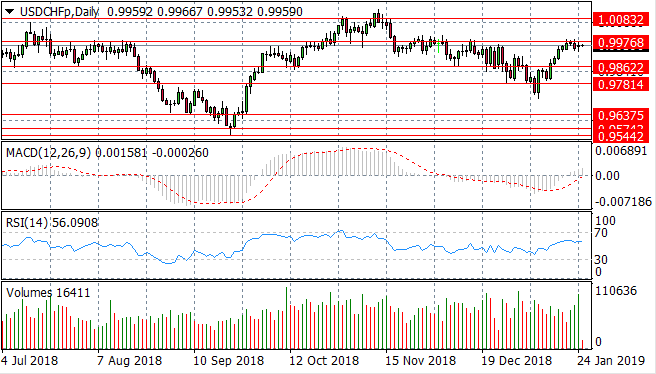

USD/CHF

The USD/CHF pair has rallied once again to break the 0.986 resistance line and the pair is now testing the 0.997 price level. This is a key resistance area for the pair which has once again resulted in a pullback. Momentum indicators are mixed; with MACD breaking the zero line yet RSI has also pulled back from the overbought area. Buying volume has risen.

USD/CAD

The USD/CAD pair appears to be attempting a recovery after the recent sell-off. Price action is once again testing the 1.334 price level which represents a key resistance area for the pair. Neither buyers nor sellers appear to be dominating. Momentum indicators are beginning a bullish reversal of sorts; as MACD turns less negative and RSI tests the default line.

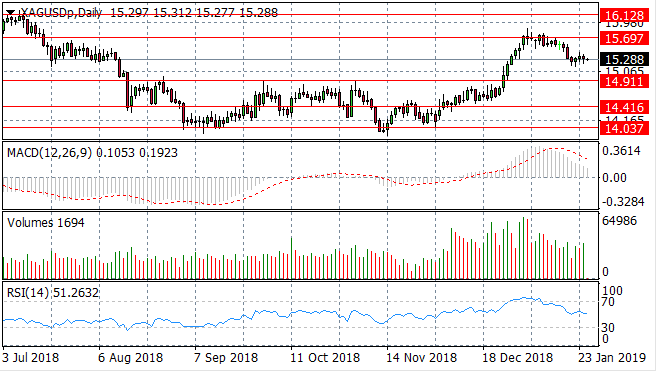

SILVER

Silver had some short-lived dominance driving price action lower, which appears to have been tempered, as denoted by a series of doji candles. Momentum indicators confirm that sentiment remains bearish with MACD continuing towards the zero line and RSI heading towards the default line.

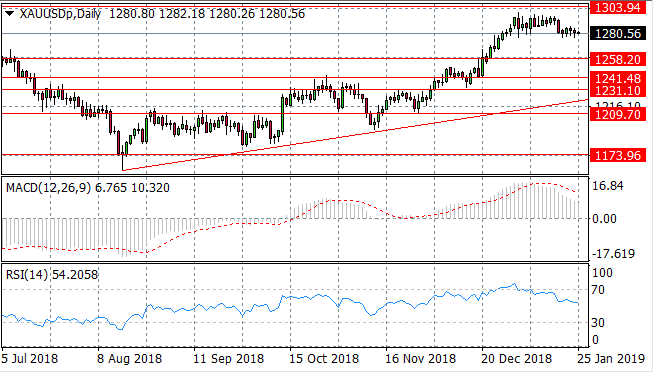

GOLD

Gold has also stalled after a significant rally and despite some selling pressure, the metal does not appear to have a strong directional bias. Given the lack of conviction from buyers and sellers; gold is likely to trade in range in the near-term. Momentum indicators confirm bearish sentiment.

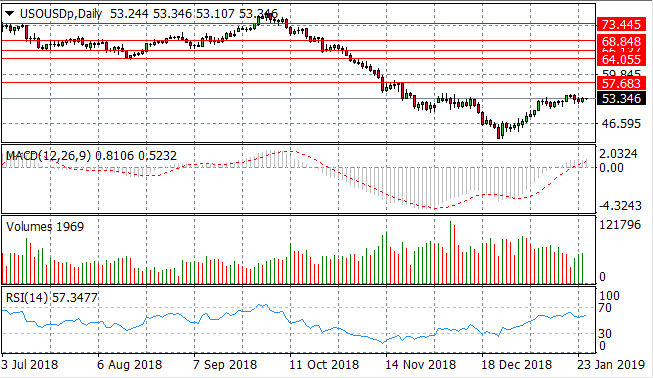

OIL

WTI buyers have returned with moderate bullish moves to take WTI beyond $50 per barrel. The move has been supported by a bullish break of the zero line on MACD, a strong upward trajectory on RSI and rising buying volume.