Pound Buyers Resilient Despite Uncertainty

- 21 Feb 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

The USD/JPY pair has stalled just above the 110.65 resistance level as there has been a deceleration in momentum. Momentum indicators are moderately bullish although have a flatter trajectory.

EUR/USD

The EUR/USD pair has broken the 1.129 price level as buying pressure has risen sharply. A trading range between the 1.129 and 1.145 price levels has been established. Momentum indicators are bullish with both MACD and RSI beginning momentum reversals.

GBP/USD

The GBP/USD pair has recovered from a pullback to the 50% retracement level and the response has been strong buying pressure. The pair has once again stalled at the 23.6% retracement level, which may be a pause in the rally. RSI has also taken a pause. It is important to remember the fundamental factors which are currently impacting this pair.

USD/CHF

The USD/CHF pair has pulled back towards the 23.6 Fibo level in a bearish retracement, which has inspired buyers to return in early trading today. The trajectory of RSI indicates that buying momentum is moderate, which may result in the pair falling further to test the 38.2% retracement area next.

USD/CAD

The USD/CAD pair has entered into a symmetrical triangle with the upper resistance line containing price action currently. Failure at the descending trendline has resulted in sellers beginning to dominate price action and hence the pair testing the 1.316 support level. RSI has a downward trajectory and MACD remains in below the zero line.

SILVER

Silver buyers have returned to push price action towards the 16.12 price level. The result has been a failure at this price high. A new trading range may have been established between the 15.69 and 16.12 price levels. Momentum indicators have resumed a bullish bias with RSI approaching overbought conditions.

GOLD

Gold appears to be forming an evening star doji pattern which indicates that a bearish reversal is imminent. At the same time RSI has reached and is on the verge of retracing from the 70 resistance line. MACD remains in bullish territory.

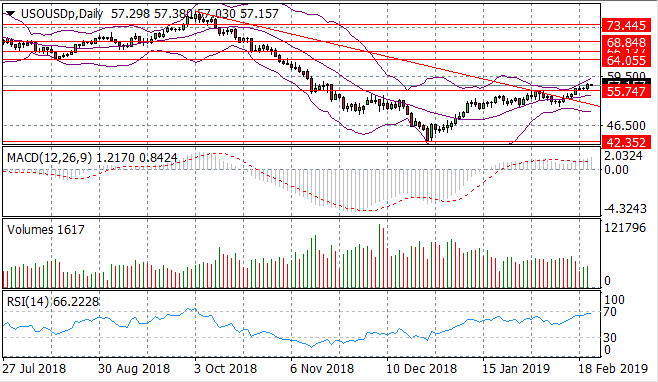

OIL

WTI buyers have returned to drive price action to the point where it tests a previous resistance line at $55.74 per barrel. The next target will be $60 per barrel at which point prices may stabilise. Momentum indicators are bullish with RSI approaching the 70 resistance line. Buying volume has also risen.