HK50 On The Verge Of A Bullish Reversal

- 10 Mar 2022

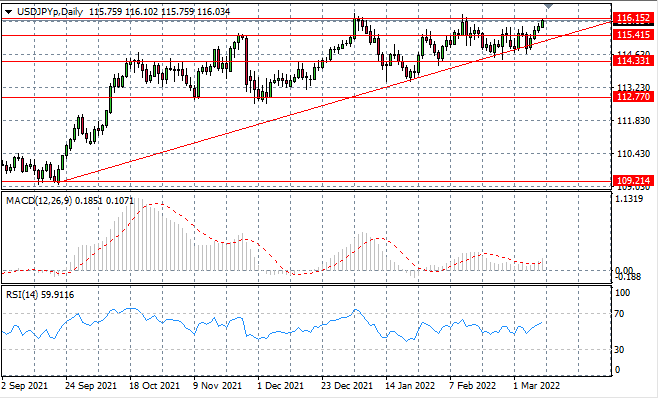

USD/JPY

USDJPY price action is testing the 116.15 resistance line which on two previous occasions, resulted in a bearish rebound. Currently, bullish conviction appears insufficient to drive a break and therefore, we may expect price action to linger within the 115.41-116.15 trading range.

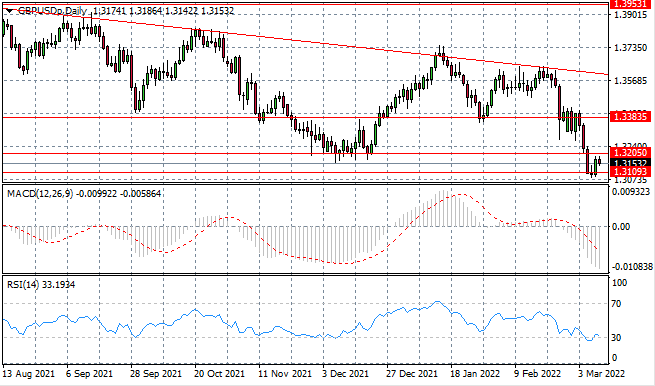

GBP/USD

The GBPUSD pair is making its way back to the 1.320 price line yet the rally is already giving way to selling activity. A consolidation range may now be established between the 1.310 and 1.320 price levels as appetite for a rally wanes. Momentum indicators have flattened in bearish territory.

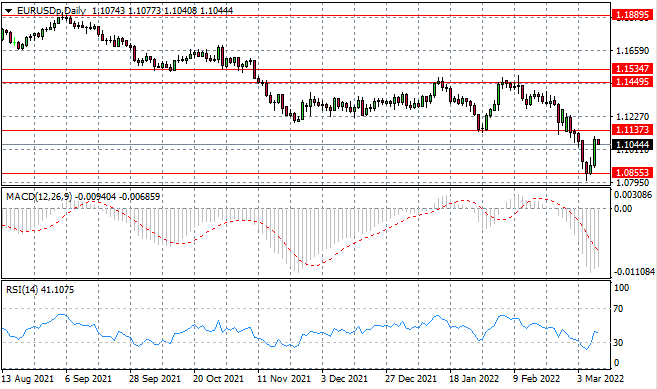

EURUSD

The EURUSD has moved back towards the 1.113 price level which represents a key support level of a previous trading range. The strong bullish move has been met with resistance in the early Asian trading session, however, indicating the rally attempt may not last.

