WTI Comes Under Further Pressure

- 2 May 2019

Be The 1st To Redeem $50 Cash Rebates! Limited-time offer! Get it now!

USD/JPY

The USD/JPY pair has fallen below the 111.75 price level after a strong sell-off at the end of last week. Buyers appear to have returned to some degree however, but small-bodied candles indicate little conviction. MACD has a downward trajectory yet RSI is neutral/bearish.

EUR/USD

The EUR/USD pair is experiencing significant volatility as a result of macroeconomic factors. The descending trendline indicates the long-term trajectory for the pair is bearish. The pair is languishing around the 1.119 support area. A bullish momentum reversal is underway on both MACD and RSI which supports current price action.

GBP/USD

The GBP/USD pair has begun a sharp rally, with a definitive break of the 1.297 price level. After the break, price action has stalled somewhat with some rise in selling pressure. Momentum indicators have turned sharply bullish with a reversal taking place on MACD.

USD/CHF

The USD/CHF pair appears to be on the verge of a reversal. A series of doji candles indicate a break in the current rally, although there is currently not enough conviction from sellers to drive prices lower. Momentum indicators signal a bearish reversal with RSI on the verge of breaking the 70 overbought line to the downside.

USD/CAD

The USD/CAD pair is returning to a previous trading range between the 1.335 and 1.345 price levels. Buyers appear to have returned to the pair after approaching the 1.335 support area. Momentum indicators are mixed if slightly bullish.

SILVER

Silver has finally broken the 14.76 support line after several previous attempts, which may now indicate longer term bearish sentiment for the pair. Momentum indicators have flattened in bearish territory with RSI approaching the 30 support level.

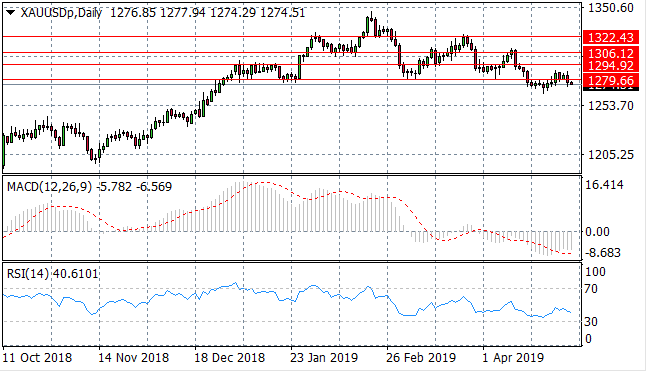

GOLD

Gold has pulled back towards the 1279.66 price level which represents a strong support area for the metal. The longer-term trend has been bearish. Momentum indicators remain in bearish territory with RSI approaching the 30 support level.

OIL

WTI has pulled back to touch the ascending trendline amid geopolitical intervention in order to stymie prices. As such, the commodity has fallen below the ascending trendline but remains above the $60 per barrel range. RSI has broken the 70 resistance area and MACD is approaching the zero line.

Follow Us on Facebook: