Precious Metals On The Verge Of A Bearish Reversal?

- 26 Aug 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

USD/JPY continues to test the descending trendline as price action spikes through and recovers with bullish price action. The small-bodied candlestick after the sell-off represents a slowdown in bearish sentiment. Momentum indicators remain in strongly bearish territory, with further downside potential.

EUR/USD

The Euro has made a recovery and has climbed to test the 1.114 resistance line. The next target is the 1.119 price level, however, sellers appear to have returned to stall price action at the 1.114 support line. Momentum indicators are pulling away from oversold conditions.

GBP/USD

The GBP/USD pair has broken the 1.218 resistance line with a strong bullish move. A reversal of sorts is underway perhaps as optimism rises related to geopolitical tensions. Momentum indicators have upwards trajectories with RSI moving into the bullish channel.

USD/CHF

The USD/CHF pair has pushed back from the 0.981 resistance line with price action heading back to the 0.971 support level. Buyers have since returned when the price action hit the 0.975 support level. Momentum indicators are neutral if slightly bearish.

USD/CAD

The USD/CAD pair continues to test the 1.330 resistance level and each time there is a break, selling pressure rises. The resistance line remains a sticking point for price action perhaps signifying the end of an extended rally. Momentum indicators are bullish, however, RSI is yet to reach overbought conditions; suggesting further upside potential.

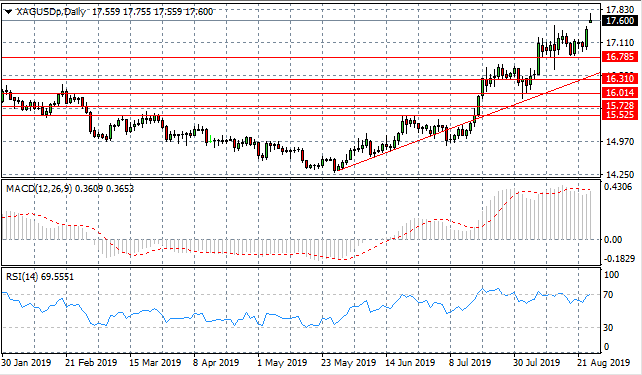

SILVER

Silver has a bearish ‘abandoned baby’ candlestick at the top of the rally which is the first indication of a potential reversal as these types of candlesticks tend to be followed with bearish sentiment. At the same time, the doji candle signifies selling pressure. Momentum indicators have flattened in overbought positions.

GOLD

Gold continues to test the ascending trendline after some horizontal trading recently. Buyers appear to have returned, however, a gravestone candlestick at the top of the rally represents indecision from market participants. Momentum indicators continue to test overbought conditions which may be an indication of a potential reversal.

OIL

WTI has broken both the 54.92 support level and the descending trendline after a moderate sell-off in the commodity. The break has woken buyers who have returned in the early Asian trading session. Momentum indicators are neutral if slightly bearish.

Follow Us on Facebook: