USD/CHF Approaches Key Support Area

- 6 Aug 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

The USD/JPY pair has broken the 107.16 price level yet there is clear buying pressure in price action. A recent price floor exists at the 104.77 support level; it remains to be seen whether sellers have the conviction to push prices lower. Momentum indicators remain bearish with MACD remaining in negative territory and RSI touching oversold conditions.

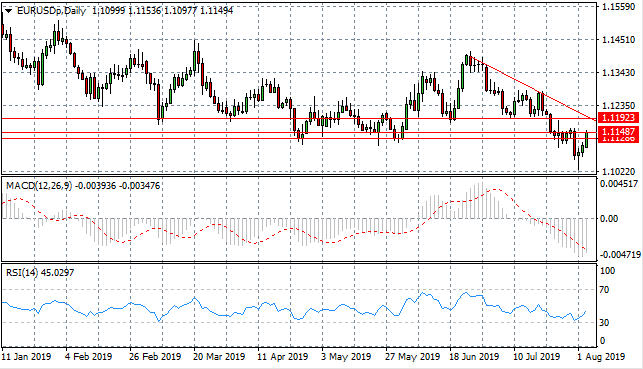

EUR/USD

The Euro has made a recovery off the back of dollar weakness and is now testing the 1.114 support level. The EUR/USD may climb towards the descending trendline and the 1.119 price level. Momentum indicators support the bullish reversal.

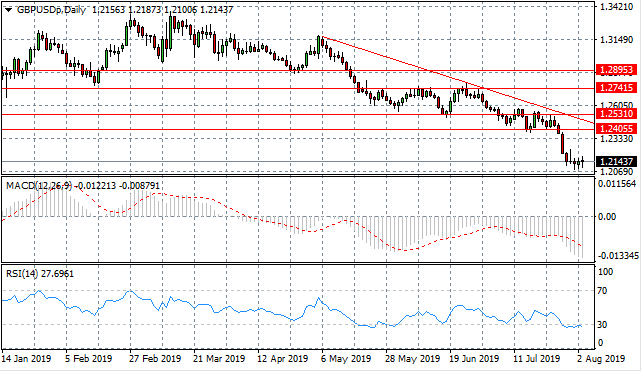

GBP/USD

The GBP/USD pair also appears to be making a recovery as a series of doji candles represent a deceleration in the sell-off. Positive sentiment may not last, however, as the pair continues to be impacted by political developments. Momentum indicators have flattened in negative territory, with RSI bouncing along the 30 support level.

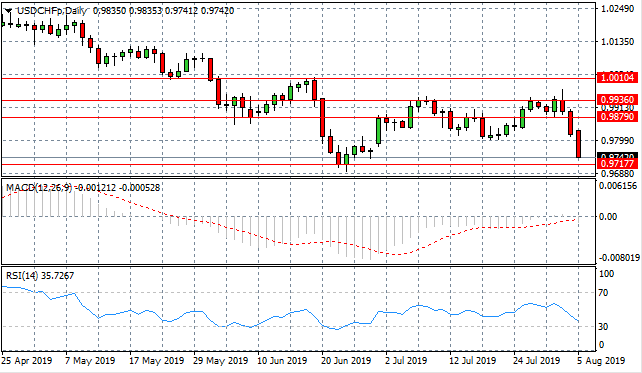

USD/CHF

The USD/CHF pair is fast approaching the 0.971 support level, which on previous occasions, has resulted in a rebound in price action. A trading range between the 0.971 and 0.987 price levels may be established. Momentum indicators have divergent trajectories yet RSI is approaching oversold conditions.

USD/CAD

The USD/CAD pair continues to extend its position past the 1.320 resistance line as buyers appear to be gathering momentum. A full close above the resistance line will provide weight to the rally and is yet to be realised. Momentum indicators are sharply bullish with MACD breaking the zero line to the upside and RSI continuing an upward trajectory.

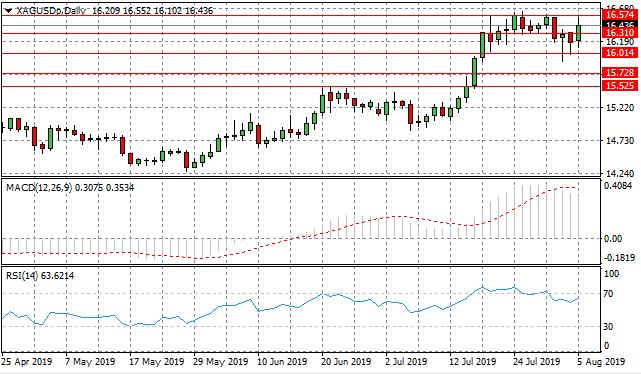

SILVER

Silver has rejected the 16.57 resistance level as buyers and sellers tussle with one another and the metal fails to break the resistance level once again. Current price action may just be a pullback in the rally. Momentum indicators remain in bullish territory.

GOLD

Gold has broken the 1439.13 price level providing further weight to the rally, as a breakout takes price action beyond the upper bound of an ascending triangle pattern. Momentum indicators are turning more bullish as MACD extends into bullish territory and RSI approaches overbought conditions.

OIL

WTI has rejected the 58.14 resistance line and is now testing the 54.92 support line having spiked to the ascending trendline; where buyers have returned. Therefore, the 54.92 support level and ascending trendline remain intact. Momentum indicators are bearish, with MACD breaking the zero line to the downside and RSI heading into the bearish channel.

Follow Us on Facebook: