US Dollar Recovery Underway

- 10 Mar 2020

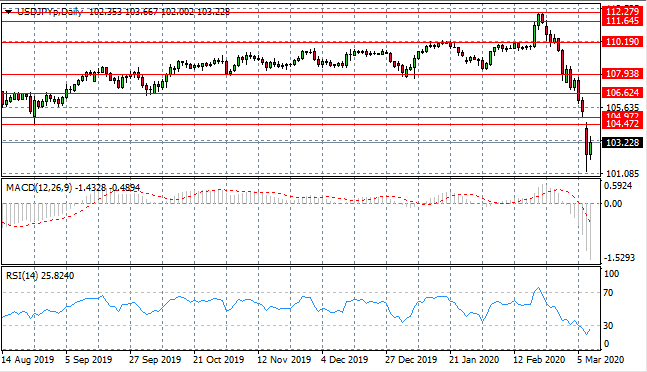

USD/JPY

The USD/JPY has begun a recovery after the surge in selling activity that ended in early trading today. A full recovery will be confirmed by a break of the next target at the 104.47 price line. Momentum indicators remain in bearish territory although a momentum reversal is underway on RSI.

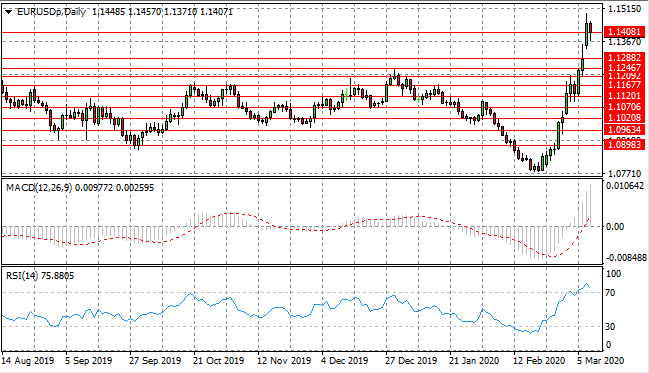

EUR/USD

The Eurodollar has returned to test the 1.140 resistance line as US Dollar weakness subsides. Buying pressure remains, however, as the pair have been unable to break the price level. Momentum indicators suggest that the pair is overbought with RSI overshooting the 70 resistance line and now beginning to pull back. MACD remains in bullish territory.

GBP/USD

The GBP/USD pair has broken a mid-term resistance level at the descending trendline which may be significant given recent price patterns. The pair is now testing the 1.309 resistance area yet has failed to move beyond this hurdle. Momentum indicators have formed upward trajectories.

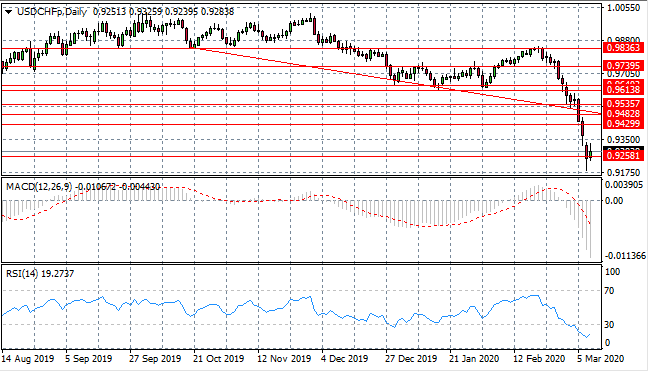

USD/CHF

The USD/CHF sell-off has stalled at the 0.925 support level. Sellers are still active in today’s trading yet a break has not materialized. The inverted hammer candlestick at the end of the sell-off may be an indication of a trend reversal. Momentum indicators suggest that the pair is strongly oversold and RSI is moving back towards the 30 support line.

