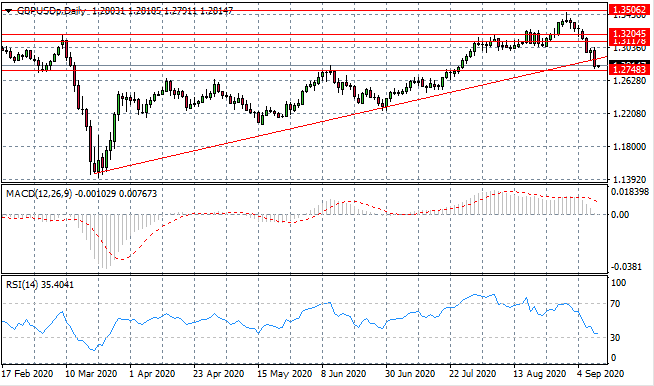

GBP/USD Pair Breaks Long-Term Support Level

- 11 Sep 2020

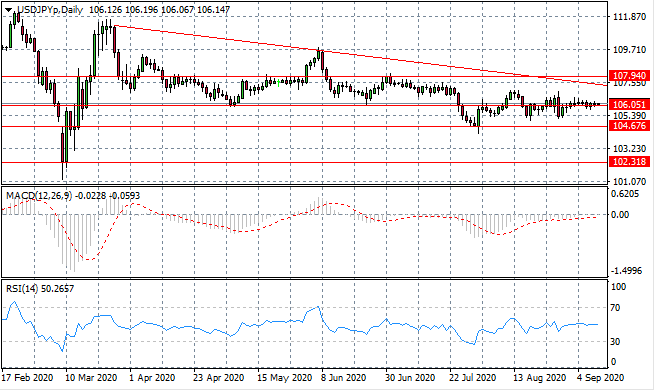

USD/JPY

The USD/JPY pair remains flat against the 106.05 support level as neither buyers nor sellers are dominating price action. A long-term downtrend has been established since mid-March, therefore we expect any breakouts to follow long-term sentiment. Momentum indicators have stalled in neutral territory.

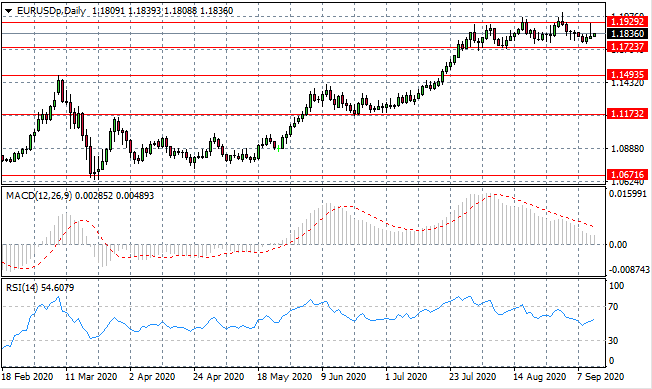

EUR/USD

The Eurodollar spiked to test the range ceiling at the 1.192 price level. Currently price action continues to oscillate in range between the 1.172-1.192 price levels. Given the series of tests of the price ceiling in this range we may expect a bullish break going forward. Momentum indicators have begun upward trajectories.

GBP/USD

GBP/USD sellers have returned with conviction to facilitate the break of the ascending trendline. Price action stalled before breaking the 1.274 support line. The break is significant, suggesting a potential longer-term trend change. The next few trading sessions will indicate the direction of near term price action. Momentum indicators have sharp downward trajectories.

USD/CHF

The USD/CHF pair has pulled back, as sellers returned to drive price action back towards the 0.903 support level. Buyers are still active, however, as seen by the long lower shadow in yesterday’s trading. Regardless, the longer-term downtrend remains intact. Momentum indicators have upward trajectories.

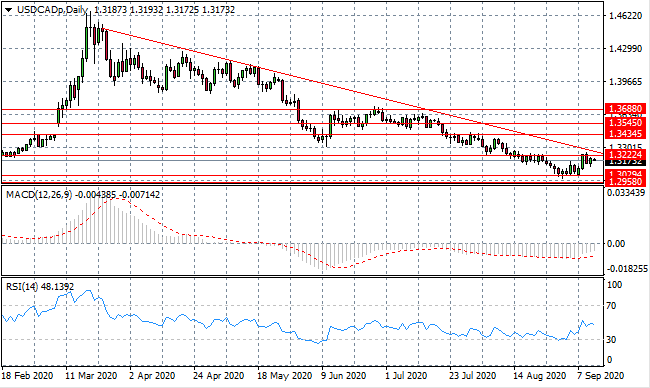

USD/CAD

USD/CAD buyers are still active despite a rejection of the 1.322 resistance level. Rising bullish momentum has taken the pair towards the descending trendline which will likely see another rejection. The pair is also moving closer to the apex of a descending triangle where a bearish breakout is anticipated. Momentum indicators have upward trajectories.

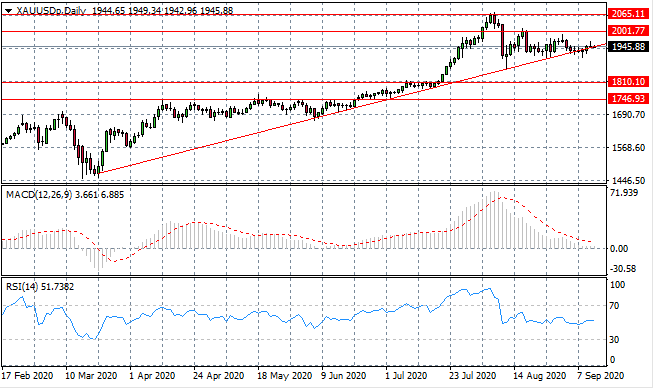

GOLD

Gold continues to trace the ascending trendline indicating that momentum remains bullish albeit, moderately bullish. An ascending triangle pattern has formed and we may expect a bullish breakout and continuation of the previous trend. Momentum indicators have flattened in neutral/bullish territory.

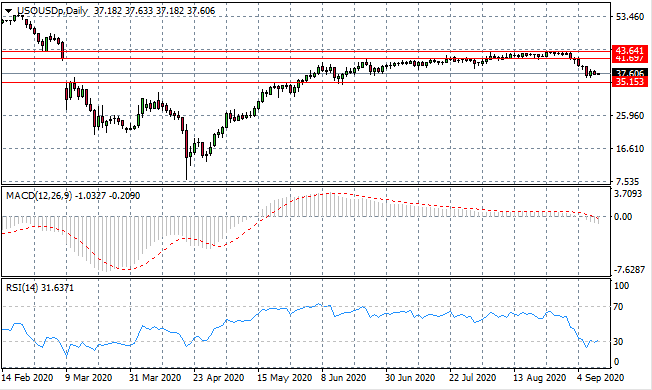

OIL

WTI has stalled mid-range as bearish sentiment has waned. Buyers are therefore still active but conviction remains low. Price action will likely remain in the $30 per barrel range unless there are changes to supply and demand fundamentals. Momentum indicators are bearish with RSI testing the 30 support level.