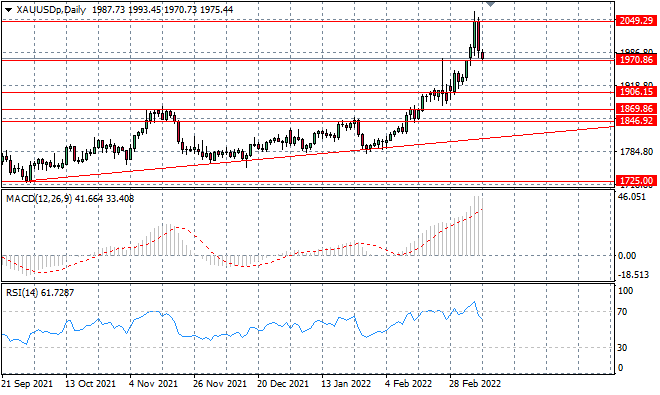

XAUUSD

The XAUUSD roller-coaster continues with highly volatile price action. A bearish bias has overcome the metal taking price action back to the 1970 support line. The question is whether bearish momentum is sufficient to drive the break. Momentum indicators are undergoing reversals.

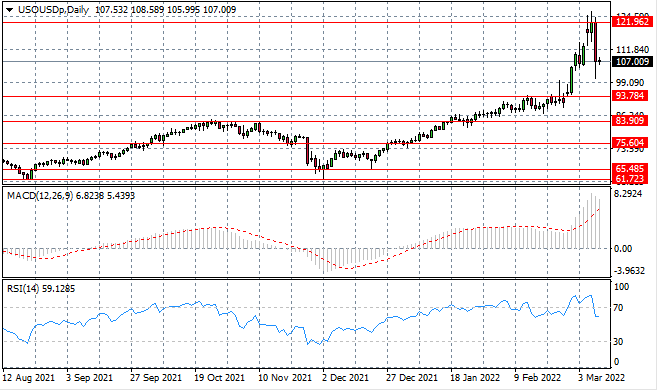

USOUSD

The USOUSD index has plummeted back to the $107 per barrel level. The commodity may now stabilize within the $100 per barrel range, as profitability levels increase so too will supply options. Momentum indicators are reversing overbought conditions with a break below the 70 line on RSI.

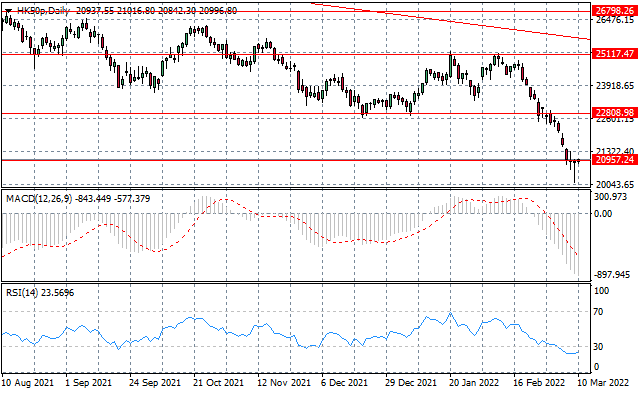

HK50

The HK50 appears to be on the edge of a bullish reversal, as further downside has been contained by buying pressure. Given the small-bodied candles and the dragonfly doji candle in yesterday’s trading we may anticipate a trend change. Momentum indicators support a bullish reversal.

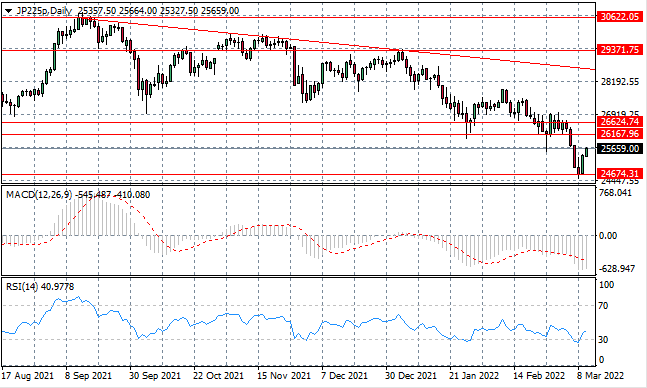

JP225

The JP225 has rebounded with gusto from the 24,674 support level and is now heading back towards the 26,167 resistance line. Bullish candles convey strong conviction, however, the longer-term sentiment in the index has been bearish. Momentum indicators are undergoing a bullish reversal.