Oil: To Buy Or To Sell?

- January 22, 2021

Oil in 2020

The year of the pandemic was a particularly tough one for oil. It was the year that WTI plummeted from $62 per barrel to $8 per barrel in the space of 4 months. The white-knuckle ride continued; we saw oil futures sink from $50 per barrel to -$30 per barrel in one day. In other words, holders of oil were paying to get rid of it. It was the first time in history, futures contracts turned negative. The drop accelerated as oil buyers became hard to find and storage tanks were at full capacity due to persistent oversupply; all despite outputs cuts from OPEC.

Unsurprisingly, oil companies suffered significantly, with Exxon Mobil being the poster child of a decimated industry. Exxon was delisted from the Dow Jones index after seeing its market capitalization plunge by $120 billion.

Oil in 2021

There appears to be a flickering of light at the end of the tunnel as we turn into a new year and renewed hopes of a recovery have driven an oil price rally.

i) Fundamentals

The year 2021 started with some positive news with Saudi Arabia; the world’s largest oil producer, committing to an output cut of 1 million barrels per day. Compliance has typically hit 70% with the Organization of The Petroleum Export Countries (OPEC) members as many struggle with profitability at lower production levels.

The following week, The Energy Information Administration (EIA) released positive short-term forecasts, albeit built on a series of economic assumptions. US growth figures registered a contraction of 3.5% in 2020 and a projection of 2.6% growth has been made for 2021. Total energy consumption is also expected to make a recovery at 2.6% for 2021. As such, the current levels of around $53 per barrel are expected to be an average, stabilizing price for 2021. Further, OPEC see production levels rising only marginally at 27.2 million barrels per day, indicating only a 2 million barrel per day increase.

The current moves in the commodity have been inspired by the new availability of a vaccine and by proxy an improvement in economic outlook, specifically, from a demand perspective as one of the largest oil purchasers; China makes a steady recovery (registering 2.3 % GDP to close out 2020).

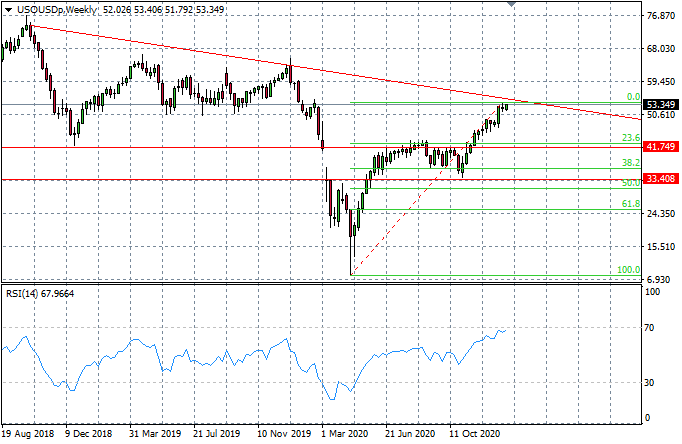

ii) Technicals

The recent surge in oil looks like it may have been overplayed. The commodity is fast approaching a longer-term descending trendline which, on previous occasions, has proven to be a hurdle for buyers. Given the doji candle in previous trading, we can already start to see some deceleration in the rally. Therefore, a pull back is anticipated. Given WTI is predicted to remain at an average $50-53 per barrel this year, we can expect retracements to be followed by bullish momentum. A strong support level exists at the 23.6 Fibo retracement level and around the $41.74 price line. This price area also represents a ‘gap-fill’ line where oil previously gapped down during a sell-off. Given such a combination, the $41 per barrel price area looks like a good place for entry for traders bullish on oil for 2020.