Pound Routed By New Brexit Woes

- 16 Nov 2018

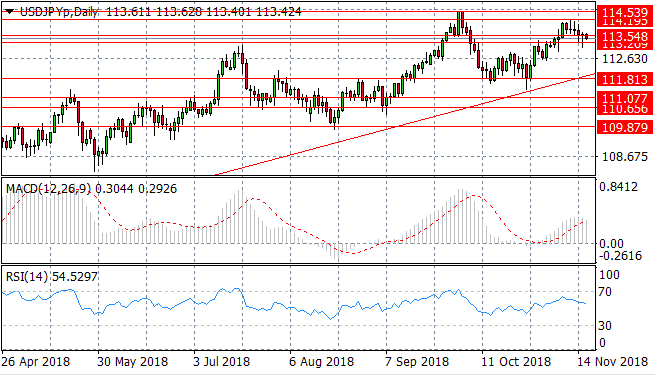

USD/JPY

The USD/JPY pair has pulled back to test the 113.54 price level as sellers appear to have returned to the pair. The next support level lies at 113.20. Momentum indicators reflect the pullback in price action; with MACD starting a bearish reversal and RSI pulling away from overbought conditions.

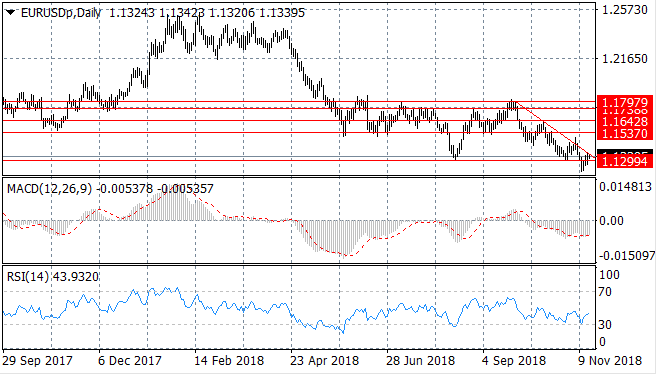

EUR/USD

The EUR/USD pair has made a mild recovery from the sell-off early in the week, returning to break the 1.129 price level once again. At the same time, the pair is testing the descending trendline and a break would prove significant especially given the recent trend has been bearish. Momentum appears to be turning less bearish with RSI pulling away from oversold conditions. MACD has flattened in bearish territory which may be the first sign of a momentum reversal.

Impact event: Eurozone CPI data will be released at 10:00 GMT and will impact all Euro pairs.

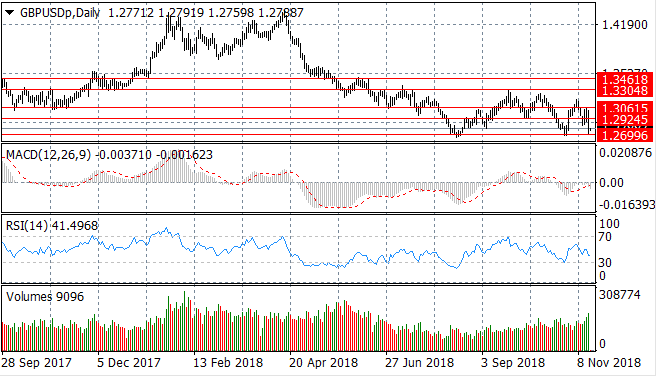

GBP/USD

Fundamental factors influenced the sell-off in the GBP/USD pair yesterday which has resulted in a pullback to the 1.269 support level. Unsurprisingly, momentum has turned bearish with MACD extending into bearish conditions and RSI turning more negative. However, the trading range between the 1.269 and 1.330 price levels will likely be maintained in the near term as geopolitical factors play out.

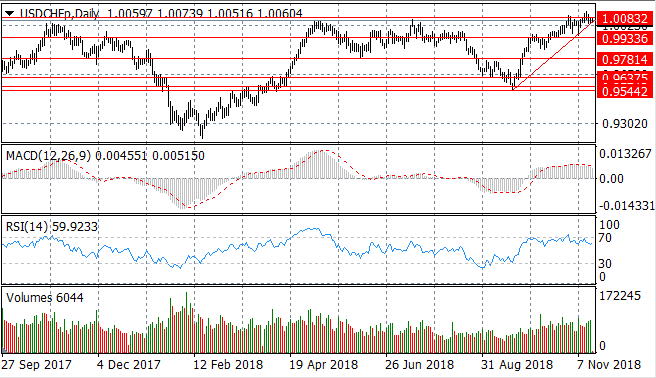

USD/CHF

The USD/CHF pair continues to test the 1.008 price level and despite a recent break, sellers returned. The result is therefore a test of the ascending trendline. Can the pair maintain the rally? Each previous occasion that price action has hit this price high has a pullback has resulted. MACD appears to be undergoing a bearish momentum reversal whilst RSI has begun to pull away from the 70 resistance line.

USD/CAD

The USD/CAD has once again pulled back to the 1.316 price level, as the 1.326 remains a key resistance level for the pair. As such, the pullback has resulted in a test of the ascending trendline which on several previous occasions has resulted in the return of buyers. Momentum indicators are mixed; RSI has pulled back from the 70 overbought area and MACD has pulled back though remains fairly bullish.

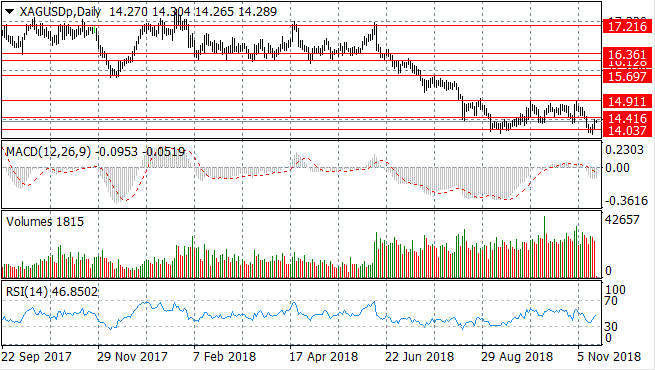

SILVER

Silver is has rebounded from the 14.03 price level to maintain a recent trading range between the 14.03 and 14.91 price levels. The pair is now testing the 14.41 price level. However, the commodity will likely move sideways within the trading range in the near term. Momentum indicators support that assumption with RSI bouncing around the default line and MACD heading back towards zero.

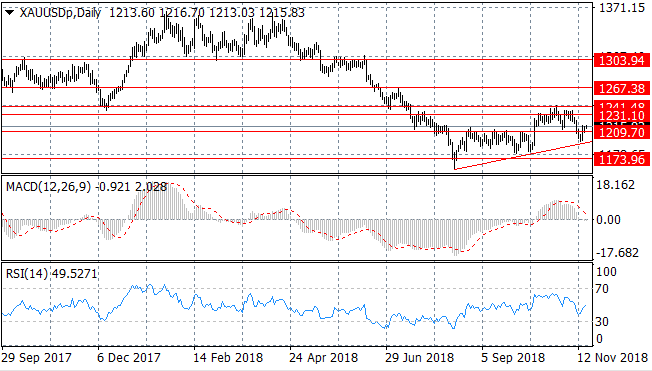

GOLD

Gold has once again undergone a bullish retracement from the ascending trendline at the 1191.58 price level and as a result, has returned to break the 1209.70 price level. Momentum indicators are mixed with MACD approaching the zero line and RSI pulling back from the 30 support level.

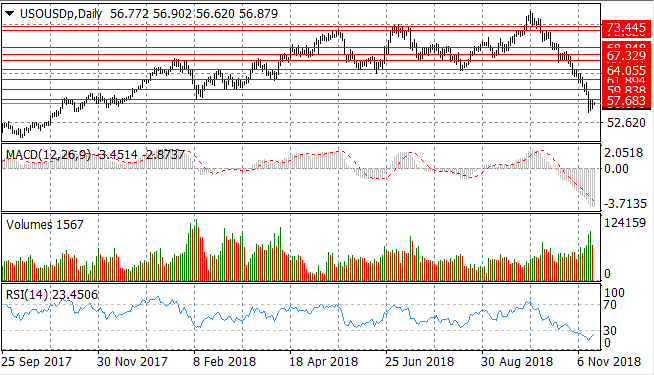

OIL

Oil price continues to break clear support levels and has pushed below the 57.68 price level. Momentum indicators suggest that support for the bearish bias has cooled; with MACD stalling in bearish territory and RSI undergoing a bullish momentum reversal. At the same time, volume has pulled back indicating sellers’ conviction is waning.