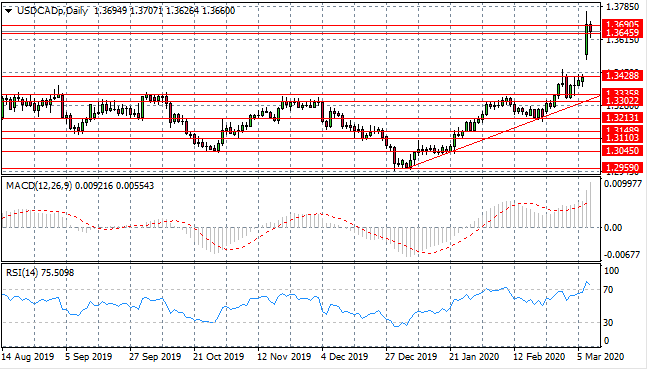

USD/CAD

The USD/CAD pair has been held back at the 1.369 price ceiling, as sellers returned to bring price action back to the 1.364 support level. A break of this support area would likely see the pair returning to its previous trading range. However, fundamental factors continue to dominate the pair. RSI indicates a momentum reversal has begun.

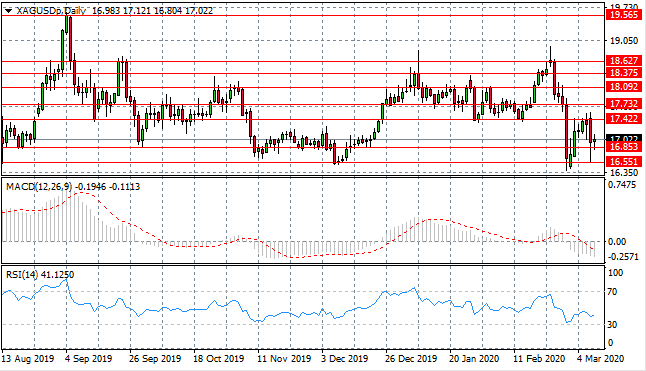

SILVER

Buyers have been held at the 17.42 resistance line where price action has pulled back. The pair has yet to return to a previous trading range where price action averaged out at the 17.73 price line. Momentum indicators have flattened in bearish territory.

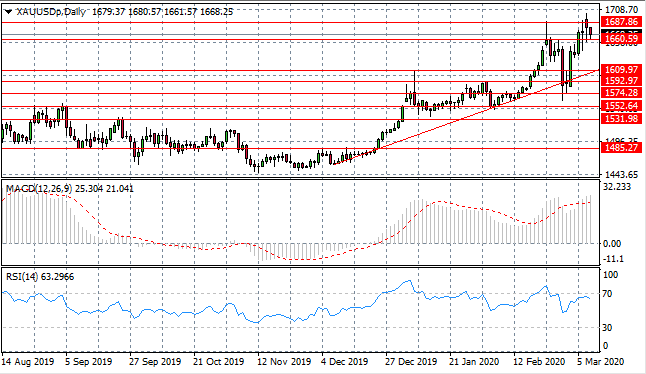

GOLD

Gold buyers have been held at the 1687.86 resistance line where sellers returned to push the metal to test the 1660 support area. The pullback seems likely to be short-lived given the strength of the longer-term bullish trend. Momentum indicators have flattened in bullish territory with RSI beginning to turn bearish.

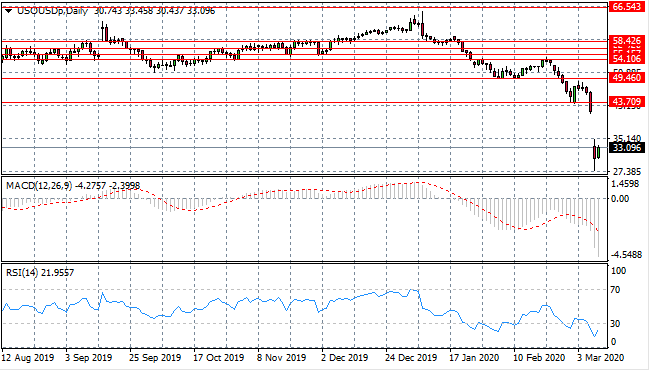

OIL

WTI has begun a reversal after dropping to the $30 per barrel range. Price action would likely stabilize at the $40 per barrel range with the next target being the 43.70 resistance area. A momentum reversal is underway on RSI yet MACD remains strongly bearish.